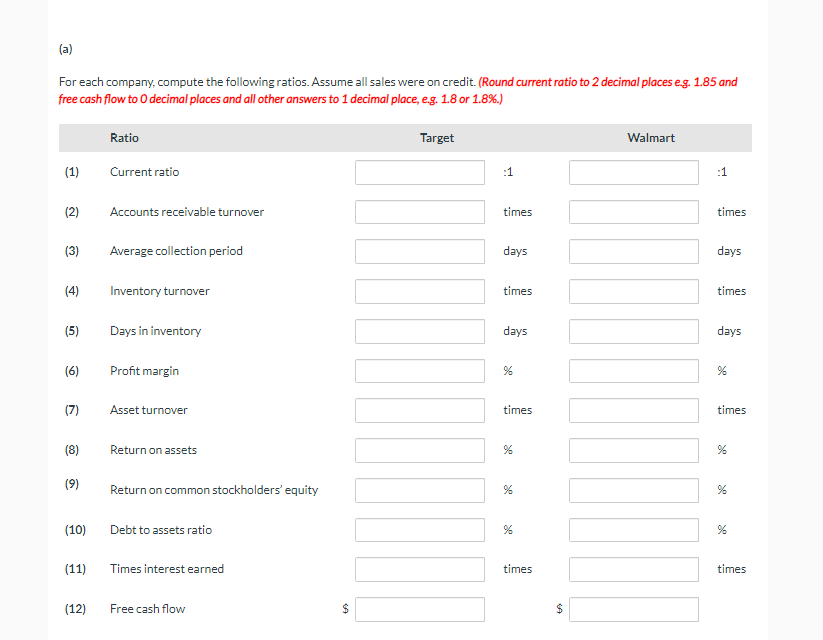

(a) For each company, compute the following ratios. Assume all sales were on credit. (Round current ratio to 2 decimal places e.g. 1.85 and free cash flow to O decimal places and all other answers to 1 decimal place, e.g. 1.8 or 1.8%.) (1) (2) (3) Ratio Current ratio Accounts receivable turnover Average collection period Target :1 times days Walmart :1 times days

(a) For each company, compute the following ratios. Assume all sales were on credit. (Round current ratio to 2 decimal places e.g. 1.85 and free cash flow to O decimal places and all other answers to 1 decimal place, e.g. 1.8 or 1.8%.) (1) (2) (3) Ratio Current ratio Accounts receivable turnover Average collection period Target :1 times days Walmart :1 times days

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter2: Financial Statements And The Annual Report

Section: Chapter Questions

Problem 2.13MCE

Related questions

Topic Video

Question

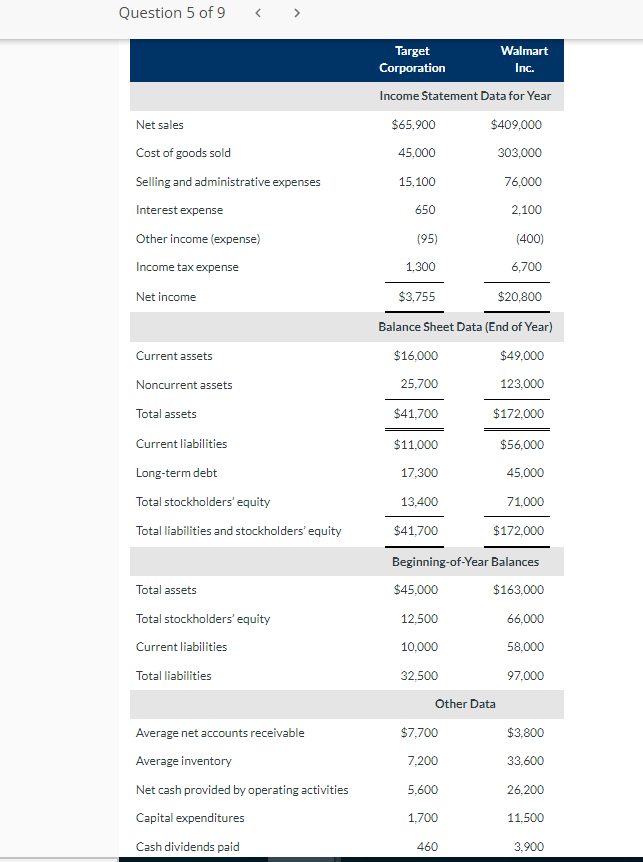

selected hypothetical financial data of of Tatget and Walmart for 2022 are presented here (in millions).

Transcribed Image Text:Question 5 of 9

<

>

Net sales

Cost of goods sold

Selling and administrative expenses

Interest expense

Other income (expense)

Income tax expense

Net income

Current assets

Noncurrent assets

Total assets

Current liabilities

Long-term debt

Total stockholders' equity

Total liabilities and stockholders' equity

Total assets

Total stockholders' equity

Current liabilities

Total liabilities

Average net accounts receivable

Average inventory

Net cash provided by operating activities

Capital expenditures

Cash dividends paid

Walmart

Target

Corporation

Inc.

Income Statement Data for Year

$409,000

303,000

76,000

2,100

(400)

6,700

$65,900

45,000

15,100

650

(95)

1,300

$3,755

$20,800

Balance Sheet Data (End of Year)

$49,000

123,000

$16,000

25,700

$41,700

$11,000

17,300

13,400

$41,700

$172,000

$56,000

45,000

71,000

$172,000

Beginning-of-Year Balances

$163,000

$45,000

12,500

10,000

32,500

Other Data

$7,700

7,200

5,600

1,700

460

66,000

58,000

97,000

$3,800

33,600

26,200

11,500

3,900

Transcribed Image Text:(a)

For each company, compute the following ratios. Assume all sales were on credit. (Round current ratio to 2 decimal places e.g. 1.85 and

free cash flow to O decimal places and all other answers to 1 decimal place, e.g. 1.8 or 1.8%.)

(1)

(2)

(3)

(4)

(5)

(6)

(7)

(8)

(9)

(10)

(11)

(12)

Ratio

Current ratio

Accounts receivable turnover

Average collection period

Inventory turnover

Days in inventory

Profit margin

Asset turnover

Return on assets

Return on common stockholders' equity

Debt to assets ratio

Times interest earned

Free cash flow

69

Target

:1

times

days

times

days

%

times

%

%

%

times

SA

Walmart

:1

times

days

times

days

times

%

%

%

times

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

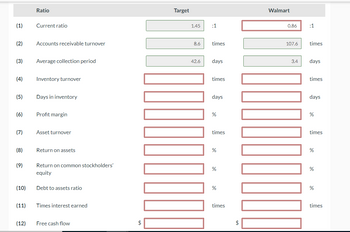

Transcribed Image Text:(1)

(2)

(3)

(4)

(5)

(6)

(7)

(8)

(9)

(10)

(11)

(12)

Ratio

Current ratio

Accounts receivable turnover

Average collection period

Inventory turnover

Days in inventory

Profit margin

Asset turnover

Return on assets

Return on common stockholders'

equity

Debt to assets ratio

Times interest earned

Free cash flow

Target

1.45

8.6 times

FOOOOOOOO

:1

42.6

days

times

days

%

times

%

%

%

times

$

Walmart

0.86

:1

107.6 times

3.4 days

OOOOOOOOO

times

days

%

times

%

%

%

times

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College