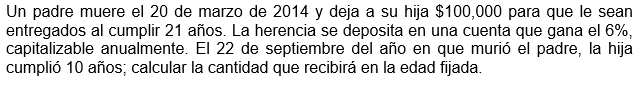

A father dies on March 20, 2014, and leaves his daughter $100,000 to be given to her on her 21st birthday. The inheritance is deposited in an account earning 6%, compoundable annually. On September 22 of the year the father died, the daughter turned 10; calculate the amount she will receive at the set age.

PLEASE, PERFORM THE EXERCISE IN EXCEL AND SHOW THE FORMULAS

Problem 4:

A father dies on March 20, 2014, and leaves his daughter $100,000 to be given to her on her 21st birthday. The inheritance is deposited in an account earning 6%, compoundable annually. On September 22 of the year the father died, the daughter turned 10; calculate the amount she will receive at the set age.

Note:

In the image, this is the original exercise, it is in Spanish, but it is easy to understand.

Very important Note:

It is necessary that you make a solution approach and then the result. Above all, to check the procedure and/or the formulas used, especially when you use excel.

TO CONSIDER THE YEAR AS 360 DAYS (WHICH IS COMMERCIAL) (only if required)

Step by step

Solved in 2 steps with 3 images