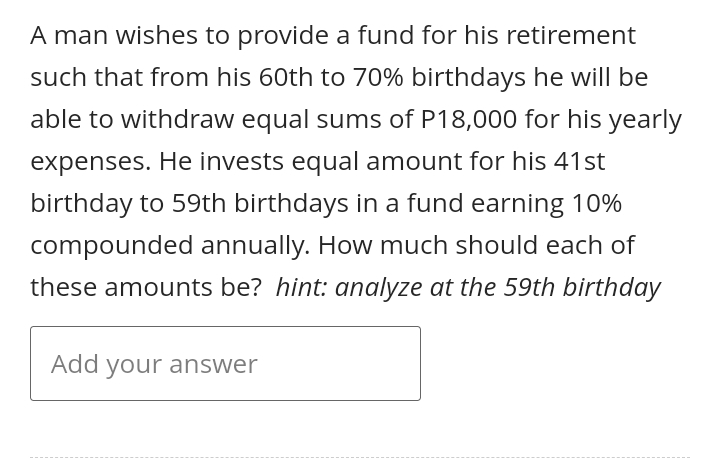

A man wishes to provide a fund for his retirement such that from his 60th to 70% birthdays he will be able to withdraw equal sums of P18,000 for his yearly expenses. He invests equal amount for his 41st birthday to 59th birthdays in a fund earning 10% compounded annually. How much should each of these amounts be? hint: analyze at the 59th birthday

A man wishes to provide a fund for his retirement such that from his 60th to 70% birthdays he will be able to withdraw equal sums of P18,000 for his yearly expenses. He invests equal amount for his 41st birthday to 59th birthdays in a fund earning 10% compounded annually. How much should each of these amounts be? hint: analyze at the 59th birthday

Chapter4: Economic Evaluation In Health Care

Section: Chapter Questions

Problem 7QAP

Related questions

Question

10. Please use the formula to solve the problem

![Legend:

Cc - Capitalized Cost (Currency)

Fc - First Cost (Currency)

Mc - maintenance Cost (Currency)

Rc - Replacement Cost (Currency); if no Re: Re Fe

Sy- Salvage Value (Curency); if no Sy: Sy = 0

A - Periodic Amount (Currency)

F-Future Value (Currency)

G - Periodic Amount Increment Amount (Currency)

P - Present Value (Currency)

g - Periodic Amount Increment Rate (Persentage)

i-Nominal Interest Rate (Percent)

m - Number of Periods per Year (Number)

r - Effective Interest Rate (Percent)

t-Number of Years (Number)

Formulae:

Compounding Transformation (i, (m₂)→ 1₂ (m₂)): (1 + ) = (1 +)**

Perpetuity (t=00):

Ordinary Annuity (Payment at End of Period):

P=A1-(1+1)-²)

Arithmetic Gradient:

Geometric Gradient:

Capitalized Cost:

n = mt

Annuity Due (Payment at Beginning of Period):

r=-

m

F = P(1+r)"

P = F(1+r)-R

F=A

F=A

= A ((1+r)^²-1)

F=

P=A (1-(1+r)^)(1+r)

= A (¹ + r)² - 1) (1 + r)

T

FA[(1+r)-1]G[-nr + (1+r)" - 1]

T

r2

A[(1+r)"-(1+g)"]

T-9

Rc-Sv

Cc=Fc++ (1+r)"-1

A = Cer](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F7053b554-3a97-4d68-beed-d147b9a2b76e%2Fce7252c2-3065-4e46-b062-2cc688dd5aaf%2F7kigzr5_processed.jpeg&w=3840&q=75)

Transcribed Image Text:Legend:

Cc - Capitalized Cost (Currency)

Fc - First Cost (Currency)

Mc - maintenance Cost (Currency)

Rc - Replacement Cost (Currency); if no Re: Re Fe

Sy- Salvage Value (Curency); if no Sy: Sy = 0

A - Periodic Amount (Currency)

F-Future Value (Currency)

G - Periodic Amount Increment Amount (Currency)

P - Present Value (Currency)

g - Periodic Amount Increment Rate (Persentage)

i-Nominal Interest Rate (Percent)

m - Number of Periods per Year (Number)

r - Effective Interest Rate (Percent)

t-Number of Years (Number)

Formulae:

Compounding Transformation (i, (m₂)→ 1₂ (m₂)): (1 + ) = (1 +)**

Perpetuity (t=00):

Ordinary Annuity (Payment at End of Period):

P=A1-(1+1)-²)

Arithmetic Gradient:

Geometric Gradient:

Capitalized Cost:

n = mt

Annuity Due (Payment at Beginning of Period):

r=-

m

F = P(1+r)"

P = F(1+r)-R

F=A

F=A

= A ((1+r)^²-1)

F=

P=A (1-(1+r)^)(1+r)

= A (¹ + r)² - 1) (1 + r)

T

FA[(1+r)-1]G[-nr + (1+r)" - 1]

T

r2

A[(1+r)"-(1+g)"]

T-9

Rc-Sv

Cc=Fc++ (1+r)"-1

A = Cer

Transcribed Image Text:A man wishes to provide a fund for his retirement

such that from his 60th to 70% birthdays he will be

able to withdraw equal sums of P18,000 for his yearly

expenses. He invests equal amount for his 41st

birthday to 59th birthdays in a fund earning 10%

compounded annually. How much should each of

these amounts be? hint: analyze at the 59th birthday

Add your answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you