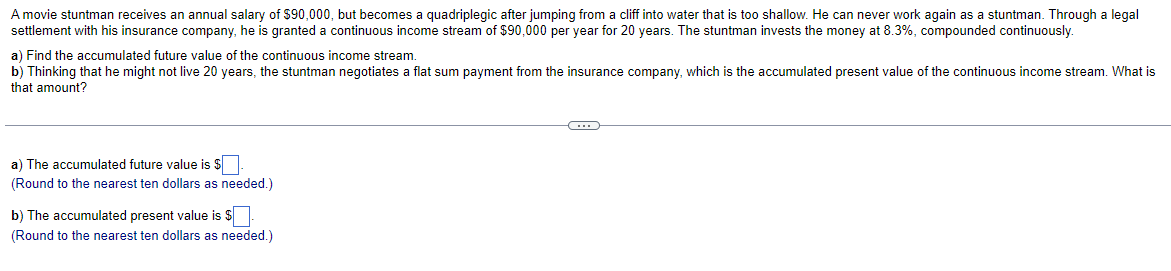

A movie stuntman receives an annual salary of $90,000, but becomes a quadriplegic after jumping from a cliff into water that is too shallow. He can never work again as a stuntman. Through a legal settlement with his insurance company, he is granted a continuous income stream of $90,000 per year for 20 years. The stuntman invests the money at 8.3%, compounded continuously. a) Find the accumulated future value of the continuous income stream. b) Thinking that he might not live 20 years, the stuntman negotiates a flat sum payment from the insurance company, which is the accumulated present value of the continuous income stream. What is that amount? a) The accumulated future value is $ (Round to the nearest ten dollars as needed.) b) The accumulated present value is $. (Round to the nearest ten dollars as needed.)

A movie stuntman receives an annual salary of $90,000, but becomes a quadriplegic after jumping from a cliff into water that is too shallow. He can never work again as a stuntman. Through a legal settlement with his insurance company, he is granted a continuous income stream of $90,000 per year for 20 years. The stuntman invests the money at 8.3%, compounded continuously. a) Find the accumulated future value of the continuous income stream. b) Thinking that he might not live 20 years, the stuntman negotiates a flat sum payment from the insurance company, which is the accumulated present value of the continuous income stream. What is that amount? a) The accumulated future value is $ (Round to the nearest ten dollars as needed.) b) The accumulated present value is $. (Round to the nearest ten dollars as needed.)

Chapter19: Deferred Compensation

Section: Chapter Questions

Problem 49P

Related questions

Question

Q17. Please show all work

Transcribed Image Text:A movie stuntman receives an annual salary of $90,000, but becomes a quadriplegic after jumping from a cliff into water that is too shallow. He can never work again as a stuntman. Through a legal

settlement with his insurance company, he is granted a continuous income stream of $90,000 per year for 20 years. The stuntman invests the money 8.3%, compounded continuously.

a) Find the accumulated future value of the continuous income stream.

b) Thinking that he might not live 20 years, the stuntman negotiates a flat sum payment from the insurance company, which is the accumulated present value of the continuous income stream. What is

that amount?

a) The accumulated future value is $

(Round to the nearest ten dollars as needed.)

b) The accumulated present value is $

(Round to the nearest ten dollars as needed.)

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT