Compute the present value for each of the following bonds: a. Priced at the end of its fifth year, a 10-year bond with a face value of $100 and a contract (coupon) rate of 10% per annum (payable at the end of each year) with an effective (required) interest rate of 14% per annum. b. Priced at the beginning of its 10th year, a 14-year bond with a face value of $1,000 and a contract (coupon) rate of 8% per annum (payable at the end of each year) with an effective (required) interest rate of 6% per annum. C. What is the answer to b if bond interest is payable in equal semiannual amounts?

Compute the present value for each of the following bonds: a. Priced at the end of its fifth year, a 10-year bond with a face value of $100 and a contract (coupon) rate of 10% per annum (payable at the end of each year) with an effective (required) interest rate of 14% per annum. b. Priced at the beginning of its 10th year, a 14-year bond with a face value of $1,000 and a contract (coupon) rate of 8% per annum (payable at the end of each year) with an effective (required) interest rate of 6% per annum. C. What is the answer to b if bond interest is payable in equal semiannual amounts?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 88PSA: Ratio Analysis Consider the following information taken from the stockholders equity section: How do...

Related questions

Question

1-13 all parts

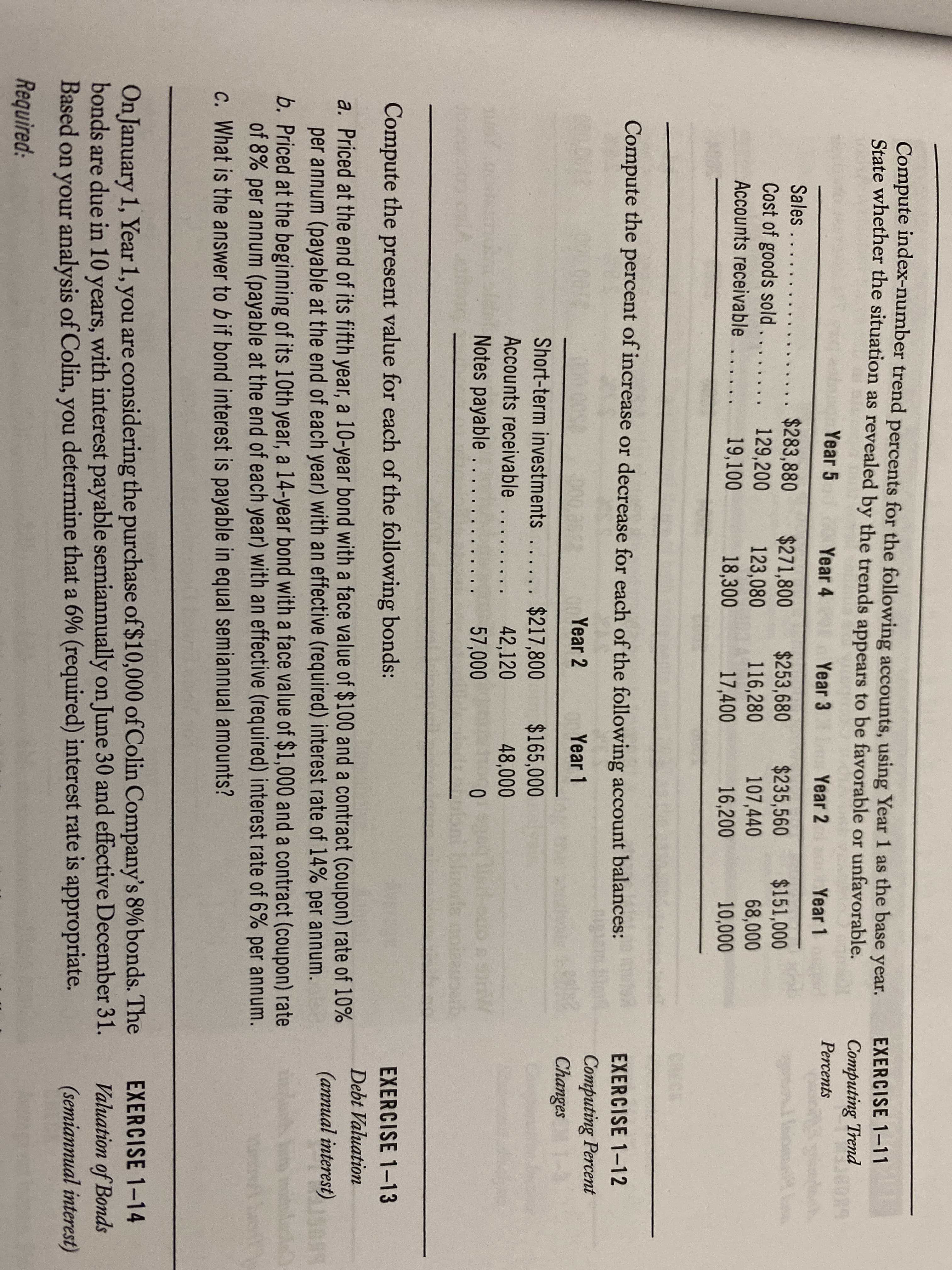

Transcribed Image Text:Compute index-number trend percents for the following accounts, using Year 1 as the base year.

State whether the situation as revealed by the trends appears to be favorable or unfavorable.

EXERCISE 1-11

Computing Trend

Year 5

Year 4

Year 3

Year 2

Year 1

Percents

Sales......

$283,880

129,200

19,100

$271,800

123,080

18,300

$253,680

116,280

17,400

$235,560

$151,000

68,000

10,000

Cost of goods sold...

107,440

16,200

Accounts receivable

CRECK

Compute the percent of increase or decrease for each of the following account balances:

EXERCISE 1-12

Year 2

Year 1

Computing Percent

Changes

1-3

Short-term investments ...... $217,800

Accounts receivable ....

Notes payable ....

$165,000

42,120

57,000

48,000

Compute the present value for each of the following bonds:

EXERCISE 1-13

Debt Valuation

a. Priced at the end of its fifth year, a 10-year bond with a face value of $100 and a contract (coupon) rate of 10%

per annum (payable at the end of each year) with an effective (required) interest rate of 14% per annum.

b. Priced at the beginning of its 10th year, a 14-year bond with a face value of $1,000 and a contract (coupon) rate

of 8% per annum (payable at the end of each year) with an effective (required) interest rate of 6% per annum.

c. What is the answer to b if bond interest is payable in equal semiannual amounts?

(annual interest)

On January 1, Year 1, you are considering the purchase of $10,000 of Colin Company's 8% bonds. The

bonds are due in 10 years, with interest payable semiannually on June 30 and effective December 31.

Based on your analysis of Colin, you determine that a 6% (required) interest rate is appropriate.

EXERCISE 1-14

Valuation of Bonds

(semiannual interest)

Required:

Expert Solution

Step 1

A bond is a financial instrument issued by large business organizations and governments to raise debt funds for a long-term period. The issuer of a bond shall be liable to pay periodic coupon payments as per the agreed coupon rate.

The intrinsic value of a financial instrument represents a sum of the present value of future cash flows expected from that instrument. Therefore, the bond price at any given time represents a sum of present value of future cash flows expected from the bond.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning