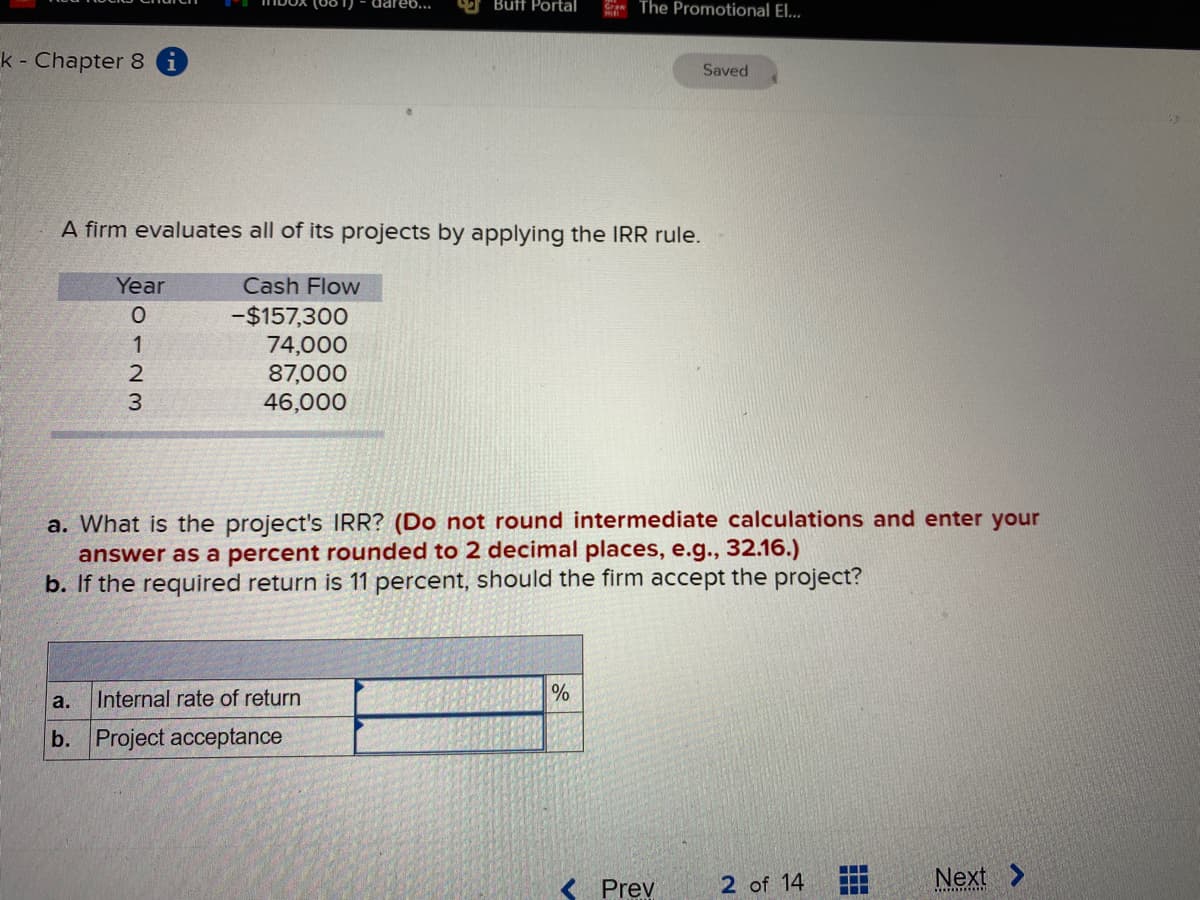

A firm evaluates all of its projects by applying the IRR rule. Year Cash Flow -$157,300 74,000 87,000 46,000 a. What is the project's IRR? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. If the required return is 11 percent, should the firm accept the project? a. Internal rate of return b. Project acceptance 0123

Q: What are the projects' NPVs assuming the WACC is 5%? Enter your answer in millions. For example, an…

A: NPV refers to net present value. It is the sum of present values of cash flows that occur in each…

Q: Given the following, determine the firm’s optimal capital structure: Debt/Assets After-Tax Cost…

A: The cost of capital is the cost of capital projects of the company which is computed by using the…

Q: Prob. Return (%) B 0.1 40 G 0.2 30 O 0.3 15 L 0.2 2 S 0.2 -12 where B-Bloom,G-Good,…

A: Risk is a factor which arises due to the possibility of differences between the actual outcome and…

Q: If $2,000 is withdrawn from the bank by a customer, the bank's Assets rise O Assets and liabilities…

A: When the customer withdraws money, in his books, the cash account is debited and bank account is…

Q: Determine how your business can apply the Responsibility to Stakeholder!

A: Stakeholder: Stake holder is a person or group of people who own a share in a business and is…

Q: Small enterprise Support- what are the key findings that lose and tengeh 2015 found in their study?…

A: lose and tengeh 2015 paper looked into the difficulties that business incubators (BIs) face when…

Q: Marta purchased a home with an adjustable rate mortgage. The margin on an adjustable-rate mortgage…

A: A Loan refers to the amount of money taken by one party named borrower from the other party named…

Q: Consider a mortgage loan where the periodic payment is 1 and the per period mortgage interest is 5%.…

A: Perpetuity can be defined as a cash flow of equal amount at equal intervals of time with out an end.…

Q: Division A of Kern Co. has sales of $350,000, cost of goods sold for $200,000, operating expenses of…

A: Formula Return on investment = (Sales-Cost of goods sold-Operating expenses)/Invested assets Where…

Q: For the given cash flows, suppose the firm uses the NPV decision rule. Year Cash Flow -$ 157,300…

A: Solution:- Net Present Value (NPV) means the present value of project in today’s terms. NPV =…

Q: Project L requires an initial outlay at t = 0 of $67,000, its expected cash inflows are $11,000 per…

A: Formula Payback period = Initial investment/Annual cash inflow Where Initial investment = $67,000…

Q: If ARORA-B = 8%, which is > MARR of 6%, then we will keep project A and drop project B, even though…

A: While comparing two or more projects, the project with highest ROR is considered to be feasible.…

Q: Nate. borrowed Php 2000.00 from Mr. Mark on June 1,1928 and Php 500.00 on June 1, 1930, agreeing…

A:

Q: How much should the monthly deposits be for his retirement plan?

A: Time value of money (TVM) refers to the method used to measure the amount of money at different…

Q: how much must you donate now if the fund earns interest at a rate of 4% per year? Show your hand…

A: Time value of money (TVM) refers to the method used to measure the amount of money at different…

Q: nsurance is a way to decrease the ffinancial risk from unexpected events, like an illness, car…

A: Insurance is a very important tool in finance which helps us to mitigate risks and reduce risks due…

Q: Problem 6. As of the end of 2022, Mindorosas Inc. had total assets of P375,000 and equity of…

A: The process by which a business evaluates possible big projects or investments is known as capital…

Q: 1a. A machine was purchased 4 years ago for $50,000. The depreciation amount each year was $10,000.…

A: Book value of depreciated assets is cost less Accumulated Depreciation.

Q: 2. (a) You have a two-asset portfolio that comprises Stock PY and Stock NY with the following…

A: Portfolio standard deviation is the standard deviation of all the different investments in the…

Q: 9. You are considering investing in a start-up project at a cost of $100,000. You expect the project…

A: The internal rate of return basically is the projected yearly rate of growth from an investment. IRR…

Q: Sainsbury is financed by both debt and equity. Using the following information and calculate the…

A: WACC means weighted average cost of finance or to raise the funds. Company has to pay an additional…

Q: Use the present value and future value tables to answer the following questions. A. If you would…

A: Since you have posted question with multiple sub parts, we shall be solving first three sub-parts…

Q: 6c A large profitable corporation is considering a capital investment of $50.000. The equipment has…

A: Tax for year 2 will be calculated on net income. Tax for year 2 =(Annual gross…

Q: A 6% coupon bond with semiannual coupons has a convexity (in years) of 120, sells for 80% of par,…

A: Convexity: Curvature in the relationship between bond prices and bond yields is measured by…

Q: Check my Required information a. What is the net present value of the project? (Negative amount…

A: NPV is capital budgeting technique used to evaluate performance of projects. It is arrived at by…

Q: Consider the two investments with the following sequences of cash flows. At Marr of 15%. What is the…

A: IRR refers to the annualized rate of return for a given project. Higher the IRR, better the…

Q: For projects A and B determine the payback period(PBP) and the Account rate of return (ARR). The…

A: Payback period and accounting rate of return are tools to evaluate potential investment projects of…

Q: On December 31, 2020, Berclair Inc. had 500 million shares of common stock and 3 million shares of 9…

A: Given, Net income = $800 million Preferred dividend = ( 9% ×$100=$9/share)…

Q: 1. Consider 3 stocks A, B, and C and the risk-free rate RF=0.5%. The logarithmic rates of return are…

A: Hi, since you have posted multiple questions and the first uestion has multiple sub-parts. We will…

Q: A mutual fund has $400 million worth of stock, $500,000 in cash, and $1 million in other assets. The…

A: Mutual funds refer to one type of financial vehicle that pools money from many investors and invests…

Q: You were offered 2 investment opportunities, Stock M and Stock D. Your decision as to which…

A: Decision would be taken based on calculating expected rate of return using CAPM formula. Required…

Q: Anne buys a television set from a merchant who asks for P1,250 at the end of 60 days. Mr. Ureta…

A: Cash price for the television can be calculated as: = Value after 60 days / (1 + Interest rate for…

Q: An unlevered firm has a cost of capital of 11.3 percent and a tax rate of 34 percent. The firm is…

A: We need to calculate weighted average cost of capital(WACC) which will be the firm's levered cost of…

Q: Suppose you want to buy a $150,000 home. You found a bank that offers a 30-year loan at 4.1% APR.…

A: Given: Loan Amount = $150,000 No. of Year = 30 years Annual Rate = 4.1% We will calculate the…

Q: 16 Zippy Pasta Corporation (ZPC) has a constant growth rate of 7 percent. The company retains 30…

A: The optimal capital structure is the best mix of debt and equity financing that maximizes a…

Q: Majestic Aircraft Corporation is considering purchasing composite wing fixtures for the assembly of…

A: Net annual cash flow can be defined as the per year cash inflows as deducted by the per year cash…

Q: 5 Dye Industries currently uses no debt, but its new CFO is considering changing the capital…

A: Beta refers to a measure of a market risk that cannot be diversified means it is a measure of…

Q: You need a home loan of $65,000 after your down payment. How much will your monthly house payment be…

A: FORMULA Monthly payment = LV/[1-(1+R)-N]/R Where LV - Loan amount i.e. $65000 R - Monthly interest…

Q: he college tuition is expected to increase with an average of 5% per year for the next 5 years. The…

A: We will use the concept of time value of money here. As per the concept of time value of money the…

Q: Cool Runnings Corp. plans to construct a building after 5 years. The Chief Financial Officer…

A: We need to use present value formula to calculate the amount of cash need to invested today. Present…

Q: What house value can Betty afford? Betty's annual income is $90,000 and she has monthly credit…

A: Here, To Find: Value of the house =?

Q: NPV and maximum return A firm can purchase new equipment for $17,000 that generates an annual cash…

A: Given: Year Particulars Amount 0 Initial investment -$17,000 1 Cash inflows $4,000 2 Cash…

Q: Assume that l2t = 0.30% and that it = 0. If the one-year interest rate is 5% and the two-year…

A: The one-year forward rate: The interest rate earned on a one year deposit is known as the one-year…

Q: How much should be invested at 6% to have $1900 at the end of 4.5 years? (Round your final answer to…

A: FORMULA Investment amount = FV/(1+R)N Where FV - Future value i.e. $1900 R - Interest rate i.e. 6% N…

Q: QUESTION 1. If Commonwealth Bank, an Australian Bank, borrows short-term funds from the United…

A: Question 1: Inward foreign portfolio investment in the United States occurs when Commonwealth Bank,…

Q: QUESTION THREE Sharpy and Jane are saving for the college education of their newborn son, Kasuba.…

A: Future Value of Ordinary Annuity refers to the concept which determines the sum total of all the…

Q: The value of anything can be determined if you know the amount and timing of related: Net…

A: Cashflow helps to calculate Income statement. From income statement, we can calculate Earnings…

Q: Jesse has a good job and pays off his one credit card every month. He was surprised that when he…

A: A credit review, also known as account monitoring or account review inquiry, is a periodic…

Q: You invest $100 in a risky asset with an expected return of 12% and a standard deviation of 15%, and…

A: The percentage of money invested in T bills can be computed with the concept of portfolio expected…

Q: A is planning for her retired life. She has 10 more years of service. He would like to deposit 20%…

A: Present value of Annuity Annuity is a series of equal payment at equal interval over a specified…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Q No.1 HASF Inc, has two investment proposals, which have the following characteristics Project A Period Cost Profit after tax Net cash flow 0 15,000 ------ ------- 1 1000 5000 2 1000 4000 4 1000 3000 Project B Period Cost Profit after tax Net cash flow 0 10000 ------- -------- 1 1000 5000 2 1000 5000 3 4000…Compute the net present value for each project. (Round answers to 0 decimal places, e.g. 125. If the net present value is negative, use either a negative sign preceding the number eg -45 or parentheses eg (45). For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Project Bono Project Edge Project Clayton Net present value $enter a dollar amount rounded to 0 decimal places $enter a dollar amount rounded to 0 decimal places $enter a dollar amount rounded to 0 decimal places Save for LaterProblem 2 ABM Enterprise would like to evaluate/analyze an investment proposal.Given the following:Investment amount - 450,000 (2022)Dividends / Revenue stream - 100,000 for the first year and an interval of 5,000 for thesucceeding yearsDiscount rate - 14% a. NPV for the perio 2023 through 2029;b. Total NPV using manual computation;c. Total NPV using the Excel function; andd. IRR rate.

- A firm evaluates all of its projects by applying the IRR rule. Year Cash Flow 0 –$ 150,000 1 66,000 2 73,000 3 57,000 What is the project's IRR? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)Task 2A business has two projects to invest in, as follows:Create a new spread sheet, calculate NPV for the following projects at discount rates of 3% and 7%, respectively, by creating a dynamic process. Project 1 Project 2Year Cash inflows Cash outflows Cash inflows Cash outflows0 0.00 70,000.00 0.00 70,000.001 24,000.00 13,000.00 25,000.00 15,000.002 22,000.00 1,000.00 25,000.00 03 25,000.00 0 20,000.00 04 25,000.00 0 43,000.00 21,000.005 17,500.00 7,500.00 20,000.00 5,000.00 P1: NPV P2: NPVThen, a) by using a built-in/Excel function, calculate the NPV for each project with discount rates of 3% and 7%, respectively;b) By comparing the NPVs at the rate of…Question 6 XY Company is considering 5 investment projects as follows: Project Investment ($) Profitability index (PI) A 10,000 1.2 B 6,000 1.1 C 18,000 1.6 D 14,000 0.9 E 12,000 1.3 The company has $30,000 available for investment. Projects C and E are mutually exclusive. All projects can be undertaken only once and are not divisible. Required: (ii)Rank the projects PI and NPV

- Using the below informtion answer: 5.1 Payback Period of Project Tan (expressed in years, months and days). 5.2 Net Present Value of Project Tan.5.3 Accounting Rate of Return on average investment of Project Tan (expressed to two decimal places). INFORMATIONThe management of Mastiff Enterprises has a choice between two projects viz. Project Cos and Project Tan, each ofwhich requires an initial investment of R2 500 000. The following information is presented to you: PROJECT COS PROJECT TANNet Profit Net ProfitYear R1 130 000 80 0002 130 000 180 0003 130 000 120 0004 130 000 220 0005 130 000 50 000A scrap value of R100 000 is expected for Project Tan only. The required rate of return is 15%. Depreciation is calculatedusing the straight-line method.Emusk Inc. is evaluating two mutually exclusive projects. The required rate of return on these projects is 8%. Calculate the internal rate of return for Project B. (Enter percentages as decimals and round to 4 decimals). Year Project A Project B 0 -15,000,000 -15,000,000 1 2,000,000 6,000,000 2 3,000,000 6,000,000 3 5,000,000 6,000,000 4 5,000,000 1,000,000 5 6,000,000 1,000,000Problem 8-14 Problems with Profitability Index [LO 4, 6] The Michner Corporation is trying to choose between the following two mutually exclusive design projects: Year Cash Flow (I) Cash Flow (II) 0 −$ 82,000 −$ 40,000 1 32,000 13,200 2 42,000 29,500 3 48,000 22,500 a-1. If the required return is 15 percent, what is the profitability index for each project? Note: Do not round intermediate calculations and round your answers to 3 decimal places, e.g., 32.161. a-2. If the company applies the profitability index decision rule, which project should it take? b-1. If the required return is 15 percent, what is the NPV for each project? Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. b-2. If the company applies the net present value decision rule, which project should it take?

- Item Skipped Print Item 6 Item 6 2.66 points Item Skipped Problem 13-13 PI (LG13-6) Compute the PI statistic for Project Z if the appropriate cost of capital is 7 percent. (Do not round intermediate calculations and round your final answer to 2 decimal places.) Project Z Time: 0 1 2 3 4 5 Cash flow: –$1,400 $430 $560 $730 $380 $180 Should the project be accepted or rejected? accepted rejectedREPLACEMENT CHAIN The Lesseig Company has an opportunity to invest in one of two mutually exclusive machines that will produce a product the company will need for the next 8 years. Machine A costs 8.9 million but will provide after-tax inflows of 4.5 million per year for 4 years. If Machine A were replaced, its cost would be 9.8 million due to inflation and its cash inflows would increase to 4.7 million due to production efficiencies. Machine B costs 13.9 million and will provide after-tax inflows of 4.3 million per year for 8 years. If the WACC is 9%, which machine should be acquired? Explain.QUESTION 11 Four different building locations have been suggested, of which only one will be selected. See table for detail data. Apply incremental B/C ratio analysis to select the best alternative. The MARR is 6%. A B C D Building cost $-200,000 $-250,000 $-180,000 $-290,000 Cash flow +22,000 +35,000 +19,500 +42,000 Life, years 25 25 25 25 plz answer correct calculation asap plz Dont answer by pen pepar