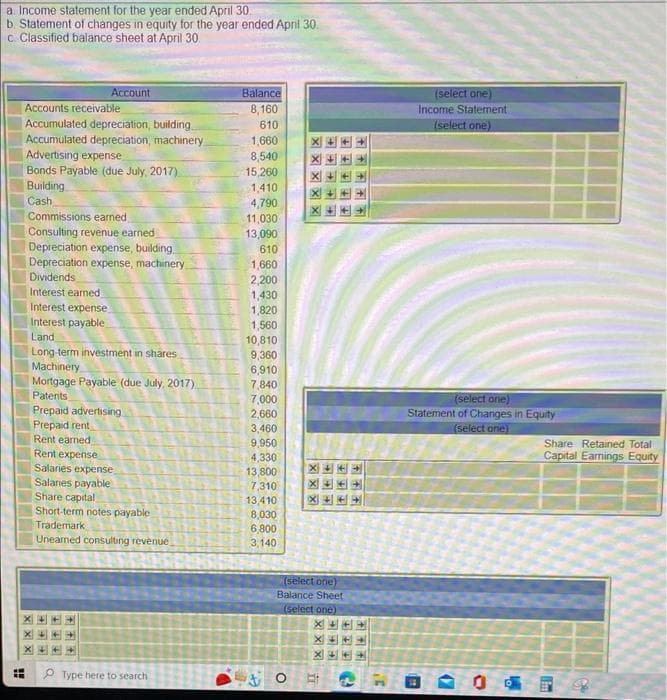

a Income statement for the year ended April 30. b. Statement of changes in equity for the year ended April 30. c. Classified balance sheet at April 30 Account Balance Accounts receivable 8,160 Accumulated depreciation, building 610 Accumulated depreciation, machinery 1,660 Advertising expense 8,540 Bonds Payable (due July, 2017) 15,260 Building 1,410 Cash 4,790 Commissions earned 11,030 Consulting revenue earned 13,090 Depreciation expense, building 610 Depreciation expense, machinery 1,660 Dividends 2,200 Interest earned 1,430 Interest expense 1,820 Interest payable 1,560 Land 10,810 9,360 Long-term investment in shares Machinery 6,910 Mortgage Payable (due July, 2017) 7,840 Patents 7,000 Prepaid advertising 2,660 Prepaid rent 3,460 Rent earned 9,950 Rent expense 4,330 Salaries expense Salanes payable 13,800 7,310 Share capital 13,410 Short-term notes payable 8,030 Trademark 6,800 Unearned consulting revenue, 3,140 + XXX 654 ** 97 47 (select one) Balance Sheet (select one) *** (select one) Income Statement (select one) (select one) Statement of Changes in Equity (select one) Share Retained Total Capital Earnings Equity

a Income statement for the year ended April 30. b. Statement of changes in equity for the year ended April 30. c. Classified balance sheet at April 30 Account Balance Accounts receivable 8,160 Accumulated depreciation, building 610 Accumulated depreciation, machinery 1,660 Advertising expense 8,540 Bonds Payable (due July, 2017) 15,260 Building 1,410 Cash 4,790 Commissions earned 11,030 Consulting revenue earned 13,090 Depreciation expense, building 610 Depreciation expense, machinery 1,660 Dividends 2,200 Interest earned 1,430 Interest expense 1,820 Interest payable 1,560 Land 10,810 9,360 Long-term investment in shares Machinery 6,910 Mortgage Payable (due July, 2017) 7,840 Patents 7,000 Prepaid advertising 2,660 Prepaid rent 3,460 Rent earned 9,950 Rent expense 4,330 Salaries expense Salanes payable 13,800 7,310 Share capital 13,410 Short-term notes payable 8,030 Trademark 6,800 Unearned consulting revenue, 3,140 + XXX 654 ** 97 47 (select one) Balance Sheet (select one) *** (select one) Income Statement (select one) (select one) Statement of Changes in Equity (select one) Share Retained Total Capital Earnings Equity

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter1: The Role Of Accounting In Business

Section: Chapter Questions

Problem 1.3.1P: Income statement, retained earnings statement, and balance sheet The following financial data were...

Related questions

Question

A9

Transcribed Image Text:a. Income statement for the year ended April 30.

b. Statement of changes in equity for the year ended April 30.

c. Classified balance sheet at April 30

Account

Balance

Accounts receivable

8,160

Accumulated depreciation, building.

610

Accumulated depreciation, machinery

1,660

Advertising expense

8,540

Bonds Payable (due July, 2017)

15,260

Building

1,410

Cash

4,790

Commissions earned

11,030

Consulting revenue earned

13,090

Depreciation expense, building.

610

Depreciation expense, machinery

1,660

Dividends

2,200

Interest earned

1,430

Interest expense

1,820

Interest payable

1,560

Land

10,810

Long-term investment in shares

9,360

Machinery

6,910

Mortgage Payable (due July, 2017)

7,840

Patents

7,000

Prepaid advertising

2,660

Prepaid rent

3,460

Rent earned

9,950

Rent expense

4,330

13,800

Salaries expense

Salanes payable

7,310

Share capital

13,410

Short-term notes payable

8,030

Trademark.

6,800

Unearned consulting revenue.

3,140

Type here to search

XX

!!

++

X X X X X

X +

X++

***

***

++

(select one)

Balance Sheet

(select one)

OE

***

X4+4

(select one)

Income Statement

(select one)

(select one)

Statement of Changes in Equity

(select one)

O

Share Retained Total

Capital Earnings Equity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,