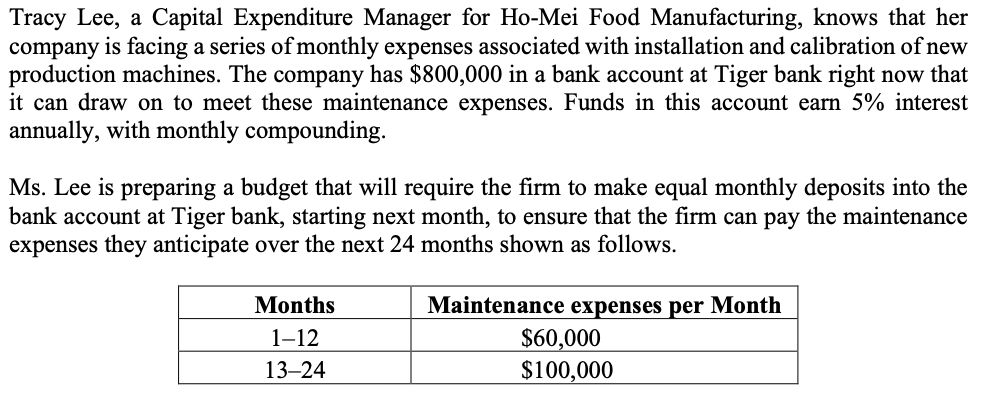

Tracy Lee, a Capital Expenditure Manager for Ho-Mei Food Manufacturing, knows that her company is facing a series of monthly expenses associated with installation and calibration of new production machines. The company has $800,000 in a bank account at Tiger bank right now that it can draw on to meet these maintenance expenses. Funds in this account earn 5% interest annually, with monthly compounding. Ms. Lee is preparing a budget that will require the firm to make equal monthly deposits into the bank account at Tiger bank, starting next month, to ensure that the firm can pay the maintenance expenses they anticipate over the next 24 months shown as follows. Months Maintenance expenses per Month $60,000 $100,000 1–12 13–24

Tracy Lee, a Capital Expenditure Manager for Ho-Mei Food Manufacturing, knows that her company is facing a series of monthly expenses associated with installation and calibration of new production machines. The company has $800,000 in a bank account at Tiger bank right now that it can draw on to meet these maintenance expenses. Funds in this account earn 5% interest annually, with monthly compounding. Ms. Lee is preparing a budget that will require the firm to make equal monthly deposits into the bank account at Tiger bank, starting next month, to ensure that the firm can pay the maintenance expenses they anticipate over the next 24 months shown as follows. Months Maintenance expenses per Month $60,000 $100,000 1–12 13–24

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 19P

Related questions

Question

(Please answer it asap, round the final answer to 2 decimals places, thanks for your help)

(a) To ensure that the firm can pay the maintenance expenses over the next 24 month, how much should the monthly bank deposit be?

(b) For the investment to acquire new production machines, name and describe this type of

Transcribed Image Text:Tracy Lee, a Capital Expenditure Manager for Ho-Mei Food Manufacturing, knows that her

company is facing a series of monthly expenses associated with installation and calibration of new

production machines. The company has $800,000 in a bank account at Tiger bank right now that

it can draw on to meet these maintenance expenses. Funds in this account earn 5% interest

annually, with monthly compounding.

Ms. Lee is preparing a budget that will require the firm to make equal monthly deposits into the

bank account at Tiger bank, starting next month, to ensure that the firm can pay the maintenance

expenses they anticipate over the next 24 months shown as follows.

Months

Maintenance expenses per Month

$60,000

$100,000

1-12

13–24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning