A given project requires an initial investment of 29800 in order to collect the following cash flows: 11900 in f=1, 12100 in t32 and 12300 in t=3. The 40% of the initial investment is supported with external funds. The debt has to be fully repaid at the end of the second year at the annual compound rate 9,8%. The opportunity cost of capital is 4,6%. Using WACC method, which is the value of the project? (answer with two decimals)

A given project requires an initial investment of 29800 in order to collect the following cash flows: 11900 in f=1, 12100 in t32 and 12300 in t=3. The 40% of the initial investment is supported with external funds. The debt has to be fully repaid at the end of the second year at the annual compound rate 9,8%. The opportunity cost of capital is 4,6%. Using WACC method, which is the value of the project? (answer with two decimals)

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 10P

Related questions

Question

100%

Can you give me the complete solution pls?

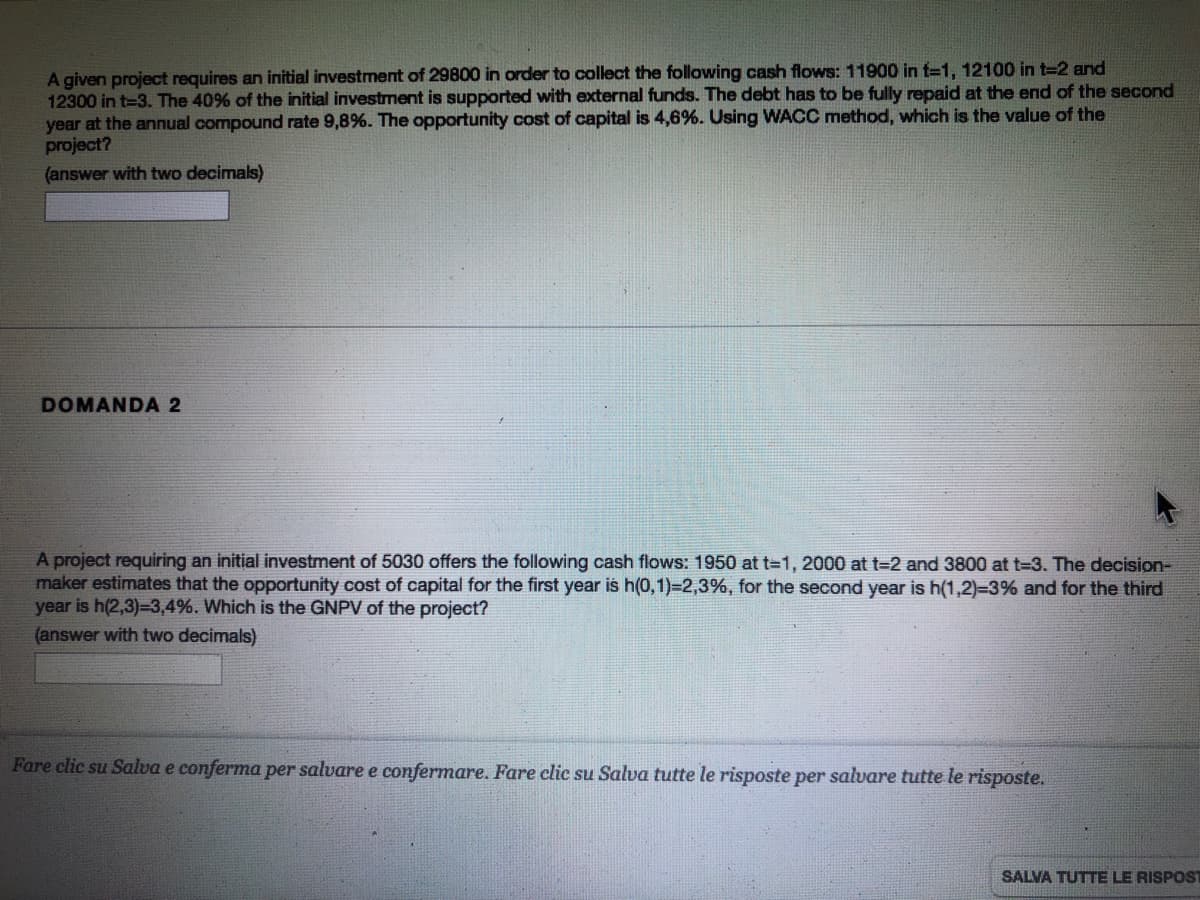

Transcribed Image Text:A given project requires an initial investment of 29800 in order to collect the following cash flows: 11900 in f=1, 12100 in t=2 and

12300 in t=3. The 40% of the initial investrment is supported with external funds. The debt has to be fully repaid at the end of the second

year at the annual compound rate 9,8%. The opportunity cost of capital is 4,6%. Using WACC method, which is the value of the

project?

(answer with two decimals)

DOMANDA 2

A project requiring an initial investment of 5030 offers the following cash flows: 1950 at t=1, 2000 at t=2 and 3800 at t=3. The decision-

maker estimates that the opportunity cost of capital for the first year is h(0,1)=2,3%, for the second year is h(1,2)=3% and for the third

year is h(2,3)=3,4%. Which is the GNPV of the project?

(answer with two decimals)

Fare clic su Salva e conferma per salvare e confermare. Fare clic su Salva tutte le risposte per salvare tutte le risposte.

SALVA TUTTE LE RISPOST

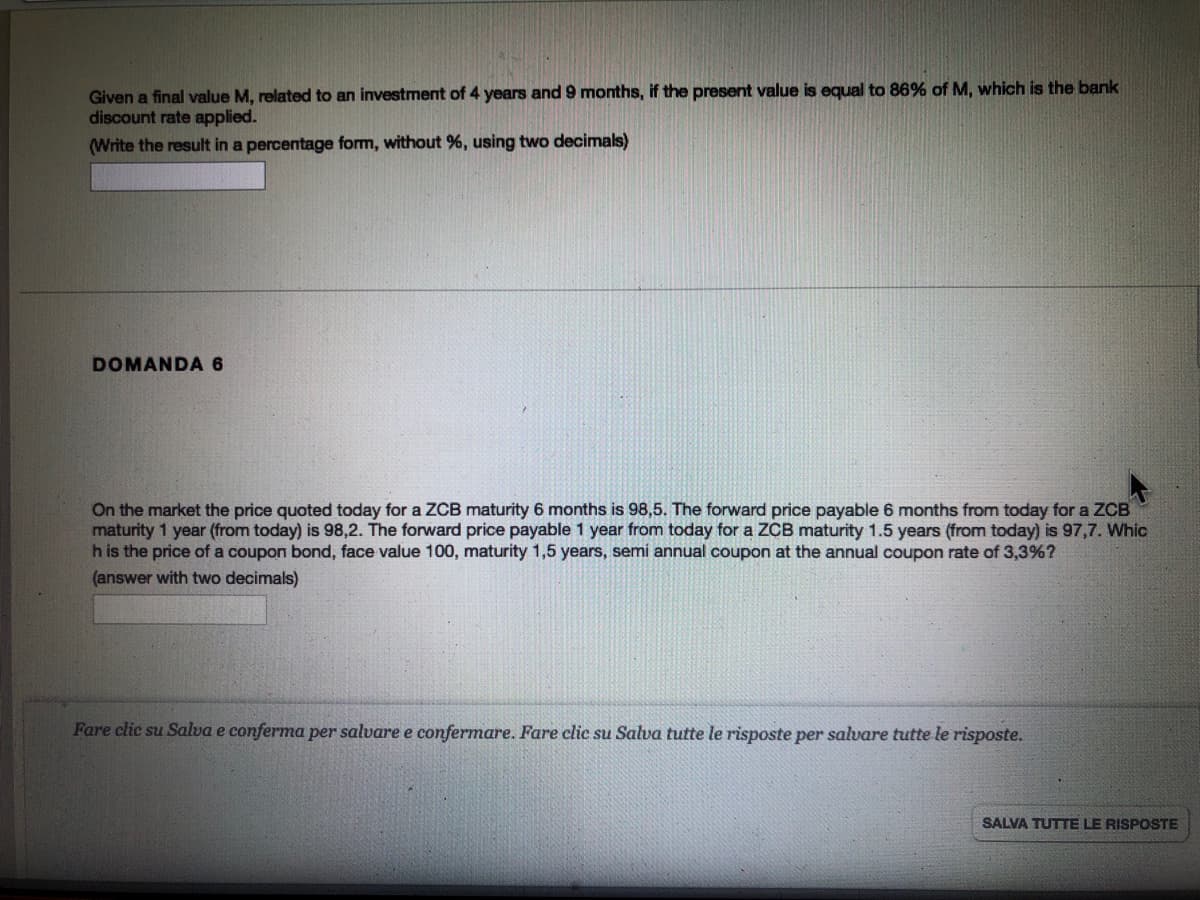

Transcribed Image Text:Given a final value M, related to an investment of 4 years and 9 months, if the present value is equal to 86% of M, which is the bank

discount rate applied.

(Write the result in a percentage form, without %, using two decimals)

DOMANDA 6

On the market the price quoted today for a ZCB maturity 6 months is 98,5. The forward price payable 6 months from today for a ZCB

maturity 1 year (from today) is 98,2. The forward price payable 1 year from today for a ZCB maturity 1.5 years (from today) is 97,7. Whic

h is the price of a coupon bond, face value 100, maturity 1,5 years, semi annual coupon at the annual coupon rate of 3,3%?

(answer with two decimals)

Fare clic su Salva e conferma per salvare e confermare. Fare clic su Salva tutte le risposte per salvare tutte le risposte.

SALVA TUTTE LE RISPOSTE

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning