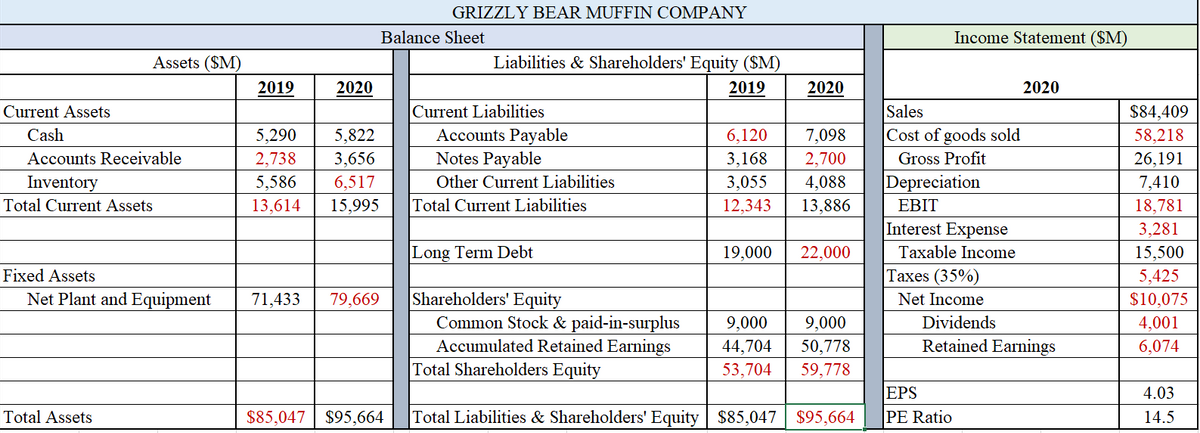

Use information from the balance sheet and income statement to calculate the following financial ratios and the market value added (MVA). (Whenever balance sheet numbers are used to calculate financial ratios, please ensure that you use the average of the 2019 and 2020 numbers in your calculation. To calculate MVA, you can assume that the average book value number for common stock and paid-in-surplus is the amount that the shareholders initially invested in the company.)

Use information from the balance sheet and income statement to calculate the following financial ratios and the market value added (MVA). (Whenever balance sheet numbers are used to calculate financial ratios, please ensure that you use the average of the 2019 and 2020 numbers in your calculation. To calculate MVA, you can assume that the average book value number for common stock and paid-in-surplus is the amount that the shareholders initially invested in the company.)

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 103.2C

Related questions

Question

Use information from the balance sheet and income statement to calculate the following financial ratios and the market value added (MVA).

(Whenever balance sheet numbers are used to calculate financial ratios, please ensure that you use the average of the 2019 and 2020 numbers in your calculation. To calculate MVA, you can assume that the average book value number for common stock and paid-in-surplus is the amount that the shareholders initially invested in the company.)

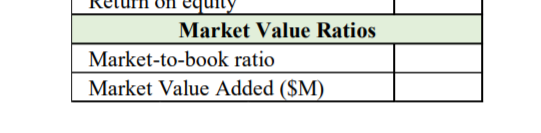

Transcribed Image Text:Market Value Ratios

Market-to-book ratio

Market Value Added ($M)

Transcribed Image Text:GRIZZLY BEAR MUFFIN COMPANY

Balance Sheet

Income Statement ($M)

Assets ($M)

Liabilities & Shareholders' Equity ($M)

2019

2020

2019

2020

2020

Current Assets

Cash

Current Liabilities

Accounts Payable

Notes Payable

Sales

$84,409

5,290

5,822

6,120

7,098

Cost of goods sold

58,218

26,191

Accounts Receivable

3,656

6,517

2,738

3,168

2,700

Gross Profit

Inventory

Total Current Assets

5,586

13,614

Other Current Liabilities

4,088

Depreciation

7,410

3,055

15,995

Total Current Liabilities

12,343

13,886

EBIT

18,781

Interest Expense

3,281

|Long Term Debt

19,000

22,000

Taxable Income

15,500

Fixed Assets

Taxes (35%)

5,425

$10,075

Shareholders' Equity

Common Stock & paid-in-surplus

Accumulated Retained Earnings

Total Shareholders Equity

Net Plant and Equipment

71,433

79,669

Net Income

9,000

9.000

Dividends

4,001

44,704

Retained Earnings

50,778

59,778

6,074

53,704

EPS

4.03

Total Assets

$85,047

$95,664

Total Liabilities & Shareholders' Equity | $85,047

$95,664

PE Ratio

14.5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning