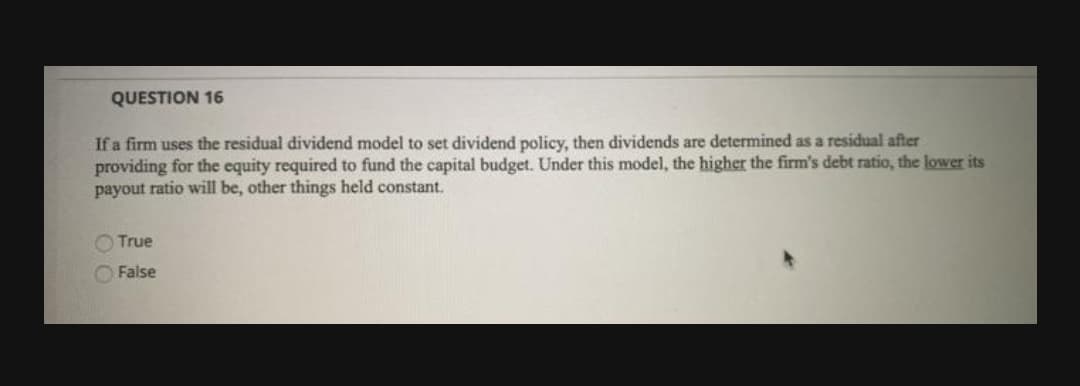

a firm uses ther roviding for the e ayout ratio will b True False

Q: Markup and margin as percentages are equal. O True O False

A:

Q: rmine (a) the current ratio and (b) the

A: The current ratio and quick ratios are a measure of liquidity for the business. Current ratio= The…

Q: The slope of the characteristic line of a security is that security's Beta. Select one: O True O…

A: Stock refers to the smallest unit of the total number of shares that are being issued by the public…

Q: A relatively low P/E ratio illustrates

A: The PE ratio is calculated by dividing the share price by the earnings per share of the company. The…

Q: Which of the following statements about the relationship between the IRR and the MIRR is correct? A…

A: The IRR is the investment discount rate that corresponds to the difference between the original…

Q: What is one interpretation of a high P/E ratio?

A: Price to earnings ratio (P/E ratio) states the relationship of the earnings with price of that…

Q: What is the put-call ratio? What is it used for? What are considered high and low values and what do…

A: The question is based on the concept for indicators of the stock market performance. The Put-Call…

Q: Which of the following is NOT true regarding the normal distribution= Multiple Choice It is…

A: Introduction: The normal distribution is one of the important and valuable distributions in the…

Q: If two returns are positively related to each other, they will have a ________, and if they are…

A: Covariance: calculates the directional relationship between two variables.

Q: Assertions: A. A Cutoff B. Accuracy C. Completene D. Existence E. Valuation

A: a. Decisional roles- The managers oversee and initiate new tasks or projects in order to enhance…

Q: general, what does a high Tobin's Q value indicate and how reliable does that value tend to be?

A:

Q: Define beta coefficient, b

A: Answer: Beta coefficient is a coefficient which leads to the measurement of stock volatility in…

Q: In a regression analysis, the variable that is being predicted is the a. Intervening variable O b.…

A: The variable that is attempted to clarify or anticipate is known as the the response variable,…

Q: The efficient frontier measures risk by using: Group of answer choices B. Correlation A. Risk-free…

A: Efficient frontier refers to the graphical representation of the set of optimal portfolios…

Q: calculate the standard deviation of returns.

A: Standard Deviation is the square root of the variance, which is the measurement of risk. And risk…

Q: I can use the regression beta as my estimate of beta in a valuation. True or false

A: Beta refers to the measurement of the volatility of stock related to the market as a whole. When…

Q: Which of the following is incorrect? V [ Select ] P= A {[(1+i)^N - 1]/[(1)]} * [(1+i)^(-N)] P= G…

A: Time Value of Money is the concept which determines that value of dollar today is more than the…

Q: 32. An analyst calculated the excess kurtosis of information, we conclude that the distribution of…

A: When the value of excess kurtosis is negative then the distribution is called platykurtic. (Note…

Q: If the B/C ratio for three alternatives A B, and Care 2.8, 3.3 and 1.95 respectively, the best…

A: Benefit-Cost Ratio: The projects which have a B/C ratio greater than 1 are considered good projects…

Q: Explain the difference between a linear risk and a nonlinear risk.

A: Linear risk is an enterprise's risk, based on the traditional economic system of "take-up-dispose."…

Q: The break-even value calculation is similar to the calculation we use for theinternal rate of…

A: The internal rate of return (IRR) is a capital budgeting metric used to gauge the benefit of…

Q: Enter a T if the statement is true and F if it is false. Explain your choice. i) The solution u to…

A: Black scholes method is a method used to calculate the call option as well as put option price.

Q: Show that the lower semi-standard deviation corrected expectation has properties (UT) und (UC)

A: Semi-deviation is an alternative to standard deviation for determining the degree of risk associated…

Q: Is a negative Sharpe ratio good or bad? EXPLAIN

A: What sharpe ratio measure? It measure the excess return earn by portfolio over risk free rate at…

Q: TE THE B/C RATIO AND ST WORTH DOING (YES /NO)

A: The benefit-cost ratio is a numerical or qualitative metric that depicts the correlation between…

Q: Explain the relationship between the conventionaL PW criterion and the B/C ratio?

A: The relationship between the cost of the project and benefits earned from the project is measured by…

Q: Which of the following statement is true of a covariance matrix? a. The diagonal values are…

A: A covariance matrix is a representation of variances and covariances between assets. Hence, a n × n…

Q: Firm A and Firm B have the same ROA, yet Firm A’s ROE is higher. How can you explain this?

A: ROA stands for return on assets and ROE stands for return on equity. If Firm A and Firm B have the…

Q: Applying the DDM model utilizing the following inputs: PO, d1, d2, r, g. When rearranging the price…

A: The dividend discount model is a model used to predict the current price of the stock by using the…

Q: When two variables are not perfectly related, then their correlation would be one? a.true…

A: In order to determine the relationship between the variables correlation is used, if in changing in…

Q: Which one of the following statements is correct? a. If NPV is positive, IRR will be less than…

A: In order to determine the Net present value, the initial cash outflows is required to be subtracted…

Q: How do you know when to use the formula FV=PV(1+i)n vs. FV=PV(1+r/m)mt

A: The value of the cash flow after a particular time period with the addition of the interest amount…

Q: Is there a difference between arithmetic and geometric average returns? Is it true that they…

A: Geometric average is generally used by investment professionals to measure the performance of…

Q: Explain arithmetic mean returns?

A: Arithmetic mean:It is a commonly used measure of mean (or measure of average). Arithmetic mean is…

Q: The factor (F/A,i,n) is approximately equal to the factor (P/A,I,n) Select one: True False

A: a. The factor (F/A, i,n) is the compound amount factor that is used to calculate the future value of…

Q: The FIFO method provides a major advantage over the weighted-average method in that______?

A: The FIFO method provides measurements of work done during the current period .

Q: Which of the following indicates that two variables tend to move in the same direction? a.negative…

A: Negative covariance means that the returns move in opposite direction. So, Option a is incorrect.…

Q: Charlie's Indifference curves have the equation y constant/x, where larger constants correspond to…

A: Y = constant/X Constant = Y*X Where constant shows utility, thus Utility = X*Y (5,13)=> utility =…

Q: b. Why do some investors prefer to use Lower Partial Standard Deviations (LPSD) as compared to the…

A: Financial Management: Financial management comprises of two words i.e. Finance and management.…

Step by step

Solved in 2 steps

- Q. Suppose a company uses only debt and internal equity to finance its capital budget and uses CAPM to compute its cost of equity. Company estimates that its WACC is 12%. The capital structure is 75% debt and 25% internal equity. Before tax cost of debt is 12.5 % and tax rate is 20%. Risk free rate is rRF = 6% and market risk premium (rm - rRF ) = 8%: What is the beta of the company?(14-4) One position expressed in the financial literature is that firms set their dividends as a residual after using income to support new investments. Explain what a residual policy implies (assuming that all distributions are in the form of dividends), illustrating your answer with a table showing how different investment opportunities could lead to different dividend payout ratios.QUESTION 13 Of the following, an example of a component of a firm’s cost of capital is ____. a. repurchase of company stock b. the purchase of another company’s bonds c. investment of corporate funds into a money market account d. the return on common stock required by investors QUESTION 17 The risk premium for an individual security is equal to the ____. a. weighted average of the individual security betas in a portfolio b. difference between the required return and the risk-free rate c. beta times the market return d. security's covariance divided by the variance of the market QUESTION 21 Which of the following statements about comparing capital budget techniques is (are) correct? I. The payback period is easy to understand and helps the firm identify how long it will be unable to use the initial investment for other projects. II. Mutually exclusive projects allow a firm to do other like projects (mutually…

- Question 32 a. Why is share valuation more difficult than bond valuation? b. Identify and explain the weaknesses of the payback period method of capital budgeting.Module 6 Question 2 (Individual or component costs of capital) Compute the cost of capital for the firm for the following: a. Currently bonds with a similar credit rating and maturity as the firm's outstanding debt are selling to yield 8.00 percent while the borrowing firm's corporate tax rate is 34 percent. b. Common stock for a firm that paid a $1.05 dividend last year. The dividends are expected to grow at a rate of 5.0 percent per year into the foreseeable future. The price of this stock is now $25.00. c. A bond that has a $1,000 par value and a coupon interest rate of 12.0 percent with interest paid semiannually. A new issue would sell for $1,150 per bond and mature in 20 years. The firm's tax rate is 34 percent. d. A preferred stock paying a dividend of 7.0 percent on a $100 par value. If a new issue is offered, the shares would sell for $85.00 per share. a. The after-tax cost of debt debt for the firm is ________%.13... What conditions are necessary for the Constant Dividend Growth Model to be used? Select all that apply. a.The required rate of return must be greater than the dividend growth rate. b.The dividend must be at least $3. c.The company must pay taxes. d.The company's dividend growth rate must be expected to remain constant.

- 3f. Whyis NPV the most accurate capital budgeting technique compared to the payback period and IRR? Relate your answers with the concept of maximizing shareholder’s Note: No need excle formula, thank youProblem 10.16 projected financial statements for Walmart for Years +1 through +5. The following data for Walmart include the actual amounts for 2012 and the projected amounts for Years +1 through +5 for comprehensive income and common shareholders equity, assuming it will use implied dividends as the financial flexible account to balance the balance sheet (amounts in millions). Assume that the market equity beta for Walmart at the end of 2012 was 1.00. Assume that the risk-free interest rate was 3.0% and the market risk premium was 6.0%. Also assume that Walmart had 3,314 million shares outstanding at the end of 2012, and share price was 69.09. REQUIRED a. Use the CAPM to compute the required rate of return on common equity capital for Walmart. b. Compute the weighted-average cost of capital for Walmart as of the start of Year +1. At the end of 2012, Walmart had 48,222 million in outstanding interest-bearing debt on the balance sheet and no preferred stock. Assume that the balance sheet value of Walmarts debt is approximately equal to the market value of the debt. Assume that at the start of Year +1, it will incur interest expense of 4.2% on debt capital and that its average tax rate will be 32.0%. Walmart also had 5,395 million in equity capital from noncontrolling interests. Assume that this equity capital carries a 15.0% required rate of return. (For our forecasts, we assume noncontrolling interests are similar to preferred shares and receive dividends equal to the required rate of return each year.) c. Use the clean surplus accounting approach to derive the projected dividends for common shareholders for Years +1 through +5 based on the projected comprehensive income and shareholders equity amounts. (Throughout this problem, you can ignore dividends to noncontrolling interests.) d. Use the clean surplus accounting approach to project the continuing dividend to common shareholders in Year +6. Assume that the steady-state long-run growth rate will be 3% in Years +6 and beyond. e. Using the required rate of return on common equity from Requirement a as a discount rate, compute the sum of the present value of dividends to common shareholders for Walmart for Years +1 through +5. f. Using the required rate of return on common equity from Requirement a as a discount rate and the long-run growth rate from Requirement d, compute the continuing value of Walmart as of the beginning of Year +6 based on its continuing dividends in Years +6 and beyond. After computing continuing value, bring continuing value back to present value at the start of Year +1. g. Compute the value of a share of Walmart common stock, as follows: (1) Compute the sum of the present value of dividends including the present value of continuing value. (2) Adjust the sum of the present value using the midyear discounting adjustment factor. (3) Compute the per-share value estimate. h. Using the same set of forecast assumptions as before, recompute the value of Walmart shares under two alternative scenarios. To quantify the sensitivity of your share value estimate for Walmart to these variations in growth and discount rates, compare (in percentage terms) your value estimates under these two scenarios with your value estimate from Requirement g. Scenario 1: Assume that Walmarts long-run growth will be 2%, not 3% as before, and assume that its required rate of return on equity is 1 percentage point higher than the rate you computed using the CAPM in Requirement a. Scenario 2: Assume that Walmarts long-run growth will be 4%, not 3% as before, and assume that its required rate of return on equity is 1 percentage point lower than the rate you computed using the CAPM in Requirement a. i. What reasonable range of share values would you expect for Walmart common stock? Where is the current price for Walmart shares relative to this range? What do you recommend?CONCEPTUAL: RETURN ON EQUITY Which of the following statements is most correct? (Hint: Work Problem 4-16 before answering 4-17, and consider the solution setup for 4-16 as you think about 4-17.) a. If a firms expected basic earning power (BEP) is constant for all of its assets and exceeds the interest rate on its debt, adding assets and financing them with debt will raise the firms expected return on common equity (ROE). b. The higher a firms tax rate, the lower its BEP ratio, other things held constant. c. The higher the interest rate on a firms debt, the lower its BEP ratio, other things held constant. d. The higher a firms debt ratio, the lower its BEP ratio, other things held constant. e. Statement a is false, but statements b, c, and d are true.