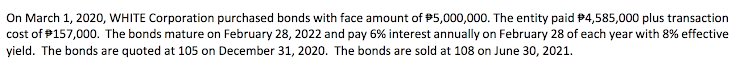

1. Assuming the investment is appropriately recognized as a financial asset intended to collect contractual cash flows and also to sell the bonds in open market: How much unrealized gain (loss) is to be reflected in the statement of changes in equity and statement of comprehensive income at yearend 2020? 2. Assuming the investment is appropriately recognized as a financial asset intended to collect contractual cash flows and also to sell the bonds in open market: What is the carrying value of the investment on December 31, 2020? 3. Assuming the investment is appropriately recognized as a financial asset intended to collect contractual cash flows and also to sell the bonds in open market: Determine the gain or (loss) to be recorded upon the sale of the investment.

1. Assuming the investment is appropriately recognized as a financial asset intended to collect contractual cash flows and also to sell the bonds in open market: How much unrealized gain (loss) is to be reflected in the statement of changes in equity and statement of comprehensive income at yearend 2020?

2. Assuming the investment is appropriately recognized as a financial asset intended to collect contractual cash flows and also to sell the bonds in open market: What is the carrying value of the investment on December 31, 2020?

3. Assuming the investment is appropriately recognized as a financial asset intended to collect contractual cash flows and also to sell the bonds in open market: Determine the gain or (loss) to be recorded upon the sale of the investment.

Step by step

Solved in 2 steps with 2 images