Depreciation expense. Brock Florist Company buys a new delivery truck for $29,000. It is classified as a light-duty truck. a. Calculate the depreciation schedule using a five-year life, straight-line depreciation, and the half-year convention for the first and last years. b. Calculate the depreciation schedule using a five-year life and MACRS depreciation, B c. Compare the depreciation schedules from parts (a) and (b) before and after taxes using a 30% tax rate. What do you notice about the difference between these two methods? a. Using a five-year life, straight-line depreciation, and the half-year convention for the first and last years, what is the annual depreciation of the truck? (Round to the nearest dollar.)

Depreciation expense. Brock Florist Company buys a new delivery truck for $29,000. It is classified as a light-duty truck. a. Calculate the depreciation schedule using a five-year life, straight-line depreciation, and the half-year convention for the first and last years. b. Calculate the depreciation schedule using a five-year life and MACRS depreciation, B c. Compare the depreciation schedules from parts (a) and (b) before and after taxes using a 30% tax rate. What do you notice about the difference between these two methods? a. Using a five-year life, straight-line depreciation, and the half-year convention for the first and last years, what is the annual depreciation of the truck? (Round to the nearest dollar.)

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 11PA: Montezuma Inc. purchases a delivery truck for $15,000. The truck has a salvage value of $3,000 and...

Related questions

Question

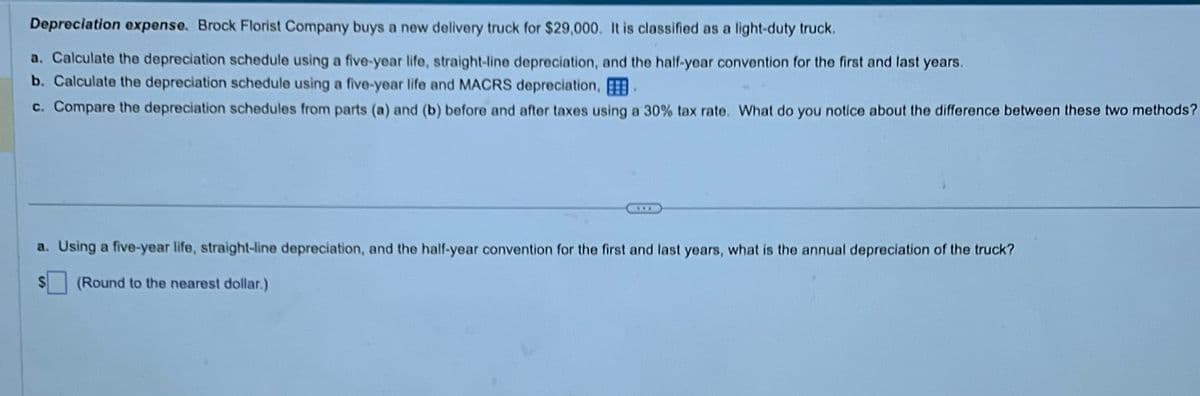

Transcribed Image Text:Depreciation expense. Brock Florist Company buys a new delivery truck for $29,000. It is classified as a light-duty truck.

a. Calculate the depreciation schedule using a five-year life, straight-line depreciation, and the half-year convention for the first and last years.

b. Calculate the depreciation schedule using a five-year life and MACRS depreciation, B

c. Compare the depreciation schedules from parts (a) and (b) before and after taxes using a 30% tax rate. What do you notice about the difference between these two methods?

a. Using a five-year life, straight-line depreciation, and the half-year convention for the first and last years, what is the annual depreciation of the truck?

(Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage