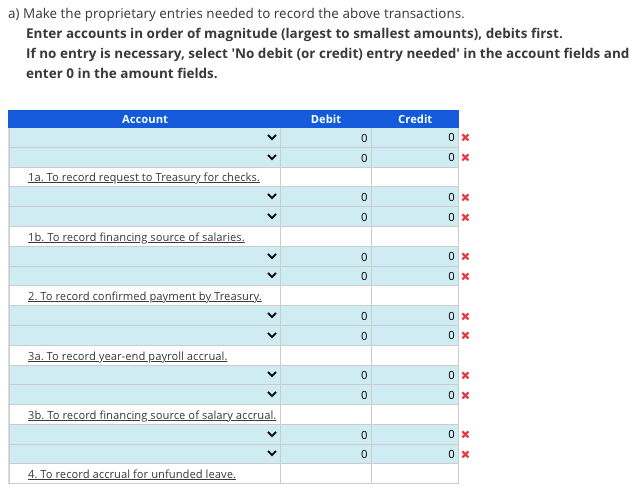

A federal agency receives a separate allotment to finance the salary costs of its program. The allotment is sufficient to cover salaries earned in the last month of the fiscal year but paid early in the next fiscal year. The account Allotments—realized resources has a credit balance of $300,000. The agency maintains budgetary control by means of a vacancy control system. The following events and transactions occurred at the agency: 1. A disbursement schedule is sent to Treasury requesting salary checks— $275,000. 2. Treasury notifies the agency that payment was made. 3. The agency accrues salaries of $18,000 at the end of the fiscal year. 4. The agency accrues $20,000 for unused vacation leave. Budgetary resources for vacation leave are provided when leave is actually taken.

A federal agency receives a separate allotment to finance the salary costs of its program. The

allotment is sufficient to cover salaries earned in the last month of the fiscal year but paid early in

the next fiscal year. The account Allotments—realized resources has a credit balance of $300,000. The

agency maintains budgetary control by means of a vacancy

and transactions occurred at the agency:

1. A disbursement schedule is sent to Treasury requesting salary checks— $275,000.

2. Treasury notifies the agency that payment was made.

3. The agency accrues salaries of $18,000 at the end of the fiscal year.

4. The agency accrues $20,000 for unused vacation leave. Budgetary resources for vacation leave

are provided when leave is actually taken.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images