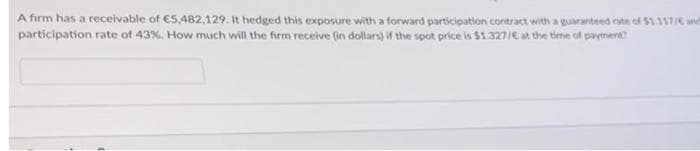

A firm has a receivable of €5,482,129. It hedged this exposure with a forward participation contract with a guaranteed rate of $1.117/C and participation rate of 43%. How much will the firm receive (in dollars) if the spot price is $1.327/€ at the time of payment?

A firm has a receivable of €5,482,129. It hedged this exposure with a forward participation contract with a guaranteed rate of $1.117/C and participation rate of 43%. How much will the firm receive (in dollars) if the spot price is $1.327/€ at the time of payment?

Chapter11: Managing Transaction Exposure

Section: Chapter Questions

Problem 6ST

Related questions

Question

Question Aa

Full explainthe this question very fast solution sent me step by step

Don't ignore any part all part work u

Text typing work only not allow paper work

Transcribed Image Text:A firm has a receivable of €5,482,129. It hedged this exposure with a forward participation contract with a guaranteed rate of $1.117/€ and

participation rate of 43%. How much will the firm receive (in dollars) if the spot price is $1.327/€ at the time of payment?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you