A good stock-based mutual fund should earn at least 7% per year over a long period of time. Consider the case of Barney and Lynn, who were overheard gloating (for all to hear) about how well they had done with their mutual fund investment." We turned a $37,500 investment of money in 1982 into $150,000 in 2007." a. What return (interest rate) did they really earn on their investment? Should they have been bragging about how investment-savvy they were? b. Instead, if $1,500 had been invested each year for 25 years to accumulate $150,000, what return did Barney and Lynn earn? E Click the icon to view the interest and annuity table for discrete compounding when i= 7% per year. a. The interest rate Barney and Lynn really earn on their investment is 5.7 %. (Round to the one decimal place.) Barney and Lynne should not have been bragging about how investment-savvy they were. b. The interest rate Barney and Lynn earn on their investments is%. (Round to the one decimal place.)

A good stock-based mutual fund should earn at least 7% per year over a long period of time. Consider the case of Barney and Lynn, who were overheard gloating (for all to hear) about how well they had done with their mutual fund investment." We turned a $37,500 investment of money in 1982 into $150,000 in 2007." a. What return (interest rate) did they really earn on their investment? Should they have been bragging about how investment-savvy they were? b. Instead, if $1,500 had been invested each year for 25 years to accumulate $150,000, what return did Barney and Lynn earn? E Click the icon to view the interest and annuity table for discrete compounding when i= 7% per year. a. The interest rate Barney and Lynn really earn on their investment is 5.7 %. (Round to the one decimal place.) Barney and Lynne should not have been bragging about how investment-savvy they were. b. The interest rate Barney and Lynn earn on their investments is%. (Round to the one decimal place.)

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter13: Investing In Mutual Funds, Etfs, And Real Estate

Section: Chapter Questions

Problem 7FPE

Related questions

Question

not use excel

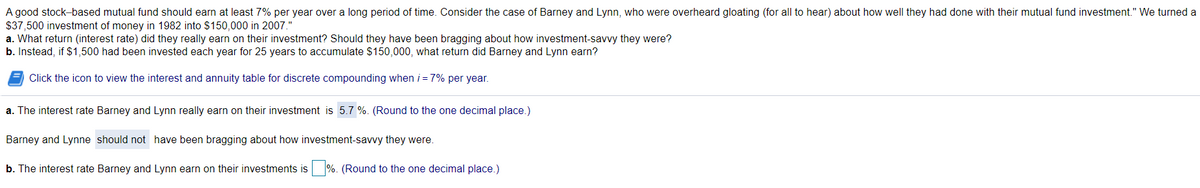

Transcribed Image Text:A good stock-based mutual fund should earn at least 7% per year over a long period of time. Consider the case of Barney and Lynn, who were overheard gloating (for all to hear) about how well they had done with their mutual fund investment." We turned a

$37,500 investment of money in 1982 into $150,000 in 2007."

a. What return (interest rate) did they really earn on their investment? Should they have been bragging about how investment-savvy they were?

b. Instead, if $1,500 had been invested each year for 25 years to accumulate $150,000, what return did Barney and Lynn earn?

Click the icon to view the interest and annuity table for discrete compounding when i = 7% per year.

a. The interest rate Barney and Lynn really earn on their investment is 5.7 %. (Round to the one decimal place.)

Barney and Lynne should not have been bragging about how investment-savvy they were.

b. The interest rate Barney and Lynn earn on their investments is %. (Round to the one decimal place.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning