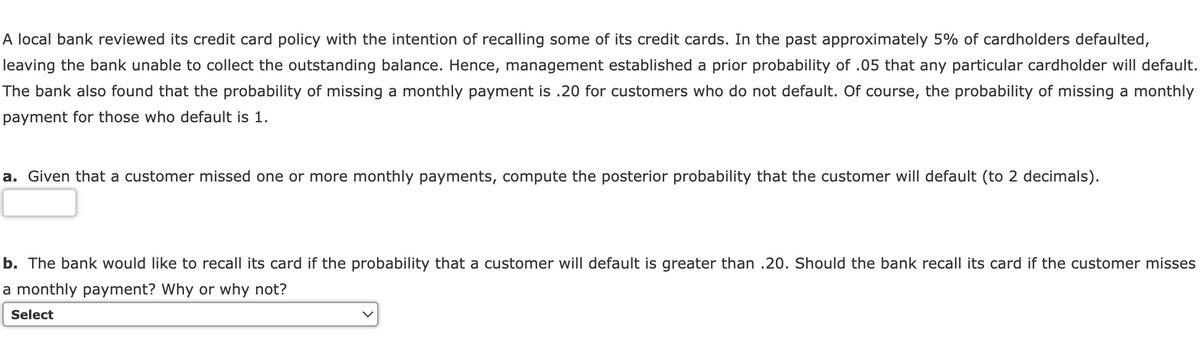

A local bank reviewed its credit card policy with the intention of recalling some of its credit cards. In the past approximately 5% of cardholders defaulted, leaving the bank unable to collect the outstanding balance. Hence, management established a prior probability of .05 that any particular cardholder will default. The bank also found that the probability of missing a monthly payment is .20 for customers who do not default. Of course, the probability of missing a monthly payment for those who default is 1. a. Given that a customer missed one or more monthly payments, compute the posterior probability that the customer will default (to 2 decimals). b. The bank would like to recall its card if the probability that a customer will default is greater than .20. Should the bank recall its card if the customer misses a monthly payment? Why or why not? Select

A local bank reviewed its credit card policy with the intention of recalling some of its credit cards. In the past approximately 5% of cardholders defaulted, leaving the bank unable to collect the outstanding balance. Hence, management established a prior probability of .05 that any particular cardholder will default. The bank also found that the probability of missing a monthly payment is .20 for customers who do not default. Of course, the probability of missing a monthly payment for those who default is 1. a. Given that a customer missed one or more monthly payments, compute the posterior probability that the customer will default (to 2 decimals). b. The bank would like to recall its card if the probability that a customer will default is greater than .20. Should the bank recall its card if the customer misses a monthly payment? Why or why not? Select

Chapter8: Sequences, Series,and Probability

Section8.7: Probability

Problem 11ECP: A manufacturer has determined that a machine averages one faulty unit for every 500 it produces....

Related questions

Question

Transcribed Image Text:A local bank reviewed its credit card policy with the intention of recalling some of its credit cards. In the past approximately 5% of cardholders defaulted,

leaving the bank unable to collect the outstanding balance. Hence, management established a prior probability of .05 that any particular cardholder will default.

The bank also found that the probability of missing a monthly payment is .20 for customers who do not default. Of course, the probability of missing a monthly

payment for those who default is 1.

a. Given that a customer missed one or more monthly payments, compute the posterior probability that the customer will default (to 2 decimals).

b. The bank would like to recall its card if the probability that a customer will default is greater than .20. Should the bank recall its card if the customer misses

a monthly payment? Why or why not?

Select

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you