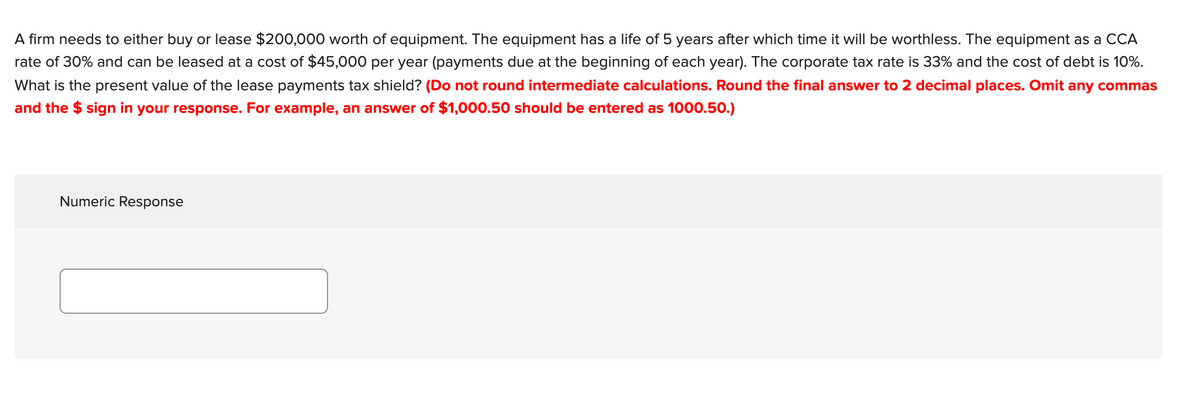

A firm needs to either buy or lease $200,000 worth of equipment. The equipment has a life of 5 years after which time it will be worthless. The equipment as a CCA rate of 30% and can be leased at a cost of $45,000 per year (payments due at the beginning of each year). The corporate tax rate is 33% and the cost of debt is 10%. What is the present value of the lease payments tax shield? (Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit any commas and the $ sign in your response. For example, an answer of $1,000.50 should be entered as 1000.50.) Numeric Response

A firm needs to either buy or lease $200,000 worth of equipment. The equipment has a life of 5 years after which time it will be worthless. The equipment as a CCA rate of 30% and can be leased at a cost of $45,000 per year (payments due at the beginning of each year). The corporate tax rate is 33% and the cost of debt is 10%. What is the present value of the lease payments tax shield? (Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit any commas and the $ sign in your response. For example, an answer of $1,000.50 should be entered as 1000.50.) Numeric Response

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter2: Introduction To Spreadsheet Modeling

Section: Chapter Questions

Problem 25P

Related questions

Question

30) can i please get help with this question?

Transcribed Image Text:A firm needs to either buy or lease $200,000 worth of equipment. The equipment has a life of 5 years after which time it will be worthless. The equipment as a CCA

rate of 30% and can be leased at a cost of $45,000 per year (payments due at the beginning of each year). The corporate tax rate is 33% and the cost of debt is 10%.

What is the present value of the lease payments tax shield? (Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit any commas

and the $ sign in your response. For example, an answer of $1,000.50 should be entered as 1000.50.)

Numeric Response

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,