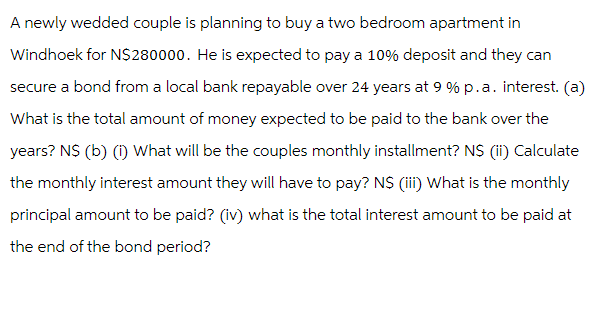

A newly wedded couple is planning to buy a two bedroom apartment in Windhoek for N$280000. He is expected to pay a 10% deposit and they can secure a bond from a local bank repayable over 24 years at 9% p.a. interest. (a) What is the total amount of money expected to be paid to the bank over the years? N$ (b) (i) What will be the couples monthly installment? N$ (ii) Calculate the monthly interest amount they will have to pay? N$ (iii) What is the monthly principal amount to be paid? (iv) what is the total interest amount to be paid at the end of the bond period?

A newly wedded couple is planning to buy a two bedroom apartment in Windhoek for N$280000. He is expected to pay a 10% deposit and they can secure a bond from a local bank repayable over 24 years at 9% p.a. interest. (a) What is the total amount of money expected to be paid to the bank over the years? N$ (b) (i) What will be the couples monthly installment? N$ (ii) Calculate the monthly interest amount they will have to pay? N$ (iii) What is the monthly principal amount to be paid? (iv) what is the total interest amount to be paid at the end of the bond period?

Chapter4: Gross Income: Concepts And Inclusions

Section: Chapter Questions

Problem 8DQ

Related questions

Question

Transcribed Image Text:A newly wedded couple is planning to buy a two bedroom apartment in

Windhoek for N$280000. He is expected to pay a 10% deposit and they can

secure a bond from a local bank repayable over 24 years at 9% p.a. interest. (a)

What is the total amount of money expected to be paid to the bank over the

years? N$ (b) (i) What will be the couples monthly installment? N$ (ii) Calculate

the monthly interest amount they will have to pay? N$ (iii) What is the monthly

principal amount to be paid? (iv) what is the total interest amount to be paid at

the end of the bond period?

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT