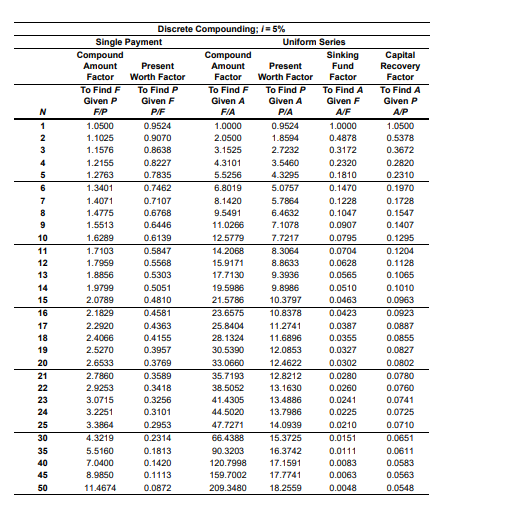

A good stockdash–based mutual fund should earn at least 5% per year over a long period of time. Consider the case of Barney and Lynn, who were overheard gloating (for all to hear) about how well they had done with their mutual fund investment." We turned a $32,500 investment of money in 1982 into $150,000 in 2007." a. What return (interest rate) did they really earn on their investment? Should they have been bragging about how investment-savvy they were? b. Instead, if $1,500 had been invested each year for 25 years to accumulate $150,000, what return did Barney and Lynn earn?

A good stockdash–based mutual fund should earn at least 5% per year over a long period of time. Consider the case of Barney and Lynn, who were overheard gloating (for all to hear) about how well they had done with their mutual fund investment." We turned a $32,500 investment of money in 1982 into $150,000 in 2007." a. What return (interest rate) did they really earn on their investment? Should they have been bragging about how investment-savvy they were? b. Instead, if $1,500 had been invested each year for 25 years to accumulate $150,000, what return did Barney and Lynn earn?

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

A good stockdash–based mutual fund should earn at least 5% per year over a long period of time. Consider the case of Barney and Lynn, who were overheard gloating (for all to hear) about how well they had done with their mutual fund investment." We turned a $32,500 investment of money in 1982 into $150,000 in 2007."

a. What return (interest rate) did they really earn on their investment? Should they have been bragging about how investment-savvy they were?

b. Instead, if $1,500 had been invested each year for 25 years to accumulate $150,000, what return did Barney and Lynn earn?

Transcribed Image Text:N

1

2

3

4

5

6

7

8

9

10

11

2341516F81920 12223 24 25 30 35 0 45 50

17

40

Single Payment

Compound

Amount Present

Factor

To Find F

Given P

F/P

1.0500

1.1025

1.1576

1.2155

1.2763

1.3401

1.4071

1.4775

1.5513

1.6289

1.7103

1.7959

1.8856

1.9799

2.0789

2.1829

2.2920

2.4066

2.5270

2.6533

2.7860

2.9253

3.0715

3.2251

3.3864

4.3219

Discrete Compounding;/= 5%

5.5160

7.0400

8.9850

11.4674

Worth Factor

To Find P

Given F

P/F

0.9524

0.9070

0.8638

0.8227

0.7835

0.7462

0.7107

0.6768

0.6446

0.6139

0.5847

0.5568

0.5303

0.5051

0.4810

0.4581

0.4363

0.4155

0.3957

0.3769

0.3589

0.3418

0.3256

0.3101

0.2953

0.2314

0.1813

0.1420

0.1113

0.0872

Compound

Amount

Factor

To Find F

Given A

F/A

1.0000

2.0500

3.1525

4.3101

5.5256

6.8019

8.1420

9.5491

11.0266

12.5779

14.2068

15.9171

17.7130

19.5986

21.5786

23.6575

Uniform Series

Present

Worth Factor

To Find P

Given A

P/A

0.9524

1.8594

2.7232

3.5460

4.3295

5.0757

5.7864

6.4632

7.1078

7.7217

8.3064

8.8633

9.3936

9.8986

10.3797

10.8378

25.8404

11.2741

28.1324

11.6896

30.5390

12.0853

33.0660

12.4622

35.7193

12.8212

38.5052

13.1630

41.4305

13.4886

44.5020

13.7986

47.7271

14.0939

66.4388

15.3725

90.3203

16.3742

120.7998 17.1591

159.7002

17.7741

209.3480

18.2559

Sinking

Fund

Factor

To Find A

Given F

A/F

1.0000

0.4878

0.3172

0.2320

0.1810

0.1470

0.1228

0.1047

0.0907

0.0795

0.0704

0.0628

0.0565

0.0510

0.0463

0.0423

0.0387

0.0355

0.0327

0.0302

0.0280

0.0260

0.0241

0.0225

0.0210

0.0151

0.0111

0.0083

0.0063

0.0048

Capital

Recovery

Factor

To Find A

Given P

A/P

1.0500

0.5378

0.3672

0.2820

0.2310

0.1970

0.1728

0.1547

0.1407

0.1295

0.1204

0.1128

0.1065

0.1010

0.0963

0.0923

0.0887

0.0855

0.0827

0.0802

0.0780

0.0760

0.0741

0.0725

0.0710

0.0651

0.0611

0.0583

0.0563

0.0548

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education