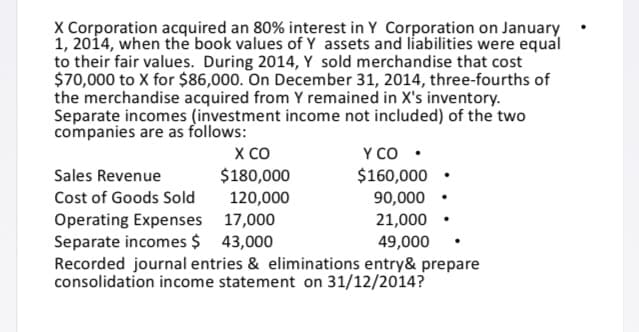

X Corporation acquired an 80% interest in Y Corporation on January 1, 2014, when the book values of Y assets and liabilities were equal to their fair values. During 2014, Y sold merchandise that cost $70,000 to X for $86,000. On December 31, 2014, three-fourths of the merchandise acquired from Y remained in X's inventory. Separate incomes (investment income not included) of the two companies are as follows: X CO $180,000 Y CO • $160,000 Sales Revenue Cost of Goods Sold 120,000 90,000 • Operating Expenses 17,000 Separate incomes $ 43,000 Recorded journal entries & eliminations entry& prepare consolidation income statement on 31/12/2014? 21,000 49,000

X Corporation acquired an 80% interest in Y Corporation on January 1, 2014, when the book values of Y assets and liabilities were equal to their fair values. During 2014, Y sold merchandise that cost $70,000 to X for $86,000. On December 31, 2014, three-fourths of the merchandise acquired from Y remained in X's inventory. Separate incomes (investment income not included) of the two companies are as follows: X CO $180,000 Y CO • $160,000 Sales Revenue Cost of Goods Sold 120,000 90,000 • Operating Expenses 17,000 Separate incomes $ 43,000 Recorded journal entries & eliminations entry& prepare consolidation income statement on 31/12/2014? 21,000 49,000

Chapter20: Corporations: Distributions In Complete Liquidation And An Overview Of Reorganizations

Section: Chapter Questions

Problem 35P

Related questions

Question

Transcribed Image Text:X Corporation acquired an 80% interest in Y Corporation on January

1, 2014, when the book values of Y assets and liabilities were equal

to their fair values. During 2014, Y sold merchandise that cost

$70,000 to X for $86,000. On December 31, 2014, three-fourths of

the merchandise acquired from Y remained in X's inventory.

Separate incomes (investment income not included) of the two

companies are as follows:

X CO

$180,000

120,000

Y CO •

$160,000 •

90,000

21,000

49,000

Sales Revenue

Cost of Goods Sold

Operating Expenses 17,000

Separate incomes $ 43,000

Recorded journal entries & eliminations entry& prepare

consolidation income statement on 31/12/2014?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning