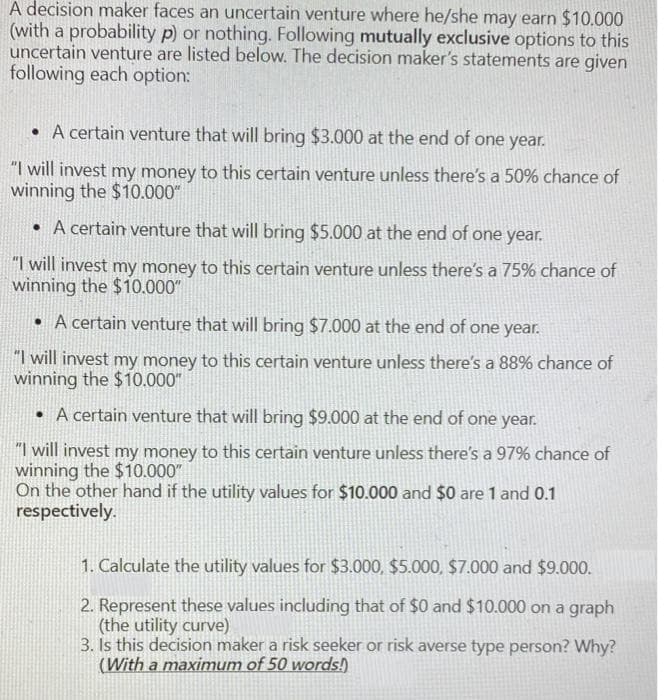

A decision maker faces an uncertain venture where he/she may earn $10.000 (with a probability p) or nothing. Following mutually exclusive options to this uncertain venture are listed below. The decision maker's statements are given following each option: • A certain venture that will bring $3.000 at the end of one year. "I will invest my money to this certain venture unless there's a 50% chance of winning the $10.000" • A certain venture that will bring $5.000 at the end of one year. "I will invest my money to this certain venture unless there's a 75% chance of winning the $10.000" • A certain venture that will bring $7.000 at the end of one year. "I will invest my money to this certain venture unless there's a 88% chance of winning the $10.000" • A certain venture that will bring $9.000 at the end of one year. "I will invest my money to this certain venture unless there's a 97% chance of winning the $10.000" On the other hand if the utility values for $10.000 and $0 are 1 and 0.1 respectively. 1. Calculate the utility values for $3.000, $5.000, $7.000 and $9.000. 2. Represent these values including that of $0 and $10.000 on a graph (the utility curve) 3. Is this decision maker a risk seeker or risk averse type person? Why? (With a maximum of 50 words!)

A decision maker faces an uncertain venture where he/she may earn $10.000 (with a probability p) or nothing. Following mutually exclusive options to this uncertain venture are listed below. The decision maker's statements are given following each option: • A certain venture that will bring $3.000 at the end of one year. "I will invest my money to this certain venture unless there's a 50% chance of winning the $10.000" • A certain venture that will bring $5.000 at the end of one year. "I will invest my money to this certain venture unless there's a 75% chance of winning the $10.000" • A certain venture that will bring $7.000 at the end of one year. "I will invest my money to this certain venture unless there's a 88% chance of winning the $10.000" • A certain venture that will bring $9.000 at the end of one year. "I will invest my money to this certain venture unless there's a 97% chance of winning the $10.000" On the other hand if the utility values for $10.000 and $0 are 1 and 0.1 respectively. 1. Calculate the utility values for $3.000, $5.000, $7.000 and $9.000. 2. Represent these values including that of $0 and $10.000 on a graph (the utility curve) 3. Is this decision maker a risk seeker or risk averse type person? Why? (With a maximum of 50 words!)

Chapter11: Venture Capital Valuation Methods

Section: Chapter Questions

Problem 1dM

Related questions

Question

Transcribed Image Text:A decision maker faces an uncertain venture where he/she may earn $10.000

(with a probability p) or nothing. Following mutually exclusive options to this

uncertain venture are listed below. The decision maker's statements are given

following each option:

• A certain venture that will bring $3.000 at the end of one year.

"I will invest my money to this certain venture unless there's a 50% chance of

winning the $10.000"

• A certain venture that will bring $5.000 at the end of one year.

"I will invest my money to this certain venture unless there's a 75% chance of

winning the $10.000"

• A certain venture that will bring $7.000 at the end of one year.

"1 will invest my money to this certain venture unless there's a 88% chance of

winning the $10.000"

• A certain venture that will bring $9.000 at the end of one year.

"1 will invest my money to this certain venture unless there's a 97% chance of

winning the $10.000"

On the other hand if the utility values for $10.000 and $0 are 1 and 0.1

respectively.

1. Calculate the utility values for $3.000, $5.000, $7.000 and $9.000.

2. Represent these values including that of $0 and $10.000 on a graph

(the utility curve)

3. Is this decision maker a risk seeker or risk averse type person? Why?

(With a maximum of 50 words!)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you