A no-load (commission-free) mutual fund has grown at a rate of 11% compounded annually since its beginning. If it is anticipated that it will continue to grow at that rate, how much must be invested every year so that $15,000 will be accumulated at the end of five years? 4 Click the ieon te vieu the interegt footere. nding uhen ir 110/

A no-load (commission-free) mutual fund has grown at a rate of 11% compounded annually since its beginning. If it is anticipated that it will continue to grow at that rate, how much must be invested every year so that $15,000 will be accumulated at the end of five years? 4 Click the ieon te vieu the interegt footere. nding uhen ir 110/

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 20P

Related questions

Question

5.

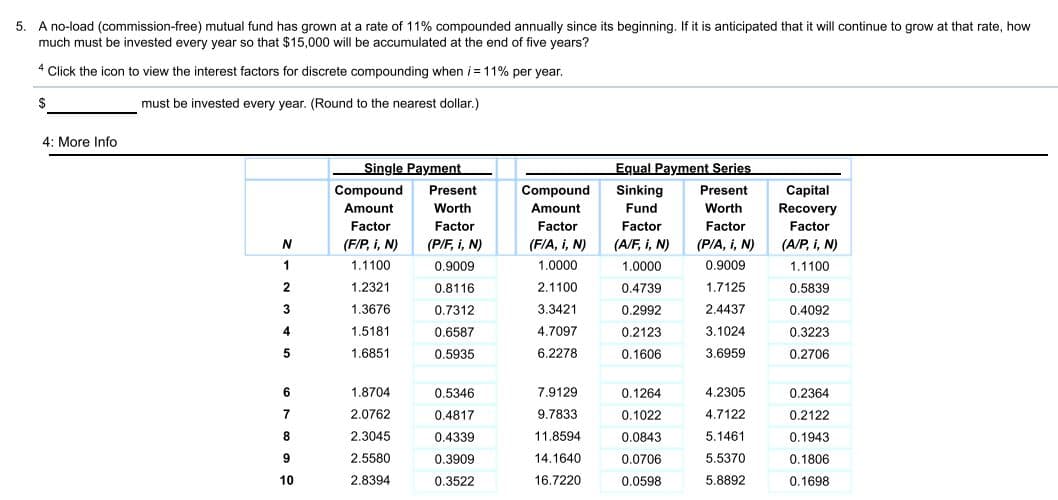

Transcribed Image Text:5. A no-load (commission-free) mutual fund has grown at a rate of 11% compounded annually since its beginning. If it is anticipated that it will continue to grow at that rate, how

much must be invested every year so that $15,000 will be accumulated at the end of five years?

4 Click the icon to view the interest factors for discrete compounding when i = 11% per year.

$

must be invested every year. (Round to the nearest dollar.)

4: More Info

Single Payment

Equal Payment Series

Compound

Present

Compound

Sinking

Present

Capital

Recovery

Factor

(A/P, i, N)

Amount

Worth

Amount

Fund

Worth

Factor

Factor

Factor

Factor

Factor

N

(F/P, i, N)

(P/F, i, N)

(F/A, i, N)

(A/F, i, N)

(P/A, i, N)

1

1.1100

0.9009

1.0000

1.0000

0.9009

1.1100

2.

1.2321

0.8116

2.1100

0.4739

1.7125

0.5839

3

1.3676

0.7312

3.3421

0.2992

2.4437

0.4092

4

1.5181

0.6587

4.7097

0.2123

3.1024

0.3223

5

1.6851

0.5935

6.2278

0.1606

3.6959

0.2706

6

1.8704

0.5346

7.9129

0.1264

4.2305

0.2364

2.0762

0.4817

9.7833

0.1022

4.7122

0.2122

2.3045

0.4339

11.8594

0.0843

5.1461

0.1943

9

2.5580

0.3909

14.1640

0.0706

5.5370

0.1806

10

2.8394

0.3522

16.7220

0.0598

5.8892

0.1698

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning