A) How much stockholders equity does diamondback have at the beginning of the current fiscal year?

A) How much stockholders equity does diamondback have at the beginning of the current fiscal year?

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter7: Property Transactions: Basis, Gain And Loss, And Nontaxable Exchanges

Section: Chapter Questions

Problem 32P

Related questions

Question

A) How much

B) Use the

C) Summarize your findings.

Transcribed Image Text:ares of

vriter, and (c) that a

and the land on which it is located, valued at $800,000, be acquir

in accordance with preliminary negotiations by the issuance of 300,000 shares of

mon stock valued at $16.50 per share. The plan was approved by the stockholders and

writer, and (c) that a building

and the land on which it is located, valued at $800,000, be acquired

accomplished by the following transactions:

Oct. 9. Borrowed $1,500,000 from St. Peter City Bank, giving a 4% mortgage note.

17. Issued 20,000 shares of preferred stock, receiving $126 per share in cash.

28. Issued 300,000 shares of common stock in exchange for land and a building,

according to the plan.

instructions

Journalize the entries to record the October transactions.

nommo

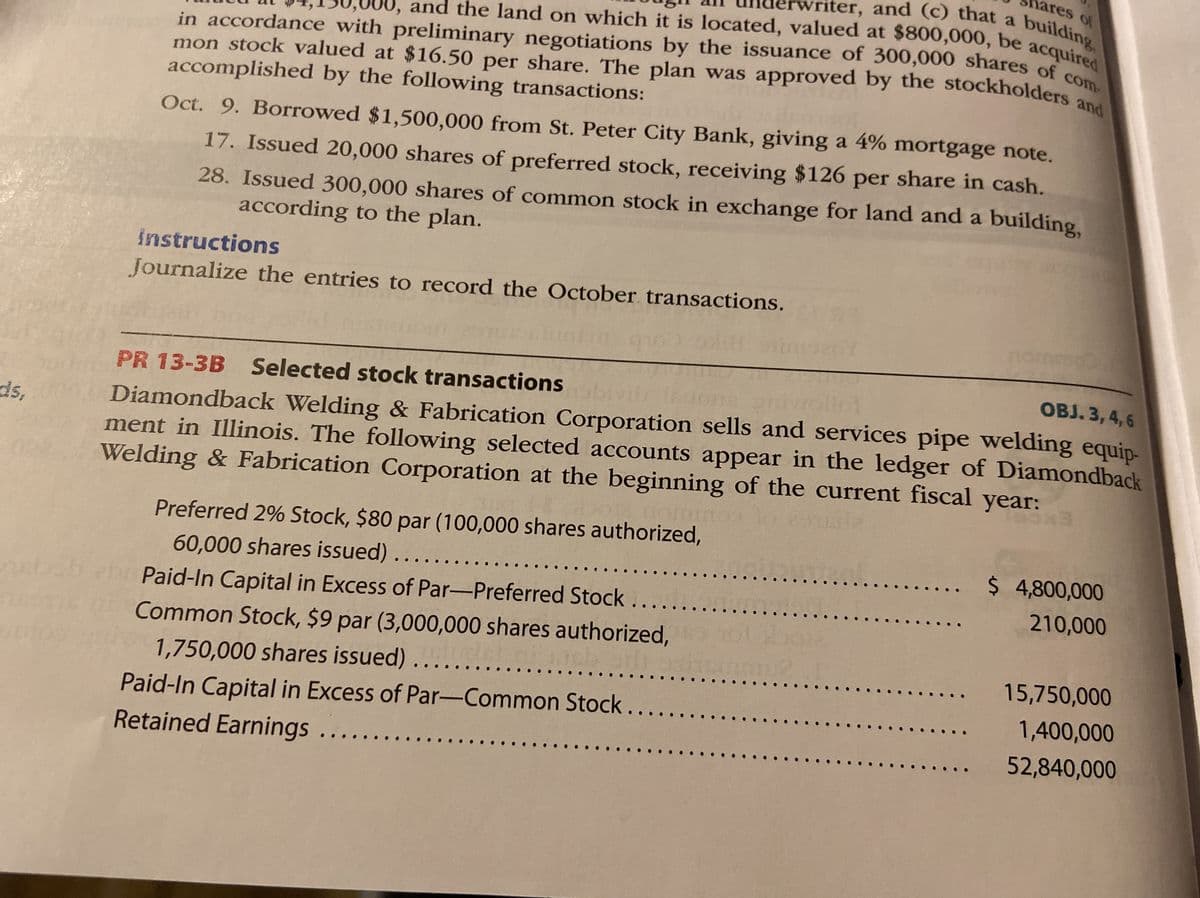

PR 13-3B Selected stock transactions

ОBJ. 3, 4,6

Diamondback Welding & Fabrication Corporation sells and services pipe welding equip-

ment in Illinois. The following selected accounts appear in the ledger of Diamondback

Welding & Fabrication Corporation at the beginning of the current fiscal year:

ds,

Preferred 2% Stock, $80 par (100,000 shares authorized,

. $ 4,800,000

60,000 shares issued)...

Paid-In Capital in Excess of Par-Preferred Stock ...

....

..

210,000

Common Stock, $9 par (3,000,000 shares authorized,

1,750,000 shares issued)

15,750,000

1,400,000

Paid-In Capital in Excess of Par-Common Stock.

Retained Earnings.

52,840,000

Transcribed Image Text:Chapter 13 Corporations: Organization, Stock Transactions, and Dividends

669

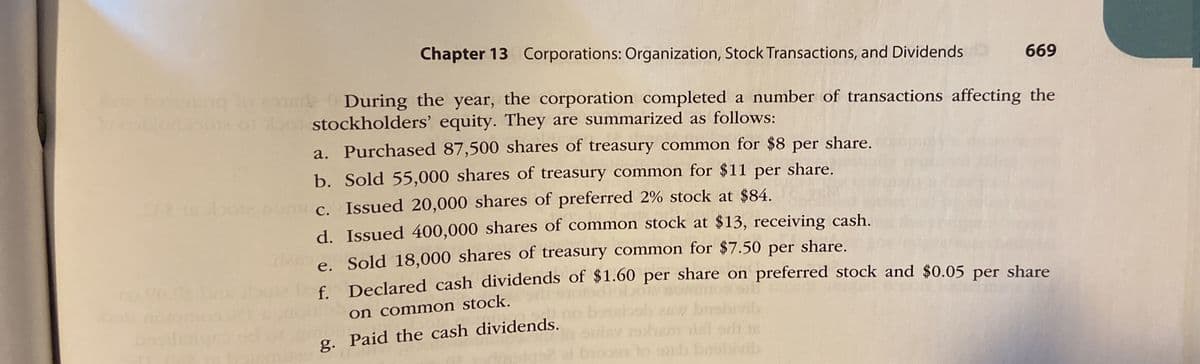

During the year, the corporation completed a number of transactions affecting the

ooblor 01 o1 o stockholders' equity. They are summarized as follows:

a. Purchased 87,500 shares of treasury common for $8

per

share.

b. Sold 55,000 shares of treasury common for $11 per share.

c. Issued 20,000 shares of preferred 2% stock at $84.

d. Issued 400,000 shares of common stock at $13, receiving cash.

e. Sold 18,000 shares of treasury common for $7.50 per share.

f Declared cash dividends of $1.60 per share on preferred stock and $0.05 per share

on common stock.

g. Paid the cash dividends.

Tt orh is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning