A manufacturer of shipping equipment decided to lease an equipment with a fair value of P2,500,000 on January 1, 2020 to a company needing the equipment but lacks sufficient funds to pay the entire list price. The transaction was recorded as a sale in the manufacturer's books and as a purchase by the buyer. The equipment had a carrying amount of P1,800,000 in the manufacturer's inventory at the time, and an estimated useful life of 6 years. The following information is presented regarding the lease: Year-end annual lease payments P700,000 Implicit rate 10% Lease term 5 years USE PV FACTORS ROUNDED TO 4 DECIMALS. ROUND FINAL ANSWERS TO NEAREST PESO.

A manufacturer of shipping equipment decided to lease an equipment with a fair value of P2,500,000 on January 1, 2020 to a company needing the equipment but lacks sufficient funds to pay the entire list price. The transaction was recorded as a sale in the manufacturer's books and as a purchase by the buyer. The equipment had a carrying amount of P1,800,000 in the manufacturer's inventory at the time, and an estimated useful life of 6 years. The following information is presented regarding the lease: Year-end annual lease payments P700,000 Implicit rate 10% Lease term 5 years USE PV FACTORS ROUNDED TO 4 DECIMALS. ROUND FINAL ANSWERS TO NEAREST PESO.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 10MC: On August 1, 2019, Kern Company leased a machine to Day Company for a 6-year period requiring...

Related questions

Question

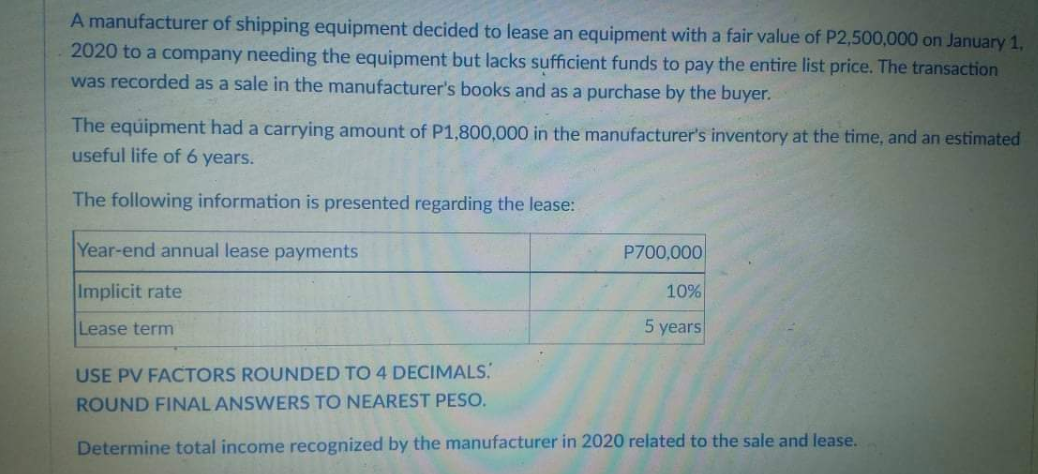

Transcribed Image Text:A manufacturer of shipping equipment decided to lease an equipment with a fair value of P2,500,000 on January 1,

2020 to a company needing the equipment but lacks sufficient funds to pay the entire list price. The transaction

was recorded as a sale in the manufacturer's books and as a purchase by the buyer.

The equipment had a carrying amount of P1,800,000 in the manufacturer's inventory at the time, and an estimated

useful life of 6 years.

The following information is presented regarding the lease:

Year-end annual lease payments

P700,000

Implicit rate

10%

Lease term

5 years

USE PV FACTORS ROUNDED TO 4 DECIMALS.

ROUND FINAL ANSWERS TO NEAREST PESO.

Determine total income recognized by the manufacturer in 2020 related to the sale and lease.

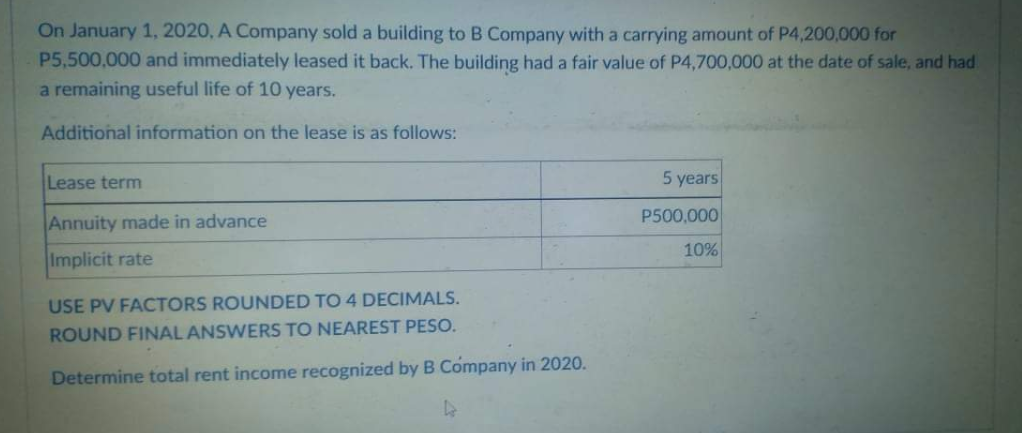

Transcribed Image Text:On January 1, 2020, A Company sold a building to B Company with a carrying amount of P4,200,000 for

P5,500,000 and immediately leased it back. The building had a fair value of P4,700,000 at the date of sale, and had

a remaining useful life of 10 years.

Additional information on the lease is as follows:

Lease term

5 years

P500,000

Annuity made in advance

10%

Implicit rate

USE PV FACTORS ROUNDED TO 4 DECIMALS.

ROUND FINAL ANSWERS TO NEAREST PESO.

Determine total rent income recognized by B Company in 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub