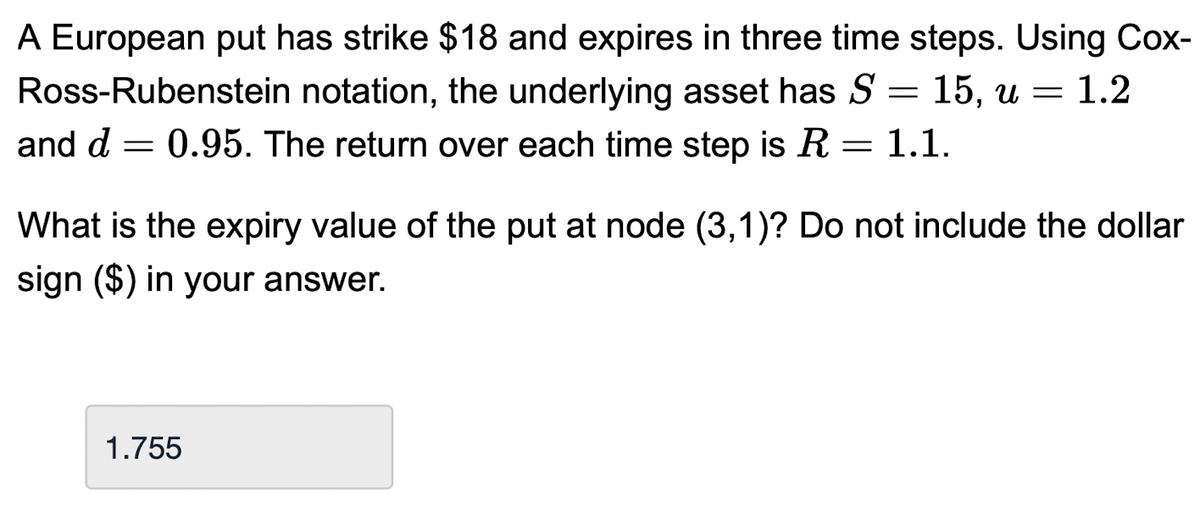

A European put has strike $18 and expires in three time steps. Using Cox- notation, the underlying asset has S = 15, u = 1.2 and d = 0.95. The return over each time step is R = 1.1. Ross-Rubenstein What is the expiry value of the put at node (3,1)? Do not include the dollar sign ($) in your answer. 1.755

Q: Ten (10) years ago Bruce invested $1,000. Today, the investment is worth $3,250. If interest is…

A: The annual rate of return is the compounded rate of return earned on the given principal amount…

Q: Consider the following information about Stocks I and II. State of Economy Recession Normal…

A: Systematic risk is undiversifiable risk and beta is a measure of systematic risk. Unsystematic risk…

Q: As a medical administrator at the local hospital, you made a total purchase of $4447.85. Currently,…

A: Given: Total purchases = $4447.85 Saline solutions =40 Catheters = 25 Syringe = 150 Cost per saline…

Q: To start saving for retirement, Alexandra opens an RRSP that earns interest at a rate of 4.9%…

A: The future value is useful to investors and financial planners, as they use it to estimate how much…

Q: Charecteristics Model approach IN FINANCE, can be used in determining the discount rate in equity…

A: The discount rate in the equity valuation describes the returns in the long term given as a…

Q: the financial institution do to lower these risks

A: The main risk is that interest rates will rise. Therefore, banks have to pay higher interest rates…

Q: quarterly. Find the amount available in this fund after 10 years

A: Quarterly payment is $30,000. Maturity period is 10 years. Rate of interest is 6%. Compounding…

Q: 1) Lincoln Industries intends to move to a bigger premise in 7 years’ time. With the increased space…

A: As per our guidelines we are supposed to answer only one question (if there are multiple questions…

Q: an we conclude that the market is expecting short term

A: The yield on long term bonds of government shows the interest rate in the market and these tell the…

Q: please do both or don't attempt

A: Deficiency judgement - This is a court ruling against a default debtor on a secured loan. When…

Q: The free cash flow valuation model is based on the same principle as dividend valuation models; that…

A: Free cash flow can be used to determine the value of a share price. It uses the same principle of…

Q: A local pension scheme collects contributions from its members each year end. The planned collection…

A: “Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only…

Q: Cherry Blossom Products Inc. produces and sells yoga-training products: how-to DVDs and a basic…

A: As per the given information: Sales:DVDs - 13,500Equipment sets- 4,500Yoga Mats - 9,000 DVDs…

Q: Matthew has a $32,500 student loan at 4.80% compounded quarterly amortized over 12 years with…

A: monthly interest rate = (1+quarterly rate)^(1/3) -1 = (1+4.80%/4)^(1/3) -1 =…

Q: please show the solution

A: A lease is a financing option where there are two parties lessor and lessee. The lessor leases an…

Q: A Services company is projecting that demand for its services will rise considerably the next three…

A: Leasing help the company to use the asset immediately without buying it at a huge cost. On the other…

Q: Prisha received a loan of $25,000 from the bank at 3.50% compounded monthly. If she had to repay…

A: Solution:- When an amount is borrowed, it can either be repaid as a lump sum payment or in…

Q: re are claims that the central bank caused the recession, and due to them, production has dropped…

A: Central bank are very important in the country and role of central banks have become major factor in…

Q: 2. Using the Interpolation Method to calculate the YTM for the below Bonds: > The par value $18000 >…

A: Working Note #1 Calculation of coupon amount Coupon amount = Par Value * Coupon Rate Coupon amount =…

Q: Which of the following statements regarding bonds and their terms is FALSE?

A: All options given are correct except The yield to maturity of a bond is the discount rate that…

Q: Consider a 1-year semi-annually paid interest rate swap, the notional is £1,000,000, the swap rate…

A: Interest rate swap is an agreement between two parties where one party agrees to make fixed interest…

Q: Consider an investment with the following probability distribution: Probability Payoff 0.40 30.0…

A: Probability is the expectation or estimate which is forecasted. For calculation of expected return,…

Q: (a) Use the YIELD command in excel to calculate the bond's yield to maturity on each of the dates.…

A: As per instructions only question a and b will be solved. The yield function in excel requires 7…

Q: At the beginning of 2022, CPA Company purchased 20% of ACCA Corp’s ordinary shares outstanding for…

A: The equity method refers to an accounting method employed to compute and report the income on the…

Q: Required: a) Explain why Bank of England's intervention during the September 1992 was described as…

A: a. This incident is called Black Wednesday. This is when Britain had to withdraw from European…

Q: on the 28/02/x2 a parent acquires 100 of the share capital of a subsidiary entity.at the groups year…

A: Pre and Post acquisition profit Pre Acquisition Profit - It is the profit which pertains to the…

Q: You have learnt three approaches that can be used in determining the discount rate in equity…

A: Equity valuation refers to the method of estimating the fair value of the firm. In the stock…

Q: Lawrence has just won S6,250 from the 50/50 at the Sea Dog's game and decides to invest all of it.…

A: Compound interest is the addition of interest to the principal sum of a loan or deposit, or in…

Q: 4. (a) How many years will it take to have $5,800 if you invest $1,500 at 5% compounded monthly? (b)…

A: 4 a) Data given: FV=$5800 PV= $1500 r=5% compounded monthly Required: No. of years =?

Q: Explain the meaning and composition of the "return" of a financial investment

A: Financial Investment Funds invested for the purpose of earning returns over a specified period of…

Q: raig Company had the following standard

A: Answer1) Price and usage variances for materials. Enter amounts as positive numbers and select…

Q: What do you see as some of the possible problems if shareholder value is seen as a strategy (and not…

A: Strategy refers to the financial approach for the planning of the functions that are based on a…

Q: Richmond Corporation was founded 20 years ago by its president, Daniel Richmond. The company…

A: Net cash flows refer to the profit or loss after payment of all debts over a period. When incomes…

Q: D. The Fixed Assets Turnover is reported to be 1.48. The Fixed Assets intensity is 56%. The company…

A: Efficiency Ratios: In financial analysis, efficiency ratios are used to analyze the efficiency of…

Q: What is the present value of end-of-year cashflows of $1,000 per year, with the first cashflow…

A: Present value is the value today of future cash flows discounted to present terms using a specified…

Q: Given the data and hints, Project Zeta’s initial investment is______ , and its NPV is ______…

A: (I would assume you to have a Financial Calculator) As we already know that the IRR (Internal Rate…

Q: Create a spreadshe

A: Terminal Cashflows represents project's last year's Cash Inflow at the end of the Economic life of…

Q: ve years ago Messy House Painting issued a 15-year bond with a $1,000 maturity value and a 6 percent…

A: The yield to maturity is rate of return realized on the bond when is held till maturity and yield to…

Q: can help investors to transform assets. Use appropriate examples and diagrams t

A: An interest rate swap is a forward contract in which one unborn interest payments is changed for…

Q: Salim and Lathika Hussein have been married for two years. Salim is 47 years old; Lathika is 42…

A: Solution: Calculation of RRSP deduction: RRSP deduction is 18% of earned income, a maximum of…

Q: a. Calculate his total profit or loss made from the sale of the phones. Round to the nearest…

A: A trade discount is a discount given by the manufacturer to the seller. It deducts from the list…

Q: c) You are in the United States. The date is 26 July 2022. You decide that the market has…

A: Price of bond is present value of coupon and the present value of par value of bond that is paid on…

Q: What is the economic rationale for compulsory auto insurance? Suppose motor insurance coverage was…

A: Insurance as a sector is key to the development of any economy. Providing Security and Protection…

Q: The last balance sheet of Lotus company is as follows Assets: Current Assets:

A: a Financing provided for assets of the firm consists of debt capital and equity capital. Debt…

Q: Your Aunt Betty has a $120,000 investment portfolio comprising some Government of Canada three-month…

A: Derivative is an contract between two parties. whose value is derived from an underlying asset. When…

Q: he Metropolitan Bus Company (MBC) purchases diesel fuel from American Petroleum Supply. In addition…

A: The variable cost is directly tied to the amount of output, and a change in production alters the…

Q: Use the following table to answer questions: Country (currency) Canada (dollar) Denmark (krone) Euro…

A: Exchange Rates on Jun2 30, 2010 1 USD($) = 7.782 Sweden krona (SKr) Exchange Rates on Jun2 30, 2009…

Q: DE HIE HIF = PH - PF EHIF EH/F=0.7341 TT F= 3% EHF=0.7361 country. denotes the growth rate in price…

A: The above given formula is from Relative Purchasing Power Parity which states the relationship…

Q: The hubris motive for M&As refers to which of the following? Explains why mergers may happen…

A: Hubris Hypothesis is when the acquiring company pays more than the current market value of the…

Q: w is the securities industry regulated in Canada? a) By OSFI. b) By the appropriate provincial…

A: Every country has own method and official authority which the govern the security market but it…

Answer provided, need solving details, thx

Step by step

Solved in 3 steps with 3 images

- Convert the projected franc flows into dollar flows and calculate the NPV. (Do not round intermediate calculations and enter your answer in dollars, not millions, rounded to 2 decimal places, e.g., 1,234,567.89.) b-1. What is the required return on franc flows? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b-2. What is the NPV of the project in Swiss francs? (Do not round intermediate calculations and enter your answer in dollars, not millions, rounded to 2 decimal places, e.g., 1,234,567.89.) b-3. What is the NPV in dollars if you convert the franc NPV to dollars?Consider the position of a call writer who sold a call option on Australian dollars at an exercise price of $US0.7600/$A, and a premium of $US0.002/$A. Calculate and graphically depict the profits/losses for this call option position for the following spot prices at exercise date: $US0.7475/$A, $US0.7550/$A, $US0.7600/$A, $US0.7700/$A, and $US0.7800/$A. Please explain it in Excel. thank youAssume that the price of a forward contract is 127.87. The European options on the forward contract has an exercise price $150, expiring in 60 days. 3.75% is the continuously compounded risk-free rate, and volatility is 0.33. Using the Black-Scholes-Merton model, compute the price of a put option on the underlying asset.

- Assume that the price of a forward contract is 127.87. The European options on the forward contract has an exercise price $150, expiring in 60 days. 3.75% is the continuously compounded risk-free rate, and volatility is 0.33. Calculate the underlying asset's price. Using the Black-Scholes-Merton model, determine the price of a call option on the underlying asset.Suppose the returns on an asset are normally distributed. The historical average annual return for the asset was 6.4 percent and the standard deviation was 12.4 percent. A. What range of returns would you expect to see 95 percent of the time? (Enter your answers for the range from lowest to highest. A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) B. What range of returns would you expect to see 99 percent of the time? (Enter your answers for the range from lowest to highest. A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.)Over a particular period, an asset had an average return of 11.6 percent and a standard deviation of 20.0 percent. What range of returns would you expect to see 95 percent of the time for this asset? (A negative answer should be indicated by a minus sign. Input your answers from lowest to highest to receive credit for your answers. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.)

- Suppose the forward contract is entered into at the price computed is $365.42 and 4 months later, the price of the asset is $325.45. The investor would like to evaluate her position with respect to any gain or loss accrued on the forward contract. The market value of the forward contract at this point in time from the perspective of the investor would be: a. -$39.97 b. -$19.57 c. $9.63 d. $19.57Consider the position of a call writer who sold a call option on Australian dollars at an exercise price of $US0.7600/$A, and a premium of $US0.002/$A. Calculate and graphically depict (excel) the profits/losses for this call option position for the following spot prices at exercise date: $US0.7475/$A, $US0.7550/$A, $US0.7600/$A, $US0.7700/$A, and $US0.7800/$A.Assume the bid rate of a Canada dollar is A$.271 while the ask rate is A$.273 at Bank A. Assume the bid rate of the Canada dollar is A$.265 while the ask rate is A$.266 at Bank B. Given this information, what would be your gain if you use A$2,500,000 and execute locational arbitrage? That is, how much will you end up with over and above the A$2,500,000 you started with? Group of answer choices A$ 46,992 A$ 65,789 - A$ 65,789 A$ 18,315 - A$ 46,992

- The following parameters are provided:S = $40, K= $45, r = 5% (continuously compounded), Time to maturity = 6 months, p = $6, Using put-call parity, the price of the call is $1.92 $2.11 $2.47 $2.78Suppose that we can describe the world using two states and that two assets are available, asset K an asset L. We assume the asset’s future prices have the following distribution State Future Price Asset K Future Price Asset L 1 $55 $60 2 $45 $30 The current price of asset K is $50, and the current price of asset L is $50. 1. What are the values of the unit claims (C1 and C2 )?Consider the position of a call writer who sold a call option on Australian dollars at an exercise price of $US0.7600/$A, and a premium of $US0.002/$A. Calculate and graphically depict the profits/losses for this call option position for the following spot prices at exercise date: $US0.7475/$A, $US0.7550/$A, $US0.7600/$A, $US0.7700/$A, and $US0.7800/$A.