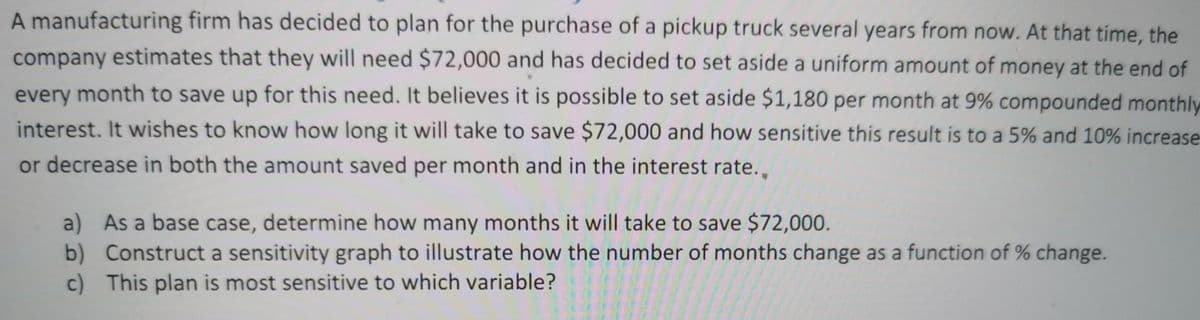

A manufacturing firm has decided to plan for the purchase of a pickup truck several years from now. At that time, the company estimates that they will need $72,000 and has decided to set aside a uniform amount of money at the end of every month to save up for this need. It believes it is possible to set aside $1,180 per month at 9% compounded monthly interest. It wishes to know how long it will take to save $72,000 and how sensitive this result is to a 5% and 10% increase or decrease in both the amount saved per month and in the interest rate., a) As a base case, determine how many months it will take to save $72,000. b) Construct a sensitivity graph to illustrate how the number of months change as a function of % change. c) This plan is most sensitive to which variable?

A manufacturing firm has decided to plan for the purchase of a pickup truck several years from now. At that time, the company estimates that they will need $72,000 and has decided to set aside a uniform amount of money at the end of every month to save up for this need. It believes it is possible to set aside $1,180 per month at 9% compounded monthly interest. It wishes to know how long it will take to save $72,000 and how sensitive this result is to a 5% and 10% increase or decrease in both the amount saved per month and in the interest rate., a) As a base case, determine how many months it will take to save $72,000. b) Construct a sensitivity graph to illustrate how the number of months change as a function of % change. c) This plan is most sensitive to which variable?

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

ChapterA: Appendix - Time Value Of Cash Flows: Compound Interest Concepts And Applications

Section: Chapter Questions

Problem 35P: Oberweis Dairy switched from delivery trucks with regular gasoline engines to ones with diesel...

Related questions

Question

100%

Transcribed Image Text:A manufacturing firm has decided to plan for the purchase of a pickup truck several years from now. At that time, the

company estimates that they will need $72,000 and has decided to set aside a uniform amount of money at the end of

every month to save up for this need. It believes it is possible to set aside $1,180 per month at 9% compounded monthly

interest. It wishes to know how long it will take to save $72,000 and how sensitive this result is to a 5% and 10% increase-

or decrease in both the amount saved per month and in the interest rate.,

a) As a base case, determine how many months it will take to save $72,000.

b) Construct a sensitivity graph to illustrate how the number of months change as a function of % change.

c) This plan is most sensitive to which variable?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,