Salim and Lathika Hussein have been married for two years. Salim is 47 years old; Lathika is 42 "ears of age. Lathika is a chartered accountant and earns a salary of $128,000. Salim is a bus river for city transit and earns a salary of $62,500. His salary last year was $60,200. Currently Falim and I Mil

Salim and Lathika Hussein have been married for two years. Salim is 47 years old; Lathika is 42 "ears of age. Lathika is a chartered accountant and earns a salary of $128,000. Salim is a bus river for city transit and earns a salary of $62,500. His salary last year was $60,200. Currently Falim and I Mil

Chapter3: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 46P

Related questions

Concept explainers

Question

E6

Transcribed Image Text:66

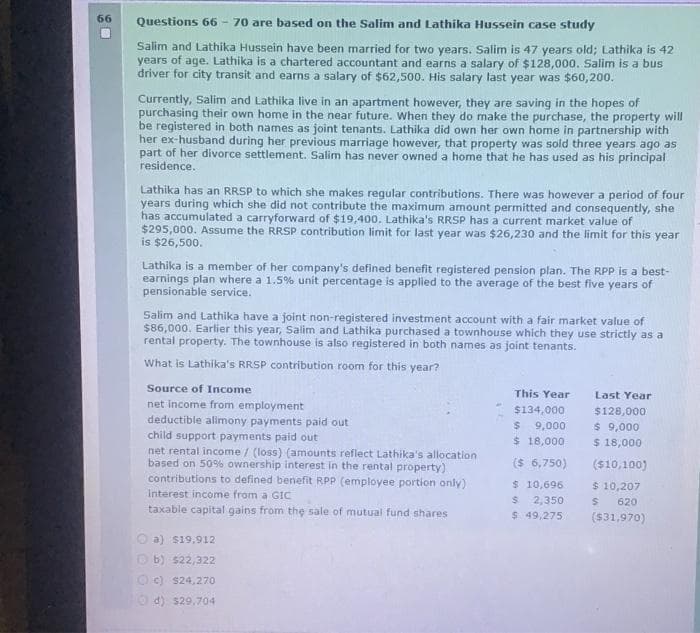

Questions 66-70 are based on the Salim and Lathika Hussein case study

Salim and Lathika Hussein have been married for two years. Salim is 47 years old; Lathika is 42

years of age. Lathika is a chartered accountant and earns a salary of $128,000. Salim is a bus

driver for city transit and earns a salary of $62,500. His salary last year was $60,200.

Currently, Salim and Lathika live in an apartment however, they are saving in the hopes of

purchasing their own home in the near future. When they do make the purchase, the property will

be registered in both names as joint tenants. Lathika did own her own home in partnership with

her ex-husband during her previous marriage however, that property was sold three years ago as

part of her divorce settlement. Salim has never owned a home that he has used as his principal

residence.

Lathika has an RRSP to which she makes regular contributions. There was however a period of four

years during which she did not contribute the maximum amount permitted and consequently, she

has accumulated a carryforward of $19,400. Lathika's RRSP has a current market value of

$295,000. Assume the RRSP contribution limit for last year was $26,230 and the limit for this year

is $26,500.

Lathika is a member of her company's defined benefit registered pension plan. The RPP is a best-

earnings plan where a 1.5% unit percentage is applied to the average of the best five years of

pensionable service.

Salim and Lathika have a joint non-registered investment account with a fair market value of

$86,000. Earlier this year, Salim and Lathika purchased a townhouse which they use strictly as a

rental property. The townhouse is also registered in both names as joint tenants.

What is Lathika's RRSP contribution room for this year?

Source of Income

net income from employment

deductible alimony payments paid out

child support payments paid out

net rental income / (loss) (amounts reflect Lathika's allocation

based on 50% ownership interest in the rental property)

contributions to defined benefit RPP (employee portion only)

Interest income from a GIC

taxable capital gains from the sale of mutual fund shares

a) $19,912

b) $22,322

c) $24,270

d) $29.704

This Year

$134,000

$ 9,000

$ 18,000

($ 6,750)

$ 10,696

$ 2,350

$ 49,275

Last Year

$128,000

$ 9,000

$ 18,000

($10,100)

$ 10,207

S 620

($31,970)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT