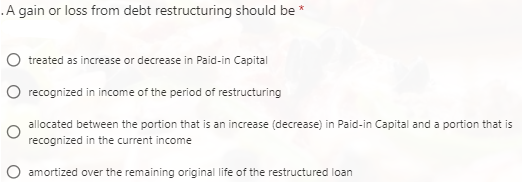

A gain or loss from debt restructuring should be * O treated as increase or decrease in Paid-in Capital O recognized in income of the period of restructuring allocated between the portion that is an increase (decrease) in Paid-in Capital and a portion that is recognized in the current income O amortized over the remaining original life of the restructured loan

A gain or loss from debt restructuring should be * O treated as increase or decrease in Paid-in Capital O recognized in income of the period of restructuring allocated between the portion that is an increase (decrease) in Paid-in Capital and a portion that is recognized in the current income O amortized over the remaining original life of the restructured loan

Chapter16: Financially Troubled Ventures: Turnaround Opportunities?

Section: Chapter Questions

Problem 12DQ

Related questions

Question

t7

Transcribed Image Text:A gain or loss from debt restructuring should be *

treated as increase or decrease in Paid-in Capital

recognized in income of the period of restructuring

allocated between the portion that is an increase (decrease) in Paid-in Capital and a portion that is

recognized in the current income

amortized over the remaining original life of the restructured loan

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT