Required information [The following information applies to the questions displayed below.] Forten Company's current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) Other Expenses are paid in advance and are initially debited to Prepaid Expenses. FORTEN COMPANY Comparative Balance Sheets December 31 Current Year Prior Year Assets $ 69,400 85,400 295,156 1,340 451,296 144,500 (43,125) $ 86,500 63,625 264,800 2,155 417,080 Cash Accounts receivable Inventory Prepaid expenses Total current assets Equipment Accum. depreciation-Equipment 121,000 (52,500) Total assets $52,671 $485,580 Liabilities and Equity Accounts payable Short-term notes payable $ 66,141 13,900 80,041 58,500 138,541 $134,175 8,600 142,775 61,750 204,525 Total current liabilities Long-term notes payable Total liabilities Equity Common stock, $5 par value Paid-in capital in excess of par, common stock Retained earnings 182,250 163,250 57,000 174,880 $52,671 117,805 Total liabilities and equity $485,580 FORTEN COMPANY Income Statement For Current Year Ended December 31 Sales $647,500 298,000 349,500 Cost of goods sold Gross profit Operating expenses Depreciation expense Other expenses Other gains (losses) Loss on sale of equipment $ 33,750 145,400 179,150 (18,125) 152,225 42,450 Income before taxes Income taxes expense Net income $109,775 Additional Information on Current Year Transactions a. The loss on the cash sale of equipment was $18,125 (details in b). b. Sold equipment costing $85,875, with accumulated depreciation of $43,125, for $24,625 cash. c. Purchased equipment costing $109,375 by paying $56,000 cash and signing a long-term note payable for the balance. d. Borrowed $5,300 cash by signing a short-term note payable. e. Paid $56,625 cash to reduce the long-term notes payable. f. Issued 3,800 shares of common stock for $20 cash per share. g. Declared and paid cash dividends of $52,700.

Required information [The following information applies to the questions displayed below.] Forten Company's current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) Other Expenses are paid in advance and are initially debited to Prepaid Expenses. FORTEN COMPANY Comparative Balance Sheets December 31 Current Year Prior Year Assets $ 69,400 85,400 295,156 1,340 451,296 144,500 (43,125) $ 86,500 63,625 264,800 2,155 417,080 Cash Accounts receivable Inventory Prepaid expenses Total current assets Equipment Accum. depreciation-Equipment 121,000 (52,500) Total assets $52,671 $485,580 Liabilities and Equity Accounts payable Short-term notes payable $ 66,141 13,900 80,041 58,500 138,541 $134,175 8,600 142,775 61,750 204,525 Total current liabilities Long-term notes payable Total liabilities Equity Common stock, $5 par value Paid-in capital in excess of par, common stock Retained earnings 182,250 163,250 57,000 174,880 $52,671 117,805 Total liabilities and equity $485,580 FORTEN COMPANY Income Statement For Current Year Ended December 31 Sales $647,500 298,000 349,500 Cost of goods sold Gross profit Operating expenses Depreciation expense Other expenses Other gains (losses) Loss on sale of equipment $ 33,750 145,400 179,150 (18,125) 152,225 42,450 Income before taxes Income taxes expense Net income $109,775 Additional Information on Current Year Transactions a. The loss on the cash sale of equipment was $18,125 (details in b). b. Sold equipment costing $85,875, with accumulated depreciation of $43,125, for $24,625 cash. c. Purchased equipment costing $109,375 by paying $56,000 cash and signing a long-term note payable for the balance. d. Borrowed $5,300 cash by signing a short-term note payable. e. Paid $56,625 cash to reduce the long-term notes payable. f. Issued 3,800 shares of common stock for $20 cash per share. g. Declared and paid cash dividends of $52,700.

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter10: Auditing Cash, Marketable Securities, And Complex Financial Instruments

Section: Chapter Questions

Problem 3RQSC: Match the following assertions with their associated description: (a) existence/occurrence, (b)...

Related questions

Topic Video

Question

100%

![Required information

[The following information applies to the questions displayed below.]

Forten Company's current year income statement, comparative balance sheets, and additional information follow. For the

year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all

purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) Other

Expenses are paid in advance and are initially debited to Prepaid Expenses.

FORTEN COMPANY

Comparative Balance Sheets

December 31

Current Year

Prior Year

Assets

$ 69,400

85,400

295,156

1,340

$ 86,500

63,625

264,800

2,155

Cash

Accounts receivable

Inventory

Prepaid expenses

Total current assets

Equipment

Accum. depreciation-Equipment

417,080

121,000

(52,500)

451,296

144,500

(43,125)

Total assets

$552,671

$485,580

Liabilities and Equity

Accounts payable

Short-term notes payable

$ 66,141

13,900

80,041

58,500

$134,175

8,600

Total current liabilities

Long-term notes payable

142,775

61,750

204,525

Total liabilities

138,541

Equity

Common stock, $5 par value

Paid-in capital in excess of par, common stock

Retained earnings

182,250

57,000

174,880

163,250

117,805

Total liabilities and equity

$552,671

$485,580

FORTEN COMPANY

Income Statement

For Current Year Ended December 31

Sales

$647,500

298,000

Cost of goods sold

Gross profit

Operating expenses

Depreciation expense

Other expenses

349,500

$ 33,750

145,400

179,150

Other gains (losses)

Loss on sale of equipment

(18,125)

Income before taxes

152,225

42,450

Income taxes expense

Net income

$109,775

Additional Information on Current Year Transactions

a. The loss on the cash sale of equipment was $18,125 (details in b).

b. Sold equipment costing $85,875, with accumulated depreciation of $43,125, for $24,625 cash.

c. Purchased equipment costing $109,375 by paying $56,000 cash and signing a long-term note payable for the balance.

d. Borrowed $5300 cash by signing a short-term note payable.

e. Paid $56,625 cash to reduce the long-term notes payable.

f. Issued 3,800 shares of common stock for $20 cash per share.

g. Declared and paid cash dividends of $52,700.](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fba99e415-6143-4d16-b5bd-ce250cd2d313%2F02be597d-7a66-431b-a944-a85718df25e2%2F8zp4xi_processed.png&w=3840&q=75)

Transcribed Image Text:Required information

[The following information applies to the questions displayed below.]

Forten Company's current year income statement, comparative balance sheets, and additional information follow. For the

year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all

purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) Other

Expenses are paid in advance and are initially debited to Prepaid Expenses.

FORTEN COMPANY

Comparative Balance Sheets

December 31

Current Year

Prior Year

Assets

$ 69,400

85,400

295,156

1,340

$ 86,500

63,625

264,800

2,155

Cash

Accounts receivable

Inventory

Prepaid expenses

Total current assets

Equipment

Accum. depreciation-Equipment

417,080

121,000

(52,500)

451,296

144,500

(43,125)

Total assets

$552,671

$485,580

Liabilities and Equity

Accounts payable

Short-term notes payable

$ 66,141

13,900

80,041

58,500

$134,175

8,600

Total current liabilities

Long-term notes payable

142,775

61,750

204,525

Total liabilities

138,541

Equity

Common stock, $5 par value

Paid-in capital in excess of par, common stock

Retained earnings

182,250

57,000

174,880

163,250

117,805

Total liabilities and equity

$552,671

$485,580

FORTEN COMPANY

Income Statement

For Current Year Ended December 31

Sales

$647,500

298,000

Cost of goods sold

Gross profit

Operating expenses

Depreciation expense

Other expenses

349,500

$ 33,750

145,400

179,150

Other gains (losses)

Loss on sale of equipment

(18,125)

Income before taxes

152,225

42,450

Income taxes expense

Net income

$109,775

Additional Information on Current Year Transactions

a. The loss on the cash sale of equipment was $18,125 (details in b).

b. Sold equipment costing $85,875, with accumulated depreciation of $43,125, for $24,625 cash.

c. Purchased equipment costing $109,375 by paying $56,000 cash and signing a long-term note payable for the balance.

d. Borrowed $5300 cash by signing a short-term note payable.

e. Paid $56,625 cash to reduce the long-term notes payable.

f. Issued 3,800 shares of common stock for $20 cash per share.

g. Declared and paid cash dividends of $52,700.

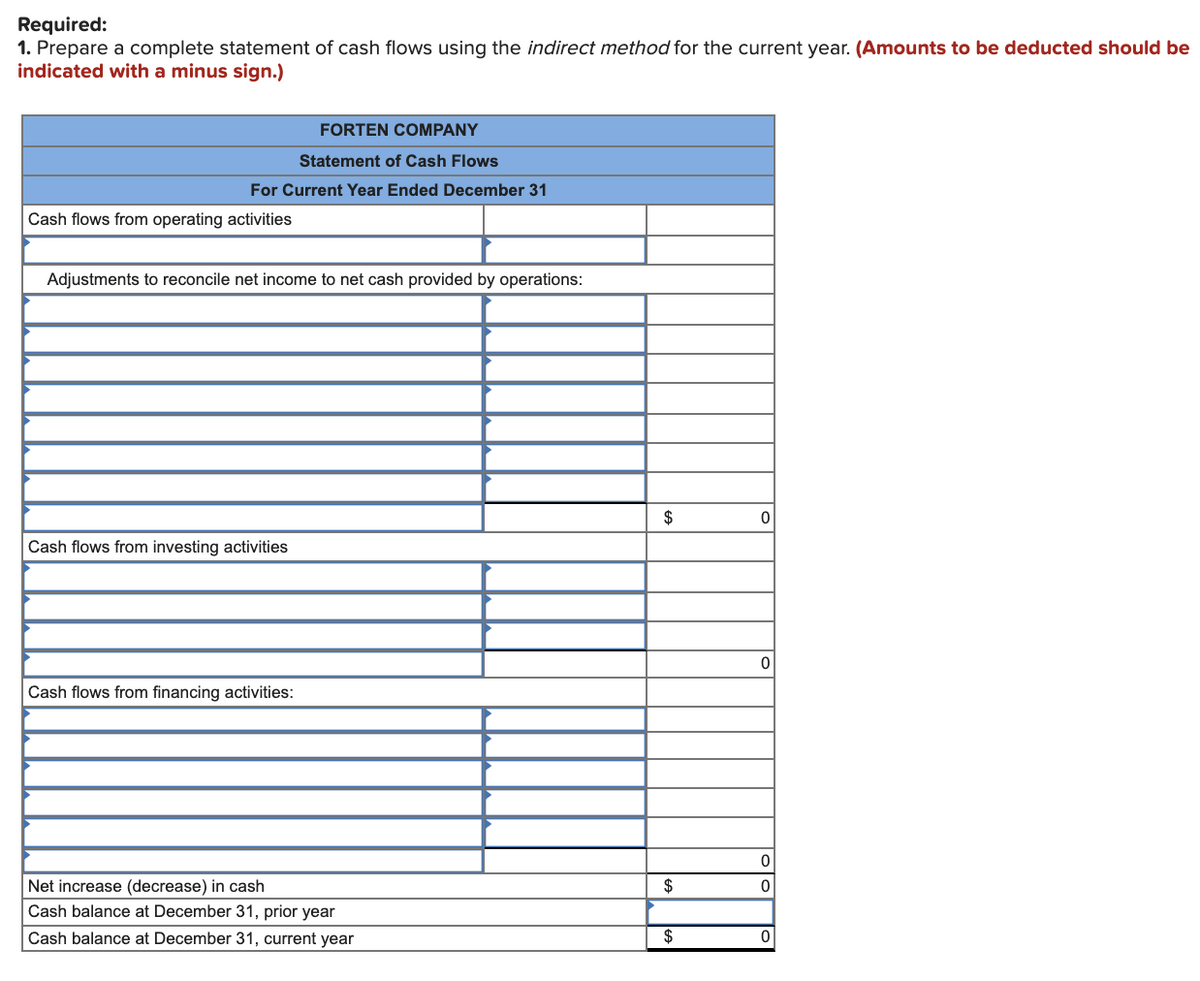

Transcribed Image Text:Required:

1. Prepare a complete statement of cash flows using the indirect method for the current year. (Amounts to be deducted should be

indicated with a minus sign.)

FORTEN COMPANY

Statement of Cash Flows

For Current Year Ended December 31

Cash flows from operating activities

Adjustments to reconcile net income to net cash provided by operations:

$

Cash flows from investing activities

Cash flows from financing activities:

Net increase (decrease) in cash

$

Cash balance at December 31, prior year

Cash balance at December 31, current year

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College