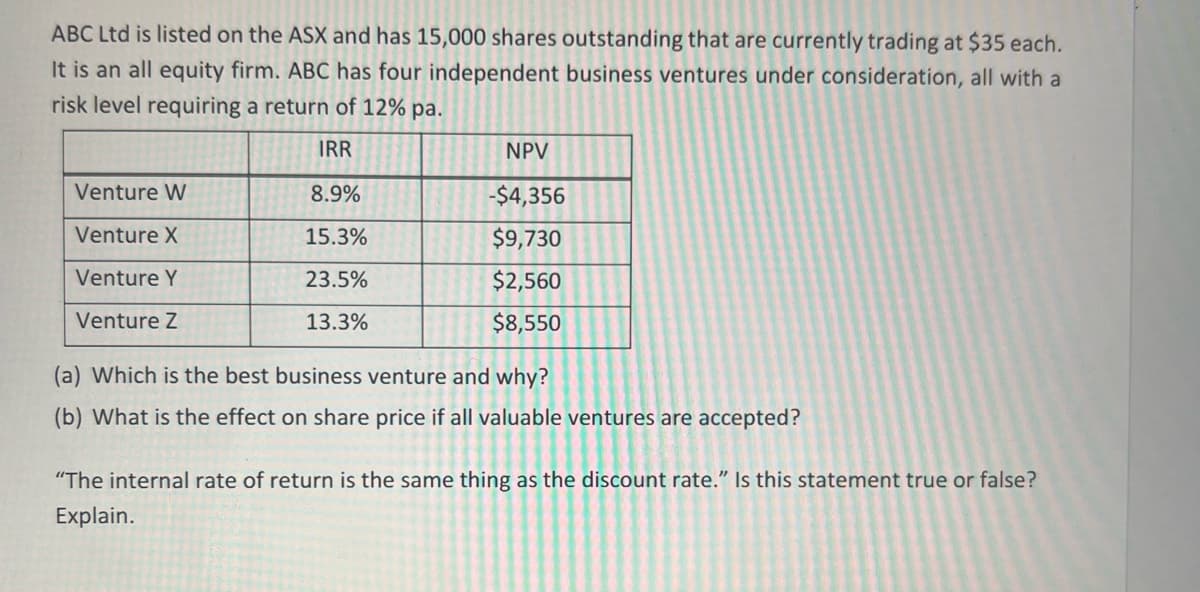

ABC Ltd is listed on the ASX and has 15,000 shares outstanding that are currently trading at $35 each. It is an all equity firm. ABC has four independent business ventures under consideration, all with a risk level requiring a return of 12% pa. IRR NPV Venture W 8.9% -$4,356 Venture X 15.3% $9,730 Venture Y 23.5% $2,560 Venture Z 13.3% $8,550 (a) Which is the best business venture and why? (b) What is the effect on share price if all valuable ventures are accepted? "The internal rate of return is the same thing as the discount rate." Is this statement true or false? Explain.

ABC Ltd is listed on the ASX and has 15,000 shares outstanding that are currently trading at $35 each. It is an all equity firm. ABC has four independent business ventures under consideration, all with a risk level requiring a return of 12% pa. IRR NPV Venture W 8.9% -$4,356 Venture X 15.3% $9,730 Venture Y 23.5% $2,560 Venture Z 13.3% $8,550 (a) Which is the best business venture and why? (b) What is the effect on share price if all valuable ventures are accepted? "The internal rate of return is the same thing as the discount rate." Is this statement true or false? Explain.

Chapter15: Dividend Policy

Section: Chapter Questions

Problem 5P

Related questions

Question

Need help with a and b as well as the last question on whether the internal rate of return is the same as discount rate

Transcribed Image Text:ABC Ltd is listed on the ASX and has 15,000 shares outstanding that are currently trading at $35 each.

It is an all equity firm. ABC has four independent business ventures under consideration, all with a

risk level requiring a return of 12% pa.

IRR

NPV

Venture W

8.9%

-$4,356

Venture X

15.3%

$9,730

Venture Y

23.5%

$2,560

Venture Z

13.3%

$8,550

(a) Which is the best business venture and why?

(b) What is the effect on share price if all valuable ventures are accepted?

"The internal rate of return is the same thing as the discount rate." Is this statement true or false?

Explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning