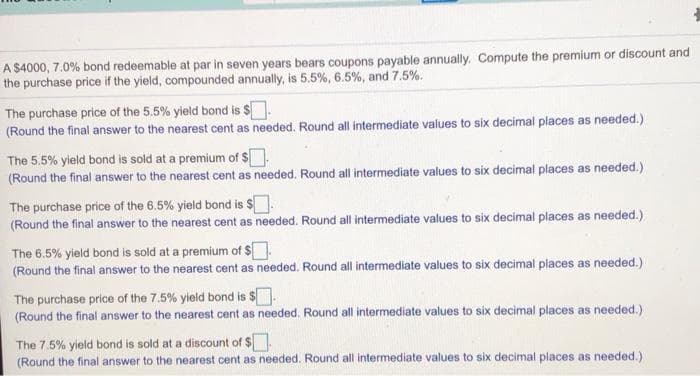

A $4000, 7.0% bond redeemable at par in seven years bears coupons payable annually. Compute the premium or discount and the purchase price if the yield, compounded annually, is 5.5%, 6.5%, and 7.5%. The purchase price of the 5.5% yield bond is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) The 5.5% yield bond is sold at a premium of $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) The purchase price of the 6.5% yield bond is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) The 6.5% yield bond is sold at a premium of $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) The purchase price of the 7.5% yield bond is $ (Round the final answer to the nearest cent as needed, Round all intermediate values to six decimal places as needed.) The 7.5% yleld bond is sold at a discount of $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)

A $4000, 7.0% bond redeemable at par in seven years bears coupons payable annually. Compute the premium or discount and the purchase price if the yield, compounded annually, is 5.5%, 6.5%, and 7.5%. The purchase price of the 5.5% yield bond is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) The 5.5% yield bond is sold at a premium of $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) The purchase price of the 6.5% yield bond is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) The 6.5% yield bond is sold at a premium of $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) The purchase price of the 7.5% yield bond is $ (Round the final answer to the nearest cent as needed, Round all intermediate values to six decimal places as needed.) The 7.5% yleld bond is sold at a discount of $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)

Step by step

Solved in 3 steps with 2 images