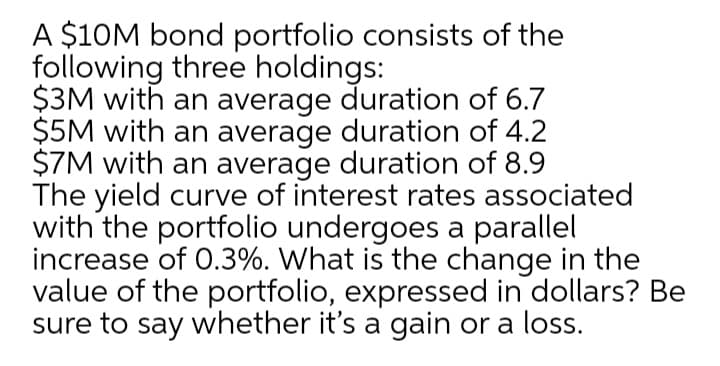

A $10M bond portfolio consists of the following three holdings: $3M with an average duration of 6.7 $5M with an average duration of 4.2 $7M with an average duration of 8.9 The yield curve of interest rates associated with the portfolio undergoes a parallel increase of 0.3%. What is the change in the value of the portfolio, expressed in dollars? Be sure to say whether it's a gain or a loss.

Q: You are creating a portfolio that consists of the following two bonds. Bond A pays an annual 7…

A: We will use the MDURATION function of the excel to calculate the modified duration of bond A.Let's…

Q: 00 par value bond that has an 8% coupon rate, pays a semi-annual coupon, matures 2 years from today,…

A: Macaulay duration is weighted average duration of bond considering the cash flow from bond. It is…

Q: The current rate of inflation is 3 percent, and long-term Treasury bonds are yielding 7 percent. You…

A: Due to the increase in the inflation rate the required rate of return also increase in the same…

Q: Suppose you have developed a bond portfolio using the bonds listed below (per $100 par value)…

A: Introduction: Yield to maturity (YTM) refers to the rate of return on a bond provided that the bond…

Q: 1. The following two portfolios have a market value of $500 million. The bonds in both portfolios…

A: Given: Two bond portfolio with different years to maturity and Par value. Coupon rate and Yield to…

Q: Suppose a 10-year, $1,000 bond with an 8.4% coupon rate and semi-annual coupons is trading for a…

A: The bond's yield to maturity is the interest rate at which, when the future benefits to be received…

Q: Bond A is a 4-year bond with a 10% coupon rate and Bond B is a 2-year bond with a 20% coupon rate.…

A: Given information Bond A - 4 Year Bonds, Coupon rate 10% Bond B -2 Year Bond, Coupon rate 20% Face…

Q: NBP Sarmaya Izafa Fund is attempting to balance one of the bond portfolios under its management. The…

A: Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: Calculate the yield spread of the floater discussed on page 45 to 46 when the maturity of the bond…

A: The question is based on the concept of Financial Management.

Q: Bond A is a 4-year bond with a 10% coupon rate and Bond B is a 2-year bond with a 20% coupon rate.…

A: Hedging is a way that limits risks of financial assets by offsetting positions in derivatives that…

Q: Your company owns the following bonds: Bond Market Value Duration A £14 million 3 B…

A: The first step to find the approximate change in the value of portfolio is to compute the weights of…

Q: Consider a five-year, default-free bond with annual coupons of 5% and a face value of $1,000 and…

A: Face value (F) = $1000 Annual coupon (C) = 5% of $1000 = $50 n = 5 years Let r = YTM

Q: Consider a bond portfolio consisting of €20 million in three-year maturity bonds, €10 million…

A: A portfolio is referred to as the collection of financial investments like cash, commodities, cash…

Q: 1. A portfolio consists of two bonds. The credit VAR is defined as the maximum loss due to defaults…

A: Data given: First Bond: Bond value =$1,000,000 Default Probability = 3% Recovery rate =60% Second…

Q: A bond for the Chelle Corporation has the following characteristics: Maturity - 12 years Coupon -…

A: The question is based on the concept of modified duration , its relation with Macaulay duration and…

Q: If a $5,000 zero coupon bond with a 10-year maturity has a market price of $1,508.30, what is its…

A: Given information: Par value is $5,000 Market price is $1,508.30 Number of years to maturity is 10…

Q: Suppose a 10-year, $1,000 bond with a 10% coupon rate and semiannual coupons is trading for a…

A: The price of bond can be calculated by using this formula Bond price =Coupon[1-1/(1+YTM)n] /YTM +…

Q: 1. Bond Delta was issued at a price of Php1,011.80 which carries a face value of Php1,000.00 and a…

A: Answer: b. The market rate of return must be lower than the coupon rate of 10%. Theory: Market…

Q: Abacus Ltd is an investment fund that specializes in fixed-income securities. At the end of 2010,…

A:

Q: Look at the following information given for a bond investment. If yield to maturity is increased…

A: Initial YTM = 10% Initial Price = 1000 Face Value = 1000 Coupon = Coupon Rate * Face Value =…

Q: hat is the current yield for a bond that has a coupon rate of 4.5% paid annually, a par value of…

A: Current yield for a bond is a metric that helps bond holders to determine the return on investment…

Q: Consider the following data for bonds A and B: _price annual cash flows t = 0 t = 1 t = 2 t = 3 A…

A:

Q: Consider the following two-bond portfolio of option-free bonds;Bond A Bond B Years to maturity 5…

A: Formula to calculate duration of the bond portfolio is: w1D1 + w2D2+...........wnDn Where w = market…

Q: What is the duration of a five-year, $1,000 Treasury bond with a 10 percent semiannual coupon…

A: Here, Face Value of Bond is $1,000 Coupon Rate is 10% Coupon Compounding is Semi annual Maturity…

Q: Given the following information, what is the approximate convexity measure for the bond if the yield…

A: Formula for approximate Convexity is as below:

Q: Portfolio A consists of a 1-year zero-coupon bond with a face value of $1,000 and a 10-year zero…

A:

Q: A manager wishes to hedge a bond with a par value of $20 million by selling Treasury bond futures.…

A: Given: Standard deviation of bond = 0.09 Standard deviation of instrument = 0.10 Correlation = 0.85

Q: Compute the following for a 2-years to maturity, 10% semi-annual fixed coupon bond when its yield-…

A: Time to maturity is 2years Coupon rate is 10% Par value of bond is $100 Coupon frequency is…

Q: NBP Sarmaya Izafa Fund is attempting to balance one of the bond portfolios under its management. The…

A: Since there are several subparts, we will answer the first three. Please repost the question…

Q: A bond portfolio has total assets of $132 million, of which 60% is financed with borrowed funds at a…

A: We need to compute the duration of portfolio equity

Q: A 6% coupon bond with semiannual coupons has a convexity (in years) of 120, sells for 80% of par,…

A: Convexity: Curvature in the relationship between bond prices and bond yields is measured by…

Q: The current market price of a 10-year zero- coupon bond is $1,234.567. The face value of the bond is…

A: A zero coupon bond is a bond which is issued at deep discount and redeemed at face value. There is…

Q: A portfolio of short-term bonds has expected cash flows of $382mln, $219mln, and $468mln at the end…

A: Cash flow of year 1 = $382 Mln Cash flow of year 2 = $219 Mln Yield of year 1 = 2.69% Yield of year…

Q: Suppose a ten-year, $1,000 bond with an 8.5% coupon rate and semiannual coupons is trading for…

A: Bond price is the sum of present value of all coupons and present value of face value at maturity.…

Q: Consider a bond that has a current value of $1,081.11, a face value of $1,000.00, a coupon rate of…

A: Current Value of Bond = 1081.11 Face Value of Bond = 1000 Coupon = Coupon Rate * Face Value of Bond…

Q: Bond A is a 4-year bond with a 10% coupon rate and Bond B is a 2-year bond with a 20% coupon rate.…

A: Macaulay duration is referred as the weighted average period term regarding the cash flows for the…

Q: the firm have a yield rate of 8.1%. Bonds with a similar debt rating has a default rate of 3.1% and…

A: Beta and Equity Beta: The beta of a stock is a measure of the systematic risk of a stock relative…

Q: "The current price of a bond having annual coupons is 1,200. The derivative of the price function of…

A: Macaulay Duration and the modified duration are used to calculate the duration of bonds. They use…

Q: What is the duration of a three-year, $1,000 Treasury bond with a 12 percent semiannual coupon…

A: Price of bond =Present value of coupon payment +Present value of par value Duration of bond =Sum of…

Q: If a $1,000 zero coupon bond with a 15- year maturity has a market price of $481.80, what is its…

A: In this question we require to compute the rate of return on a zero coupon bond. In case of zero…

Q: What is the expected rate of return on a bond that pays a coupon rate of 9%, has a par value of…

A: Facts of the question : Coupon rate = 9% Interest amount = (P1000*9%) = P90 Par value of Bond =…

Q: Assume that a RM1,000 par value bond has a coupon rate of 5% and will mature in 10 years. It has a…

A: Par Value = 1000 Coupon = Coupon Rate * Par Value = 5%* 1000 = 50 Price = 810.34 N = 10

Q: b) You are a fixed-income portfolio manager in an investment company. Currently, you are analysing…

A: Duration is the weighted average measure of a bond's life. The various time periods in which the…

Q: Assume the following yield to maturities: one year YTM 6%, two year YTM 7%, and three year YTM is…

A: Answer The price of a zero coupon bond can be calculated as: Price = M / (1 + r)n M= $1000 r= 5%…

4

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Portfolio A consists of a 1-year zero-coupon bond with a face value of $1,000 and a 10-year zero coupon bond with a face value of $1,000. Portfolio B consists of a single zero coupon bond with a face value of $2,000 and 3.6 years remaining to maturity. The current yield on all bonds is 10% per annum. Show that both portfolios have the same duration (start with B then do A). Show that the percentage changes in the values of the two portfolios for a 0.1% per annum drop in yields are virtually the same.A portfolio consists of two bonds. The bond value, default probability, and recovery rate are USD $1,000,000,1%, and 60% for one bond, and USD $400,000, 5%, and 30% for the other. The default correlation of the two bonds is 15%. Calculate the probability of joint default Calculate the expected credit loss for the portfolio Calculate the credit VaR for the portfolio at confidence levels from 99%-95%.Bluerock manages a well-diversified speculative grade bond portfolio which is expected to have an annual default rate of 5.3% and loss given default of 60%. A) What is the portfolio’s expected loss over the next 12 months? (answer % carried to 2 places.) B) If the speculative portfolio has a weighted average contractual coupon rate of 8.1%/year, what is its expected annual yield? (answer % carried to 2 places.)

- Consider a three-security portfolio below: Security Maturity (in years) Par value Price Yield to maturity 1 1 $100 $98 2.06% 2 1 $100 $95 5.0% 3 1 $100 $97 3.1% These securities pay $0 coupons at the end of the first 6-month period and par value at maturity. What is the weighted-average portfolio yield? A. 2.35% B. 4.34% C. 3.35% D. 5.34%These securities pay $0 coupons at the end of the first 6-month period and par value at maturity. What is the weighted-average portfolio yield? What is the portfolio yield (i.e., portfolio internal rate of return)?Consider a three-security portfolio below: Security Maturity (in years) Par value Price Yield to maturity 1 1 $100 $98 2.06% 2 1 $100 $95 5.0% 3 1 $100 $97 3.1% These securities pay $0 coupons at the end of the first 6-month period and par value at maturity. What is the portfolio yield (i.e., portfolio internal rate of return)? A. 3.12% B. 3.42% C. 4.24% D. 5.24%

- A portfolio consists of $15,000 in Stock M and $22,900 invested in Stock N. The expected return on these stocks is 8.80 percent and 12.40 percent, respectively. What is the expected return on the portfolio?A portfolio is invested 22 percent in Stock G, 37 percent in Stock J, and 41 percent in Stock K. The expected returns on these stocks are 9.5 percent, 12 percent, and 17.4 percent, respectively. What is the portfolio’s expected return?A portfolio consists of two securities: a 90-day T-bill and the S&P/TSX Composite. The expected return on the T-bill is 4.5%. The expected return on the S&P/TSX Composite is 12% with a standard deviation of 20%. What is the portfolio standard deviation if the expected return for this portfolio is 15%?

- You are creating a portfolio that consists of the following two bonds. Bond A pays an annual 7 percent coupon, matures in two years, has a yield to maturity of 8 percent, and a face value of $1,000. Bond B pays an annual 8 percent coupon, matures in three years, has a yield to maturity of 9 percent, and a face value of $1,000. Calculate the Modified Duration for Bond A.Assignement B Abacus Ltd is an investment fund that specializes in fixed income securities. At the end of2010 the fund’s bond portfolio has the following information BOND YIELD TO MATURITY PRICE DURATION CONVEXITY A 12% 1045 2.35 16.46 B 14% 2265 4.26 22.80 C 8% 1430 3.45 11.96 D 10% 1100 4.20 15.56 Assume that the yield to maturity on each bond increases by 4%, calculate(i) The percentage by which the price of each bond will decrease(ii) The amount in cedis by which the price of each bond will decrease (iii) The percentage and the cedi decrease in the total value of the portfolio.NBP Sarmaya Izafa Fund is attempting to balance one of the bond portfolios under its management. The fund has identified three bonds which have five-year maturities and which trade at a YTM of 9 percent. The bonds differ only in that the coupons are 7 percent, 9 percent, and 11 percent. a. What does the concept of duration mean in context of security valuation? b. On what factors duration of a bond depends and what relation duration has with those factors? c. Calculate the duration of the tree bonds as described in para above. d. Plot the relation between duration and coupon rate