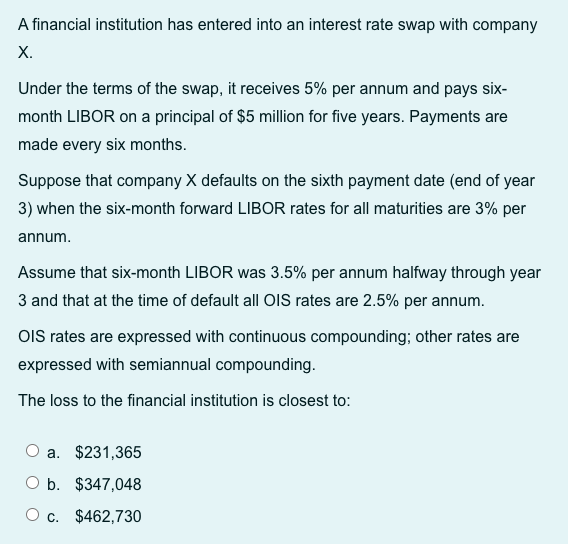

A financial institution has entered into an interest rate swap with company X. Under the terms of the swap, it receives 5% per annum and pays six- month LIBOR on a principal of $5 million for five years. Payments are made every six months. Suppose that company X defaults on the sixth payment date (end of year 3) when the six-month forward LIBOR rates for all maturities are 3% per annum. Assume that six-month LIBOR was 3.5% per annum halfway through year 3 and that at the time of default all OIS rates are 2.5% per annum. OIS rates are expressed with continuous compounding; other rates are expressed with semiannual compounding. The loss to the financial institution is closest to: O a. $231,365 O b. $347,048 O c. $462,730

A financial institution has entered into an interest rate swap with company X. Under the terms of the swap, it receives 5% per annum and pays six- month LIBOR on a principal of $5 million for five years. Payments are made every six months. Suppose that company X defaults on the sixth payment date (end of year 3) when the six-month forward LIBOR rates for all maturities are 3% per annum. Assume that six-month LIBOR was 3.5% per annum halfway through year 3 and that at the time of default all OIS rates are 2.5% per annum. OIS rates are expressed with continuous compounding; other rates are expressed with semiannual compounding. The loss to the financial institution is closest to: O a. $231,365 O b. $347,048 O c. $462,730

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 17P

Related questions

Question

Give typing answer with explanation and conclusion

Transcribed Image Text:A financial institution has entered into an interest rate swap with company

X.

Under the terms of the swap, it receives 5% per annum and pays six-

month LIBOR on a principal of $5 million for five years. Payments are

made every six months.

Suppose that company X defaults on the sixth payment date (end of year

3) when the six-month forward LIBOR rates for all maturities are 3% per

annum.

Assume that six-month LIBOR was 3.5% per annum halfway through year

3 and that at the time of default all OIS rates are 2.5% per annum.

OIS rates are expressed with continuous compounding; other rates are

expressed with semiannual compounding.

The loss to the financial institution is closest to:

a. $231,365

O b. $347,048

O c. $462,730

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College