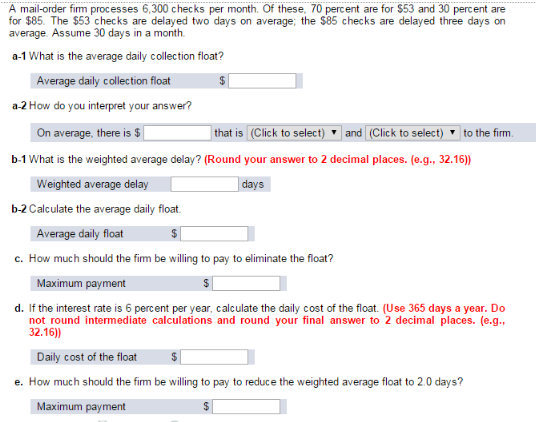

A mail-order firm processes 6,300 checks per month. Of these, 70 percent are for $53 and 30 percent are for $85. The $53 checks are delayed two days on average; the $85 checks are delayed three days on average. Assume 30 days in a month. a-1 What is the average daily collection float? Average daily collection float $ a-2 How do you interpret your answer? On average, there is $| | that is (Click to select) ▪ and (Click to select) to the firm. b-1 What is the weighted average delay? (Round your answer to 2 decimal places. (e.g., 32.16)) Weighted average delay days b-2 Calculate the average daily float. Average daily float c. How much should the fim be willing to pay to eliminate the float? Maximum payment d. If the interest rate is 6 percent per year, calculate the daily cost of the float. (Use 365 days a year. Do not round intermediate calculations and round your final answer to 2 decimal places. (e.g., 32.16)) Daily cost of the float e. How much should the fim be willing to pay to reduce the weighted average float to 2.0 days? Maximum payment

A mail-order firm processes 6,300 checks per month. Of these, 70 percent are for $53 and 30 percent are for $85. The $53 checks are delayed two days on average; the $85 checks are delayed three days on average. Assume 30 days in a month. a-1 What is the average daily collection float? Average daily collection float $ a-2 How do you interpret your answer? On average, there is $| | that is (Click to select) ▪ and (Click to select) to the firm. b-1 What is the weighted average delay? (Round your answer to 2 decimal places. (e.g., 32.16)) Weighted average delay days b-2 Calculate the average daily float. Average daily float c. How much should the fim be willing to pay to eliminate the float? Maximum payment d. If the interest rate is 6 percent per year, calculate the daily cost of the float. (Use 365 days a year. Do not round intermediate calculations and round your final answer to 2 decimal places. (e.g., 32.16)) Daily cost of the float e. How much should the fim be willing to pay to reduce the weighted average float to 2.0 days? Maximum payment

Chapter17: The Management Of Cash And Marketable Securities

Section: Chapter Questions

Problem 9P

Related questions

Question

Transcribed Image Text:A mail-order firm processes 6,300 checks per month. Of these, 70 percent are for $53 and 30 percent are

for $85. The $53 checks are delayed two days on average; the $85 checks are delayed three days on

average. Assume 30 days in a month.

a-1 What is the average daily collection float?

Average daily collection float

$

a-2 How do you interpret your answer?

On average, there is $|

| that is (Click to select) ▪ and (Click to select)

to the firm.

b-1 What is the weighted average delay? (Round your answer to 2 decimal places. (e.g., 32.16))

Weighted average delay

days

b-2 Calculate the average daily float.

Average daily float

c. How much should the fim be willing to pay to eliminate the float?

Maximum payment

d. If the interest rate is 6 percent per year, calculate the daily cost of the float. (Use 365 days a year. Do

not round intermediate calculations and round your final answer to 2 decimal places. (e.g.,

32.16))

Daily cost of the float

e. How much should the fim be willing to pay to reduce the weighted average float to 2.0 days?

Maximum payment

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning