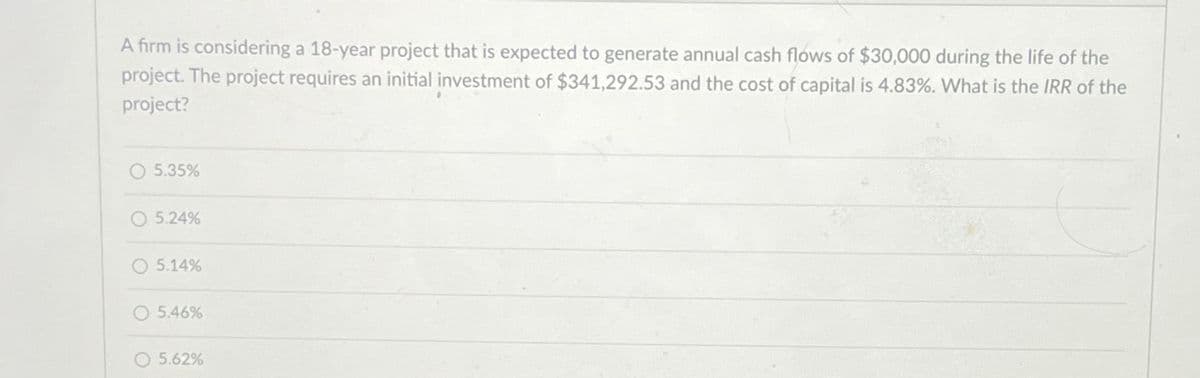

A firm is considering a 18-year project that is expected to generate annual cash flows of $30,000 during the life of the project. The project requires an initial investment of $341,292.53 and the cost of capital is 4.83%. What is the IRR of the project? ○ 5.35% 5.24% O 5.14% 5.46% 5.62%

Q: Bhupatbhai

A: The calculation you provided breaks down the cash flows for each year of the project. Let's analyze…

Q: None

A: Here's a structured step-by-step answer with explanations: Step 1: Understand the given…

Q: Cat Supplies offers terms of 1/10, net 35. The discount is taken by 77 percent of customers. What is…

A: Average Collection Period = (Discounted Days * % of Customers Taking Discount) + (Full Days * % of…

Q: None

A: Use the Gordon Growth Model, which is a method used to determine the intrinsic value of a stock…

Q: Problem 11-5 (Algo) Next week, Super Discount Airlines has a flight from New York to Los Angeles…

A: Step 1:Given that, Cost of underestimating the demand (Cu) = $100 Cost of overestimating the demand…

Q: Since international logistics may contribute to a nation's, nation's it directly increases a Time 42…

A: Transportation in foreign affairs is a very important element of the economic system of the nation.…

Q: None

A: Solving for Forward Rates:We can use the provided yields on zero-coupon Treasury bills to calculate…

Q: You are valuing a project for Gila Corporation using the APV method. You already found the net…

A: Sure, let's break down the calculation step by step: 1. Present Value of Interest Tax Shields…

Q: You are evaluating a closed-end mutual fund and see that its price is different from its net asset…

A: Discount = (Risk-Adjusted Abnormal Return - Expense Ratio) / (Dividend Yield + Expense Ratio -…

Q: Create pro-Forma Financial Statements for 39 Storage. This Business. https://www.39storage.com/…

A: Detailed Financial Projections for 39 Storage: Revenue Projections:Year 1 (2024): $XXXXX Year 2…

Q: This assignment repeats the work done in class using a company named Nodiv. The current share price…

A: Long Futures PositionNodiv Stock Price at Expiry ($50) Payoff at ExpiryAbove $55.30 Price at Expiry…

Q: You are trying to pick the least-expensive car for your new delivery service. You have two choices:…

A: 1. Present Value Interest Factor of Annuity (PVIFA): . For the Kia Rio: PVIFA [Rio]…

Q: es Suppose the following bond quote for IOU Corporation appears in the financial page of today's…

A: currentyield is calculated as the annual coupon payment divided by the current bond price,…

Q: Nikul

A: To calculate the total cost of issuing the securities, we need to consider the expenses incurred by…

Q: Kari is purchasing a home for $220,000. The down payment is 25% and the balance will be financed…

A: To calculate Kari's closing costs, find: Down Payment:Percentage = 25%Home Price = $220,000Down…

Q: Esfandairi Enterprises is considering a new three-year expansion project that requires an initial…

A: Let's break down the calculation of the Operating Cash Flow (OCF) for Esfandairi Enterprises'…

Q: Exercise 9-11 (Algo) Computing payroll taxes LO P2, P3 Mest Company has nine employees. FICA Social…

A: Employee Payroll Tax Calculations (without table)FICA Social Security:Total wages subject to tax:…

Q: Saved Modern Artifacts can produce keepsakes that will be sold for $60 each. Nondepreciation fixed…

A: Understanding Break-Even Levels:Accounting Break-Even: The point at which total revenue equals total…

Q: A project has an initial cost of $75,000, expected net cash inflows of $12,000 per year for 12…

A:

Q: Ch 12-Assignment - Cash Flow Estimation and Risk Analysis Year 0: -$20,000 Year 0: -$40,000 Year 1:…

A: The Equivalent Annual Annuity (EAA) is a financial metric used to evaluate the profitability of an…

Q: Stock X has systematic risk of betax=1 and the analyst forecasts its return to be 12%. Stock Y has…

A: 2. Alpha of Each Stock and Better Buy:Alpha (α) measures the difference between a stock's actual…

Q: Q4. You are willing to buy a car which will cost you 20000 euros. A bank is willing to provides you…

A: In this scenario, you are considering two loan options from a bank to purchase a car costing 20,000…

Q: Please Give Step by Step Answer Otherwise i give DISLIKES !!

A: Step 1:iRobot = 0.99 x 3,490/3,490+0 = 0.99Middleby's = 1.94 x 7,610/7,610+777 = 1.760National…

Q: k 1 ences You are evaluating two different cookie-baking ovens. The Pillsbury 707 costs $70,500, has…

A: Pilsbury 707 NPV = -Machine cost + (Operating cash flow x Cumulative PVF @ 13% 1 to 5 years life )…

Q: Vijay

A: Free Cash Flow=EBIT∗(1−t)+Depreciation−Capital expenditure−Increase in…

Q: The price of a home is $180,000. The bank requires a 5% down payment and one pointat the time of…

A: a. Required Down PaymentThe down payment required is 5% of the price of the home.Given:• Price of…

Q: Dixie Dynamite Company is evaluating two methods of blowing up old buildings for commercial purposes…

A: The Net Present Value (NPV) is a financial metric used to evaluate the profitability of an…

Q: Bhupatbhai

A: To calculate the cash flows for the project, we followed these steps:1. Calculated Sales Revenue: We…

Q: Calgary Corp. issued 20-year bonds 3 years ago. The bonds have a face value of $1,000 and their…

A: Answers: PV = C * (1 - (1 + r)^-n) / r + M / (1 + r)^n Where:PV = Present Value = Market Price of…

Q: how does walmart used blockchain

A: Key references:Nakamura, A. (2019). Walmart's Blockchain Initiative Faces COVID-19 Test. Harvard…

Q: 2. Assuming sales in the 1st year are breakeven, what is the growth rate of sales required to pay…

A: The objective of the question is to calculate the growth rate of sales required to pay the start-up…

Q: a. Modern Medical Devices has a current ratio of 0.5. Which of thefollowing actions would improve…

A: There are two options for improving Modern Medical Devices' current ratio of 0.5. For starters,…

Q: Please Write Step by Step Answer Otherwise i give DISLIKE !!

A: Sure, I can help you with this Monte Carlo simulation problem to estimate the expected total cost of…

Q: An unlevered firm has a cost of equity capital of 10%. The firm will invest in a project that will…

A: In a perfect capital market, the cost of capital for the levered firm is determined by the weighted…

Q: Suppose you simultaneously buy 400 shares of Exxon at 70 and write two APR 70 puts at $2.50. What is…

A: Step 1: Final answer: At option expiration, if Exxon's stock sells for $77.38, your gain is $2,957.…

Q: None

A: Calculate the after-tax cost of leasing and compare it to the after-tax cost of borrowing and buying…

Q: Which shows the discounted payback period at an interest rate of 15% for each project for each…

A: Step 1:Discounted Payback period takes into account time value of money to calculate the time it…

Q: Suppose we are thinking about replacing an old computer with a new one. The old one cost us…

A: Calculations:A. Equivalent Annual Cost (EAC) for Old Computer (Year 0):1. Tax shield from…

Q: Suppose the risk-free rate of return is 3.5 percent and the market risk premium is 7 percent. Stock…

A: To determine whether stock Ubis correctly priced,we need to compare it's expected rate of return…

Q: None

A: When the commuter gets a new job that is closer to home, the time spent commuting would decrease as…

Q: A couple has decided to purchase a $120000 house using a down payment of $10000. They can amortize…

A: Additional considerations:This is a simplified example, and it doesn't take into account factors…

Q: Stock Risk Premium 25% 20% 15% 10% Intercept • 5% Market Risk Premium -15% -10% -9% 5% 10% -5% .…

A: d)The residuals in this graph are simply the vertical distances between the individual data points…

Q: 33. the commercial package policy declarations contain interlines enduements cause of loss forms…

A: Without a doubt! To get a better understanding of each of the components that are specified in the…

Q: 8. C. d. a. Firm-specific risk is measured by the residual standard deviation. Thus, stock A has…

A: Your answers for parts a, b, and c are correct! Let's discuss part d in more detail.d. The Security…

Q: 2.

A:

Q: A firm is considering Projects S and L, whose cash flows are shown below. These projects are…

A: To determine how much potential value the firm would lose if the wrong decision criterion is used…

Q: Which of the following statements are CORRECT? Check all that apply: The aftertax cost of debt…

A: The aftertax cost of debt decreases when the market price of a bond increases: The aftertax cost of…

Q: None

A: The monthly risk-free rate isn't a static value; it varies over time based on the prevailing…

Q: Lugget Corp. has one bond issue outstanding with an annual coupon of 3.8%, a face value of $1,000…

A: Estimate the Yield to Maturity (YTM):There are various approximation formulas for YTM. Here, we'll…

Q: Consider the following teo mutually exclusive projects X 20600, 9000 9400 8950 Y 20600 10400 7950…

A: Using Excel to get the IRR use this code:For Project x: =IRR(B2:B5)For Project y: =iRR(C2:C5)Project…

Unlock instant AI solutions

Tap the button

to generate a solution

Click the button to generate

a solution

- Redbird Company is considering a project with an initial investment of $265,000 in new equipment that will yield annual net cash flows of $45,800 each year over its seven-year life. The companys minimum required rate of return is 8%. What is the internal rate of return? Should Redbird accept the project based on IRR?Jasmine Manufacturing is considering a project that will require an initial investment of $52,000 and is expected to generate future cash flows of $10,000 for years 1 through 3, $8,000 for years 4 and 5, and $2,000 for years 6 through 10. What is the payback period for this project?The Pinkerton Publishing Company is considering two mutually exclusive expansion plans. Plan A calls for the expenditure of 50 million on a large-scale, integrated plant that will provide an expected cash flow stream of 8 million per year for 20 years. Plan B calls for the expenditure of 15 million to build a somewhat less efficient, more labor-intensive plant that has an expected cash flow stream of 3.4 million per year for 20 years. The firms cost of capital is 10%. a. Calculate each projects NPV and IRR. b. Set up a Project by showing the cash flows that will exist if the firm goes with the large plant rather than the smaller plant. What are the NPV and the IRR for this Project ? c. Graph the NPV profiles for Plan A, Plan B, and Project .

- Buena Vision Clinic is considering an investment that requires an outlay of 600,000 and promises a net cash inflow one year from now of 810,000. Assume the cost of capital is 10 percent. Required: 1. Break the 810,000 future cash inflow into three components: a. The return of the original investment b. The cost of capital c. The profit earned on the investment 2. Now, compute the present value of the profit earned on the investment. 3. Compute the NPV of the investment. Compare this with the present value of the profit computed in Requirement 2. What does this tell you about the meaning of NPV?Falkland, Inc., is considering the purchase of a patent that has a cost of $50,000 and an estimated revenue producing life of 4 years. Falkland has a cost of capital of 8%. The patent is expected to generate the following amounts of annual income and cash flows: A. What is the NPV of the investment? B. What happens if the required rate of return increases?Project S has a cost of $10,000 and is expected to produce benefits (cash flows) of $3,000 per year for 5 years. Project L costs $25,000 and is expected to produce cash flows of $7,400 per year for 5 years. Calculate the two projects’ NPVs, IRRs, MIRRs, and PIs, assuming a cost of capital of 12%. Which project would be selected, assuming they are mutually exclusive, using each ranking method? Which should actually be selected?

- Mason, Inc., is considering the purchase of a patent that has a cost of $85000 and an estimated revenue producing lite of 4 years. Mason has a required rate of return that is 12% and a cost of capital of 11%. The patent is expected to generate the following amounts of annual income and cash flows: A. What is the NPV of the investment? B. What happens if the required rate of return increases?Wansley Lumber is considering the purchase of a paper company, which would require an initial investment of $300 million. Wansley estimates that the paper company would provide net cash flows of $40 million at the end of each of the next 20 years. The cost of capital for the paper company is 13%. Should Wansley purchase the paper company? Wansley realizes that the cash flows in Years 1 to 20 might be $30 million per year or $50 million per year, with a 50% probability of each outcome. Because of the nature of the purchase contract, Wansley can sell the company 2 years after purchase (at Year 2 in this case) for $280 million if it no longer wants to own it. Given this additional information, does decision-tree analysis indicate that it makes sense to purchase the paper company? Again, assume that all cash flows are discounted at 13%. Wansley can wait for 1 year and find out whether the cash flows will be $30 million per year or $50 million per year before deciding to purchase the company. Because of the nature of the purchase contract, if it waits to purchase, Wansley can no longer sell the company 2 years after purchase. Given this additional information, does decision-tree analysis indicate that it makes sense to purchase the paper company? If so, when? Again, assume that all cash flows are discounted at 13%.Fenton, Inc., has established a new strategic plan that calls for new capital investment. The company has a 9.8% required rate of return and an 8.3% cost of capital. Fenton currently has a return of 10% on its other investments. The proposed new investments have equal annual cash inflows expected. Management used a screening procedure of calculating a payback period for potential investments and annual cash flows, and the IRR for the 7 possible investments are displayed in image. Each investment has a 6-year expected useful life and no salvage value. A. Identify which project(s) is/are unacceptable and briefly state the conceptual justification as to why each of your choices is unacceptable. B. Assume Fenton has $330,000 available to spend. Which remaining projects should Fenton invest in and in what order? C. If Fenton was not limited to a spending amount, should they invest in all of the projects given the company is evaluated using return on investment?

- The Ulmer Uranium Company is deciding whether or not to open a strip mine whose net cost is $4.4 million. Net cash inflows are expected to be $27.7 million, all coming at the end of Year 1. The land must be returned to its natural state at a cost of $25 million, payable at the end of Year 2. Plot the project’s NPV profile. Should the project be accepted if r = 8%? If r = 14%? Explain your reasoning. Can you think of some other capital budgeting situations in which negative cash flows during or at the end of the project’s life might lead to multiple IRRs? What is the project’s MIRR at r = 8%? At r = 14%? Does the MIRR method lead to the same accept-reject decision as the NPV method?Manzer Enterprises is considering two independent investments: A new automated materials handling system that costs 900,000 and will produce net cash inflows of 300,000 at the end of each year for the next four years. A computer-aided manufacturing system that costs 775,000 and will produce labor savings of 400,000 and 500,000 at the end of the first year and second year, respectively. Manzer has a cost of capital of 8 percent. Required: 1. Calculate the IRR for the first investment and determine if it is acceptable or not. 2. Calculate the IRR of the second investment and comment on its acceptability. Use 12 percent as the first guess. 3. What if the cash flows for the first investment are 250,000 instead of 300,000?