1. TechGate makes PS4 games with a selling price of P1,040.00 per CD with a variable cost of P624.00 per unit. The fixed cost for the period is P2,080,000. How many CDs should TechGate sell to breakeven?

1. TechGate makes PS4 games with a selling price of P1,040.00 per CD with a variable cost of P624.00 per unit. The fixed cost for the period is P2,080,000. How many CDs should TechGate sell to breakeven?

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter16: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 8E

Related questions

Question

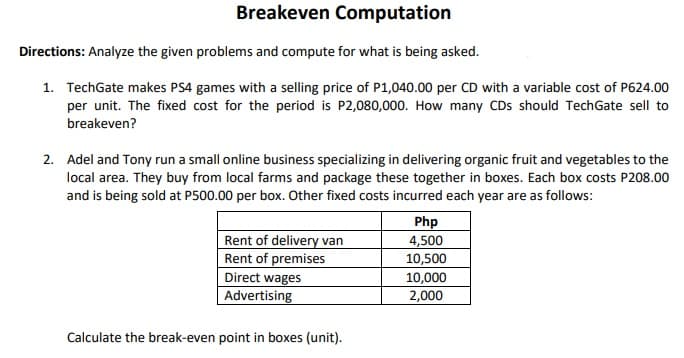

Transcribed Image Text:Breakeven Computation

Directions: Analyze the given problems and compute for what is being asked.

1. TechGate makes PS4 games with a selling price of P1,040.00 per CD with a variable cost of P624.00

per unit. The fixed cost for the period is P2,080,000. How many CDs should TechGate sell to

breakeven?

2. Adel and Tony run a small online business specializing in delivering organic fruit and vegetables to the

local area. They buy from local farms and package these together in boxes. Each box costs P208.00

and is being sold at P500.00 per box. Other fixed costs incurred each year are as follows:

Php

Rent of delivery van

4,500

Rent of premises

10,500

Direct wages

10,000

Advertising

2,000

Calculate the break-even point in boxes (unit).

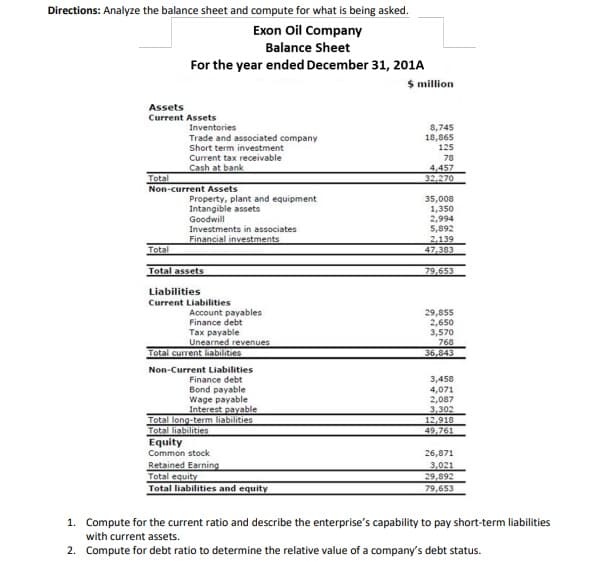

Transcribed Image Text:Directions: Analyze the balance sheet and compute for what is being asked.

Exon Oil Company

Balance Sheet

For the year ended December 31, 201A

$ million

Assets

Current Assets

Inventories

8,745

Trade and associated company

18,865

Short term investment

125

Current tax receivable

78

Cash at bank

4,457

Total

32,270

Non-current Assets

35,008

Property, plant and equipment

Intangible assets

1,350

Goodwill

2,994

5,892

Investments in associates

Financial investments

2,139

Total

47,383

Total assets

79,653

Liabilities

Current Liabilities

29,855

Account payables

Finance debt

2,650

Tax payable

3,570

Unearned revenues

768

Total current liabilities

36,843

Non-Current Liabilities

3,458

Finance debt

Bond payable

4,071

Wage payable

2,087

Interest payable

3,302

Total long-term liabilities

12,918

Total liabilities

Equity

Common stock

26,871

Retained Earning

3,021

Total equity

29,892

Total liabilities and equity

79,653

1. Compute for the current ratio and describe the enterprise's capability to pay short-term liabilities

with current assets.

2. Compute for debt ratio to determine the relative value of a company's debt status.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College