A monopolist produces a certain good. The cost c for producing this good is given by c = 20q, where q is the quantity produced. The (inverse) demand function for this product is given by p = = 30 - 0.019, where p is the price per unit of the product. We assume that the full produced quantity is sold. The government taxes the sales of the good and would like to maximize the received tax T. Suppose in first instance that the government introduces a tax of 4 monetary units per unit of the product sold. We determine how much the government then receives. (a) The monopolist will want to maximize his profit. What quantity should he produce to obtain maximal profit? (While making your calculations, do not forget to take into account the tax the monopolist needs to pay!) (b) The government is interested in the total amount of tax they will receive. How much will this total amount be? Next, suppose that the tax is 7 units of money per unit of the product sold. (c) Solve part a and b again, taking into account that the tax now is 7 units instead of 4.

A monopolist produces a certain good. The cost c for producing this good is given by c = 20q, where q is the quantity produced. The (inverse) demand function for this product is given by p = = 30 - 0.019, where p is the price per unit of the product. We assume that the full produced quantity is sold. The government taxes the sales of the good and would like to maximize the received tax T. Suppose in first instance that the government introduces a tax of 4 monetary units per unit of the product sold. We determine how much the government then receives. (a) The monopolist will want to maximize his profit. What quantity should he produce to obtain maximal profit? (While making your calculations, do not forget to take into account the tax the monopolist needs to pay!) (b) The government is interested in the total amount of tax they will receive. How much will this total amount be? Next, suppose that the tax is 7 units of money per unit of the product sold. (c) Solve part a and b again, taking into account that the tax now is 7 units instead of 4.

Microeconomics A Contemporary Intro

10th Edition

ISBN:9781285635101

Author:MCEACHERN

Publisher:MCEACHERN

Chapter9: Monopoly

Section: Chapter Questions

Problem 1QFR

Related questions

Question

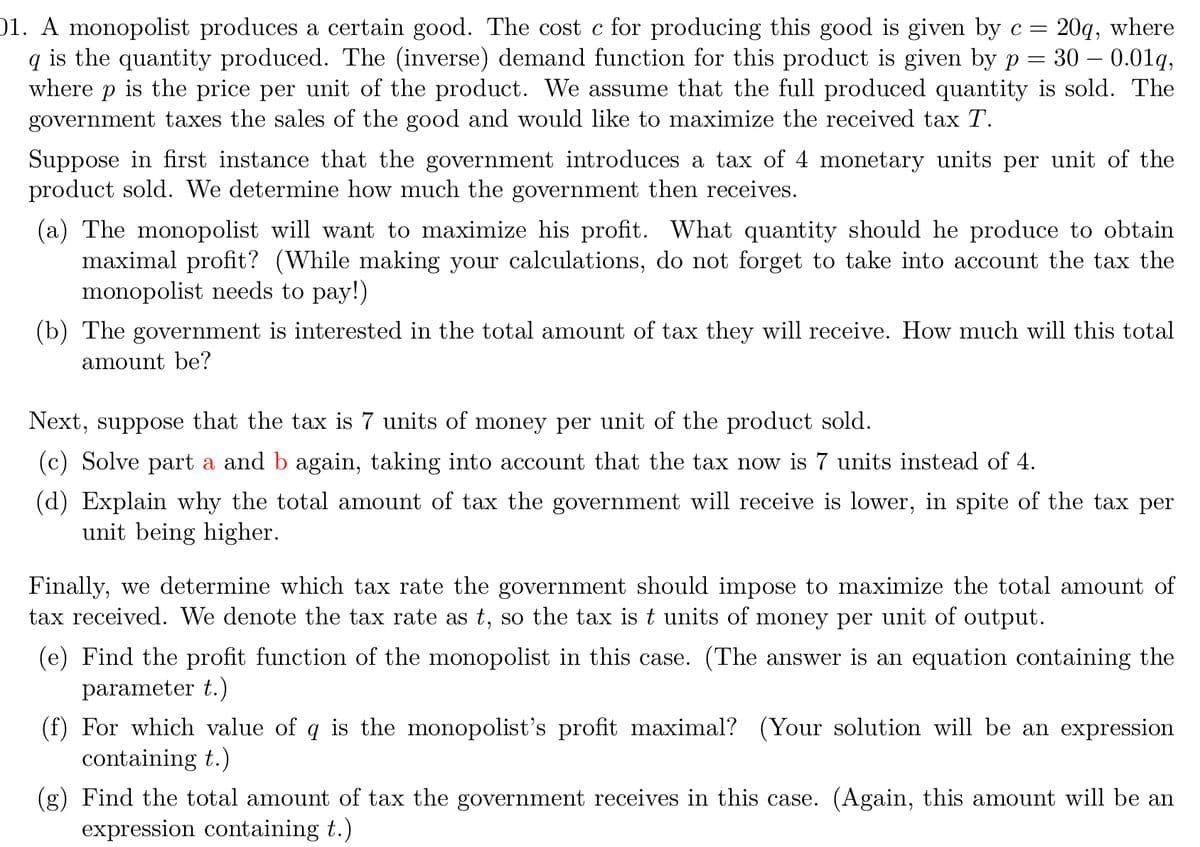

A monopolist produces a certain good. The cost c for producing this good is given by c = 20q, where

q is the quantity produced. The (inverse) demand function for this product is given by p = 30 − 0.01q,

where p is the price per unit of the product. We assume that the full produced quantity is sold. The

government taxes the sales of the good and would like to maximize the received tax T .

Suppose in first instance that the government introduces a tax of 4 monetary units per unit of the

product sold. We determine how much the government then receives.

Transcribed Image Text:=

01. A monopolist produces a certain good. The cost c for producing this good is given by c = 20q, where

qis the quantity produced. The (inverse) demand function for this product is given by p 30 – 0.01q,

where p is the price per unit of the product. We assume that the full produced quantity is sold. The

government taxes the sales of the good and would like to maximize the received tax T.

Suppose in first instance that the government introduces a tax of 4 monetary units per unit of the

product sold. We determine how much the government then receives.

(a) The monopolist will want to maximize his profit. What quantity should he produce to obtain

maximal profit? (While making your calculations, do not forget to take into account the tax the

monopolist needs to pay!)

(b) The government is interested in the total amount of tax they will receive. How much will this total

amount be?

Next, suppose that the tax is 7 units of money per unit of the product sold.

(c) Solve part a and b again, taking into account that the tax now is 7 units instead of 4.

(d) Explain why the total amount of tax the government will receive is lower, in spite of the tax per

unit being higher.

Finally, we determine which tax rate the government should impose to maximize the total amount of

tax received. We denote the tax rate as t, so the tax is t units of money per unit of output.

(e) Find the profit function of the monopolist in this case. (The answer is an equation containing the

parameter t.)

(f) For which value of q is the monopolist's profit maximal? (Your solution will be an expression

containing t.)

(g) Find the total amount of tax the government receives in this case. (Again, this amount will be an

expression containing t.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning