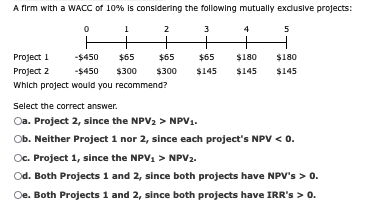

A firm with a WACC of 10% is considering the following mutually exclusive projects: 1 2 3 4 5 + + + + H Project 1 -$450 $65 $65 $65 $180 $180 Project 2 -$450 $300 $300 $145 $145 $145 Which project would you recommend? Select the correct answer. Oa. Project 2, since the NPV2 > NPV1. Ob. Neither Project 1 nor 2, since each project's NPV < 0. Oc. Project 1, since the NPV1 > NPV2. Od. Both Projects 1 and 2, since both projects have NPV's > 0. Oe. Both Projects 1 and 2, since both projects have IRR's > 0.

Q: Vijay

A: 1. Calculate the contribution margin per unit for each product line:Contribution Margin = Revenues -…

Q: Suppose NCKU company currently has NTD 10 million of five-year bonds with a coupon rate of 2%, a…

A: The modified duration of a bond portfolio refers to the sensitivity of the price of the bond…

Q: None

A: To calculate the return for investing in Boeing stock (BA) from January 2, 2008, to January 2, 2009,…

Q: Bhuptbhai

A: Step 1 To calculate the bid price, we need to determine the total cost of producing and delivering…

Q: Common Stock: 30 million shares of Class A trading at $ 48 10 million shares of Class B trading at…

A: Summary: To determine the Weighted Average Cost of Capital (WACC):1. Calculate the cost of equity…

Q: You are attempting to value a call option with an exercise price of $108 and one year to expiration.…

A: Calculate the Up and Down Factors (u and d):u = S_u / S = $136 / $108 ≈ 1.26 d = S_d / S = $80 /…

Q: Shinedown Company needs to raise $150 million to start a new project and will raise the money by…

A: To determine the true initial cost figure, Shinedown Company calculates the weighted average…

Q: A company is considering two mutually exclusive expansion plans. Plan A requires a $41 million…

A: 1.2.Cross Over rate=12%3.Cross over: 11.5%

Q: You are considering the purchase of a new stock. The stock is expected to grow at 2.52% for the…

A: Given information, Growth rate (g) = 2.52% or 0.0252Just paid dividend (D0) = $2.88Required rate of…

Q: A Treasury note has 2 years left to maturity, a $1,000 face value, and a coupon rate of 4.4%, with…

A: Step 1: The calculation of the yield to maturity AB1Face value $1,000.00 2Years23Coupon…

Q: A U.S. firm holds an asset in France and faces the following scenario: Probability Spot rate P* P…

A: Exchange exposure refers to the risk faced by an entity, such as a firm or investor, due to…

Q: You need to estimate the value of Laputa Aviation. You have the following forecasts (in millions of…

A: Step 1:Calculation of WACC:WACC=(Ke × We) + (Kd × Wd)=((12%×40%)+(7%×(1−30%)×60%))×100=7.74Cost of…

Q: You are considering the purchase of 100 units of a 3-month 25 - strike European call option on a…

A: As per Black Scholes ModelValue of call option = number of units(S*e^(q*t))*N(d1)-N(d2)*K*e^(-r*t)…

Q: None

A: The Capital Asset Pricing Model (CAPM) uses the following formula to determine an estimate of a…

Q: Bandon Manufacturing intends to issue callable, perpetual bonds with annual coupon payments and a…

A: Step 1:In thisPar value = $1000One-year interest rates = 8%Callable value = $1,255 If interest rates…

Q: Let R be the one-year LIBOR rate with annual compounding that will be determined in 6 years from…

A: A financial derivative is a type of contract where the value is based on how well an underlying…

Q: A company is analyzing two mutually exclusive projects, S and L, with the following cash flows: ° 1…

A: Step 1: The calculation of the IRR with a better project ABC1YearProject SProject L20 $-1,000.00…

Q: Nikul

A: Answer image:

Q: Consider the following countinuous compunding LIBOR spot rates: 3M (2,2% pa.), 6M (2,3% pa.), 9M…

A: Libor rates:LIBOR rates, often referred to as the bedrock of global finance, are pivotal benchmarks…

Q: You just graduated and started your new job. Your starting salary is $80,000/year. Your employer's…

A: Let's examine each stage in more detail: If you make no contributions, how much ($) will your…

Q: Your company rose in the Series A funding round EUR 6 million with a pre money valuation of EUR 7…

A: The Series A, B, and C funding refers to the funding rounds that the company undertakes to raise…

Q: Vijay

A: The objective of the question is to calculate the cash flow for Rebecca under the current and…

Q: Project L requires an initial outlay at t = 0 of $35,000, its expected cash inflows are $9,000 per…

A: The above answer can be explained as under - NPV or net present value is calculated as under - NPV =…

Q: Jeff bought an annuity immediate for $45.24. This annuity immediate is designed such that payments…

A: An annuity refers to a series of periodic payments received/paid in exchange for a lump sum payment.…

Q: (please correct answer and Step by step solutions this question) Assume you have taken a long…

A: The option becomes in-the-money when the stock price at expiration rises above the strike price.…

Q: Vijay

A: The value of the put option can be calculated using the following formula:Put option value = e^(-rt)…

Q: Rare Agri-Products Ltd. is considering a new project with a projected life of seven (7) years. The…

A: Earnings After Taxes (EAT) and Operating Cash Flow (OCF) CalculationTo compute the earnings after…

Q: None

A: c. Expected Capital Gains (or Loss) Yield:This calculation depends on whether the bond is expected…

Q: Pecking order hypothesis. Ross Enterprises can raise capital from the sources in the popup window:.…

A: Step 1:Step 2:

Q: Fill in the missing numbers for the following income statement. (Do not round intermediate…

A: Step 1: To complete the missing amounts in the income statement, here is its detailed solution:…

Q: A corporate customer obtains a $2 million loan from a bank. The annual spread between the interest…

A:

Q: McGilla Golf has decided to sell a new line of golf clubs. The clubs will sell for $815 per set and…

A: ## McGilla Golf Capital Budgeting Analysis**a. Payback Period**1. Calculate annual contribution…

Q: Vijay

A: Calculate the after-tax salvage value of the land in four years:…

Q: Problem 1 Fitbit, Inc. went public in June 2015. Please fill in the following figures and analyze…

A: Part 2: Explanation:Step 1: Initial AnalysisFitbit, Inc. went public in June 2015 with an offer…

Q: If Bob and Judy combine their savings of $1,500 and $900, respectively, and deposit this amount into…

A:

Q: is my response accurate

A: . Preferred dividends are tax-deductible - This statement is incorrect. Preferred dividends are not…

Q: Suppose the management of a firm is trying to allocate liquid assets to two accounts, one of which…

A: The ratio of investment typically refers to the proportion of funds allocated to different assets…

Q: You find the following corporate bond quotes. To calculate the number of years until maturity,…

A: The information provided in the image is not enough to directly calculate the yield to maturity.The…

Q: You are considering the following two projects and can take only one. Your cost of capital is 10.7%.…

A: The objective of the question is to evaluate two investment projects using the concepts of Internal…

Q: None

A: Let's create a table to evaluate Ms. Kendall's hedged costs at different possible spot prices of…

Q: Raghubhai

A: The objective of the question is to calculate the Net Present Value (NPV), Internal Rate of Return…

Q: Sales VC Complete the shaded cells below: Year 1 $32,960,000 13,440,000 Year 2 Year 3 Year 4…

A: Kindly follow the excel screenshots:

Q: considering the need to get to know the customer, how does the advisor present financial products…

A: To solve these issues, advisers should focus on transparency, education, and communication. They…

Q: Depreciation expense. Brock Florist Company buys a new delivery truck for $29,000. It is classified…

A: a. Straight-Line Depreciation with Half-Year ConventionAnnual Depreciation (Straight-Line):Cost of…

Q: what are some factors that need to reflect in the Income statement? How should it be project these…

A: The objective of this question is to identify the key factors that need to be reflected in an income…

Q: Name Complete the analogies. stitch embroidery :: write : sleepy: tired :: old: Week 26 Rewrite the…

A: The objective of the question is to test various aspects of English language understanding,…

Q: Bhupatbhai

A: From 1900 to 2017, the average return on extensive U.S. common stocks was:- The information shows…

Q: please answer this too accuretly:

A: The specific question is about a computer-based order entry system that will cost $535,000 and…

Q: Your parents are giving you $100 a month for four years while you are in college. At a 6% annual…

A: The objective of this question is to calculate the present value of a series of future payments,…

Q: A stock is expected to pay $1.25 per share every year indefinitely and the required return for the…

A: The objective of the question is to find the price an investor would be expected to pay per share…

Step by step

Solved in 2 steps with 1 images

- A firm with a WACC of 10% is considering the following mutually exclusive projects: 0 1 2 3 4 5 Project 1 -$350 $65 $65 $65 $210 $210 Project 2 -$400 $250 $250 $145 $145 $145 Which project would you recommend? Select the correct answer. a. Neither Project 1 nor 2, since each project's NPV < 0. b. Both Projects 1 and 2, since both projects have NPV's > 0. c. Project 1, since the NPV1 > NPV2. d. Both Projects 1 and 2, since both projects have IRR's > 0. e. Project 2, since the NPV2 > NPV1.A firm with a WACC of 10% is considering the following mutually exclusive projects: 0 1 2 3 4 5 Project 1 -$450 $50 $50 $50 $200 $200 Project 2 -$550 $200 $200 $150 $150 $150 Which project would you recommend? Select the correct answer. a. Both Projects 1 and 2, since both projects have IRR's > 0. b. Neither Project 1 nor 2, since each project's NPV < 0. c. Both Projects 1 and 2, since both projects have NPV's > 0. d. Project 1, since the NPV1 > NPV2. e. Project 2, since the NPV2 > NPV1.The Weiland Computer Corporation is trying to choose between the following mutually exclusive design projects, P1 and P2:Year 0123 Cash flows (P1) -$53,000 27,000 27,000 27,000 Cash flow (P2) -$16,000 9,100 9,100 9,100a. If the discount rate is 10 percent and the company applies the profitability index (PI) decision rule, which project should the firm accept?b. If the firm applies the Net Present Value (NPV) decision rule, which project should it take?c. Are your answers in (a) and (b) different? Explain why?

- Consider the following projects, X and Y where the firm can only choose one. Project X costs $1500 and has cash flows of $678, $652, $347, $111, $54, $16 in each of the next 6 years. Project Y also costs $1500, and generates cash flows of $738, $693, $405 for the next 3 years, respectively. WACC=11%.H) Is it possible for conflicts to exist between the NPV and the IRR when independent projects are being evaluated? Explain your answer.An engineer at Suncore Micro, LLC calculated the present worth of mutually exclusive bundles, each composed of one or more independent projects. Select the acceptable bundle if the capital investment limit is $50,000 and the MARR is 15% per year. Project Bundle Initial Investment PW, $ 1 −27,000 2400 2 −33,000 9200 3 −44,000 7300 4 −51,000 11,400 5 −66,000 10,800 I know you have already solved this exercise.XY Company is considering 5 investment projects as follows: Project Investment ($) Profitability index (PI) A 10,000 1.2 B 6,000 1.1 C 18,000 1.6 D 14,000 0.9 E 12,000 1.3 The company has $30,000 available for investment. Projects C and E are mutually exclusive. All projects can be undertaken only once and are not divisible. Required: Calculate the projects’ NPV

- A firm with a WACC of 6% has a choice between Project A which has a NPV of $45,000 and IRR of 10% and Project B which has a NPV of $80,000 and IRR of 8%. If the projects are mutually exclusive, which project should be chosen? Project A Project B Both projects Neither project6 Lewis Services is evaluating six investment opportunities (projects). The following table reflects each project’s net present value NPV and the respective initial investments required. All of these projects are independent.Project NPV InvestmentI 2,500 2,500II 4,000 20,000III 7,500 30,000IV 8,000 40,000V 2,000 10,000VI 2,500 5,000Lewis has an investment constraint of P50,000. Which combination of projects would represent the optimal investment that should be recommended to Lewis Services’ management? Group of answer choices II, IV and III IV only I, IV and VI I, II, III, V, and VI I, III and IV I, II, III, IV, V, and VI I, III, and VI I, III, V, and VIHampton Manufacturing estimates that its WACC is 12.5%. The company is considering the following seven investment projects:Project................ Size..................IRRA....................$ 750,000..........14.0%B....................1,250,000............13.5C....................1,250,000............13.2D....................1,250,000............13.0E......................750,000............12.7F......................750,000............12.3G......................750,000............12.2a. Assume that each of these projects is independent and that each is just as risky as the firm's existing assets. Which set of projects should be accepted, and what is the firm's optimal capital budget?b. Now assume that Projects C and D are mutually exclusive. Project D has an NPV of $400,000, whereas Project C has an NPV of $350,000. Which set of projects should be accepted, and what is the firm's optimal capital budget?c. Ignore part b and assume that each of the projects is independent but that…

- A firm evaluates all of its projects by applying the IRR rule. If the required return is 18 percent, will the firm accept the following project?CF0 = -$30,000CO1 = $20,000C02 = $14,000C03 = $11,000 yes or noXY Company is considering 5 investment projects as follows: Project Investment ($) Profitability index (PI) A 10,000 1.2 B 6,000 1.1 C 18,000 1.6 D 14,000 0.9 E 12,000 1.3 The company has $30,000 available for investment. Projects C and E are mutually exclusive. All projects can be undertaken only once and are not divisible. Required: (iii)Calculate the maximum NPV earned from the projects to be picked.Consider the following projects, X and Y where the firm can only choose one. Project X costs $1500 and has cash flows of $678, $652, $347, $111, $54, $16 in each of the next 6 years. Project Y also costs $1500, and generates cash flows of $738, $693, $405 for the next 3 years, respectively. WACC=11%. If the WACC were 5 percent, would this change your recommendation if the projects were mutually exclusive? If the WACC were 15 percent, would this change your recommendation? Explain your answers.