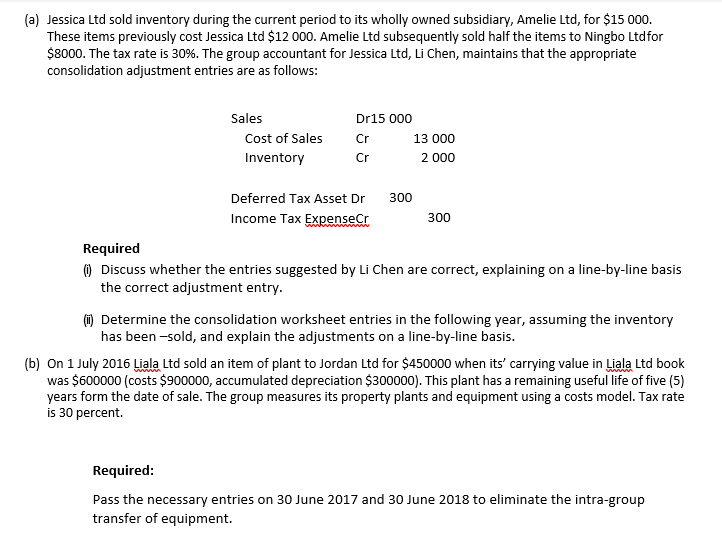

(a) Jessica Ltd sold inventory during the current period to its wholly owned subsidiary, Amelie Ltd, for $15 000. These items previously cost Jessica Ltd $12 000. Amelie Ltd subsequently sold half the items to Ningbo Ltdfor $8000. The tax rate is 30%. The group accountant for Jessica Ltd, Li Chen, maintains that the appropriate consolidation adjustment entries are as follows: Sales Dr15 000 Cost of Sales Cr 13 000 Inventory Cr 2 000 Deferred Tax Asset Dr 300 Income Tax ExpenseCr 300 Required ) Discuss whether the entries suggested by Li Chen are correct, explaining on a line-by-line basis the correct adjustment entry. (1) Determine the consolidation worksheet entries in the following year, assuming the inventory has been -sold, and explain the adjustments on a line-by-line basis.

(a) Jessica Ltd sold inventory during the current period to its wholly owned subsidiary, Amelie Ltd, for $15 000. These items previously cost Jessica Ltd $12 000. Amelie Ltd subsequently sold half the items to Ningbo Ltdfor $8000. The tax rate is 30%. The group accountant for Jessica Ltd, Li Chen, maintains that the appropriate consolidation adjustment entries are as follows: Sales Dr15 000 Cost of Sales Cr 13 000 Inventory Cr 2 000 Deferred Tax Asset Dr 300 Income Tax ExpenseCr 300 Required ) Discuss whether the entries suggested by Li Chen are correct, explaining on a line-by-line basis the correct adjustment entry. (1) Determine the consolidation worksheet entries in the following year, assuming the inventory has been -sold, and explain the adjustments on a line-by-line basis.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 2P

Related questions

Question

Transcribed Image Text:(a) Jessica Ltd sold inventory during the current period to its wholly owned subsidiary, Amelie Ltd, for $15 000.

These items previously cost Jessica Ltd $12 000. Amelie Ltd subsequently sold half the items to Ningbo Ltdfor

$8000. The tax rate is 30%. The group accountant for Jessica Ltd, Li Chen, maintains that the appropriate

consolidation adjustment entries are as follows:

Sales

Dr15 000

Cost of Sales

Cr

13 000

Inventory

Cr

2 000

Deferred Tax Asset Dr

300

Income Tax ExpenseCr

300

Required

O Discuss whether the entries suggested by Li Chen are correct, explaining on a line-by-line basis

the correct adjustment entry.

(1) Determine the consolidation worksheet entries in the following year, assuming the inventory

has been -sold, and explain the adjustments on a line-by-line basis.

(b) On 1 July 2016 Liala Ltd sold an item of plant to Jordan Ltd for $450000 when its' carrying value in Liala Ltd book

was $600000 (costs $900000, accumulated depreciation $300000). This plant has a remaining useful life of five (5)

years form the date of sale. The group measures its property plants and equipment using a costs model. Tax rate

is 30 percent.

Required:

Pass the necessary entries on 30 June 2017 and 30 June 2018 to eliminate the intra-group

transfer of equipment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning