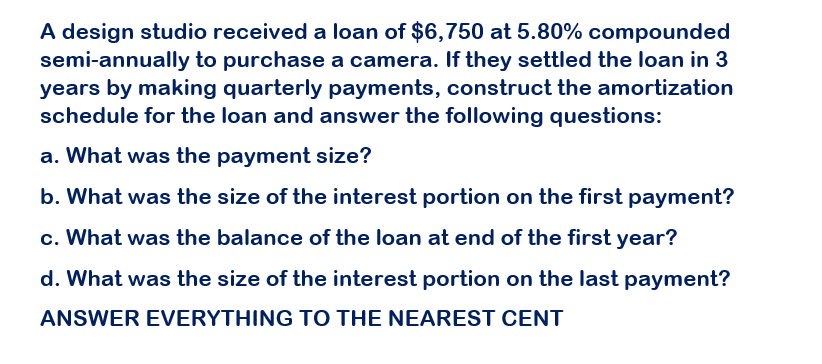

A design studio received a loan of $6,750 at 5.80% compounded semi-annually to purchase a camera. If they settled the loan in 3 years by making quarterly payments, construct the amortization schedule for the loan and answer the following questions: a. What was the payment size? b. What was the size of the interest portion on the first payment? c. What was the balance of the loan at end of the first year? d. What was the size of the interest portion on the last payment? ANSWER EVERYTHING TO THE NEAREST CENT

A design studio received a loan of $6,750 at 5.80% compounded semi-annually to purchase a camera. If they settled the loan in 3 years by making quarterly payments, construct the amortization schedule for the loan and answer the following questions: a. What was the payment size? b. What was the size of the interest portion on the first payment? c. What was the balance of the loan at end of the first year? d. What was the size of the interest portion on the last payment? ANSWER EVERYTHING TO THE NEAREST CENT

Chapter4: Time Value Of Money

Section4.17: Amortized Loans

Problem 1ST

Related questions

Question

Transcribed Image Text:A design studio received a loan of $6,750 at 5.80% compounded

semi-annually to purchase a camera. If they settled the loan in 3

years by making quarterly payments, construct the amortization

schedule for the loan and answer the following questions:

a. What was the payment size?

b. What was the size of the interest portion on the first payment?

c. What was the balance of the loan at end of the first year?

d. What was the size of the interest portion on the last payment?

ANSWER EVERYTHING TO THE NEAREST CENT

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning