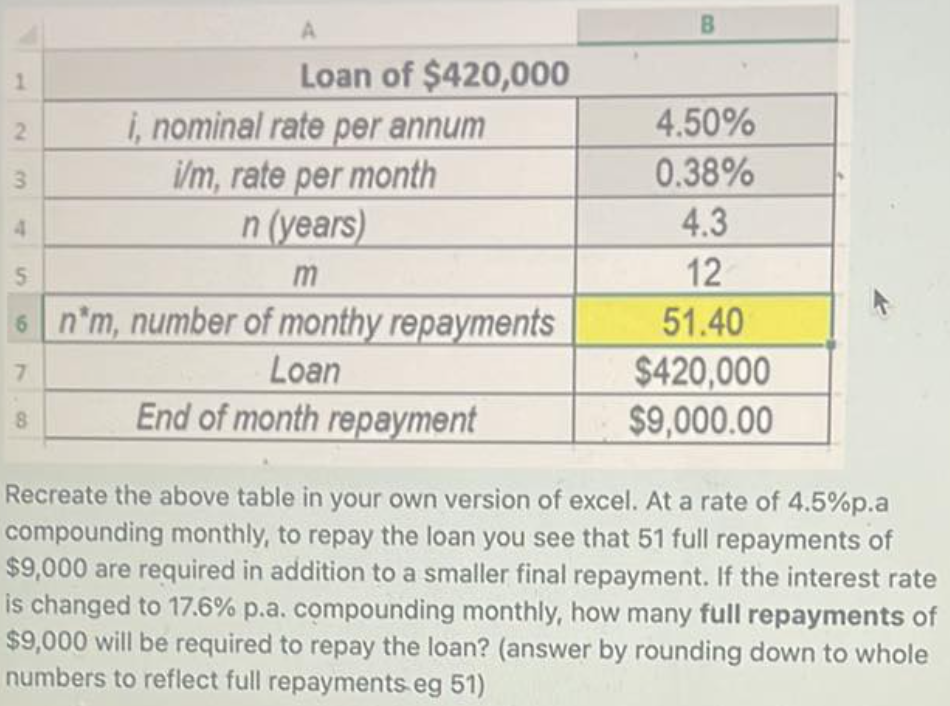

A Loan of $420,000 1 2 i, nominal rate per annum i/m, rate per month 3 4 n (years) 5 m 6 n'm, number of monthy repayments 7 Loan 8 End of month repayment B 4.50% 0.38% 4.3 12 51.40 $420,000 $9,000.00 Recreate the above table in your own version of excel. At a rate of 4.5%p.a compounding monthly, to repay the loan you see that 51 full repayments of $9,000 are required in addition to a smaller final repayment. If the interest ra s changed to 17.6% p.a. compounding monthly, how many full repayments $9,000 will be required to repay the loan? (answer by rounding down to who numbers to reflect full repayments.eg 51)

A Loan of $420,000 1 2 i, nominal rate per annum i/m, rate per month 3 4 n (years) 5 m 6 n'm, number of monthy repayments 7 Loan 8 End of month repayment B 4.50% 0.38% 4.3 12 51.40 $420,000 $9,000.00 Recreate the above table in your own version of excel. At a rate of 4.5%p.a compounding monthly, to repay the loan you see that 51 full repayments of $9,000 are required in addition to a smaller final repayment. If the interest ra s changed to 17.6% p.a. compounding monthly, how many full repayments $9,000 will be required to repay the loan? (answer by rounding down to who numbers to reflect full repayments.eg 51)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

ChapterM: Time Value Of Money Module

Section: Chapter Questions

Problem 8E: Cash Flow Amounts R. Lee Rouse borrows 10,000 that is to be repaid in 24 equal monthly installments...

Related questions

Question

Can you help me to find the full repayment for this question, please?

Transcribed Image Text:1

A

Loan of $420,000

i, nominal rate per annum

i/m, rate per month

n (years)

m

2

3

4

5

6 n'm, number of monthy repayments

7

Loan

8

End of month repayment

B

4.50%

0.38%

4.3

12

51.40

$420,000

$9,000.00

Recreate the above table in your own version of excel. At a rate of 4.5%p.a

compounding monthly, to repay the loan you see that 51 full repayments of

$9,000 are required in addition to a smaller final repayment. If the interest rate

is changed to 17.6% p.a. compounding monthly, how many full repayments of

$9,000 will be required to repay the loan? (answer by rounding down to whole

numbers to reflect full repayments.eg 51)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning