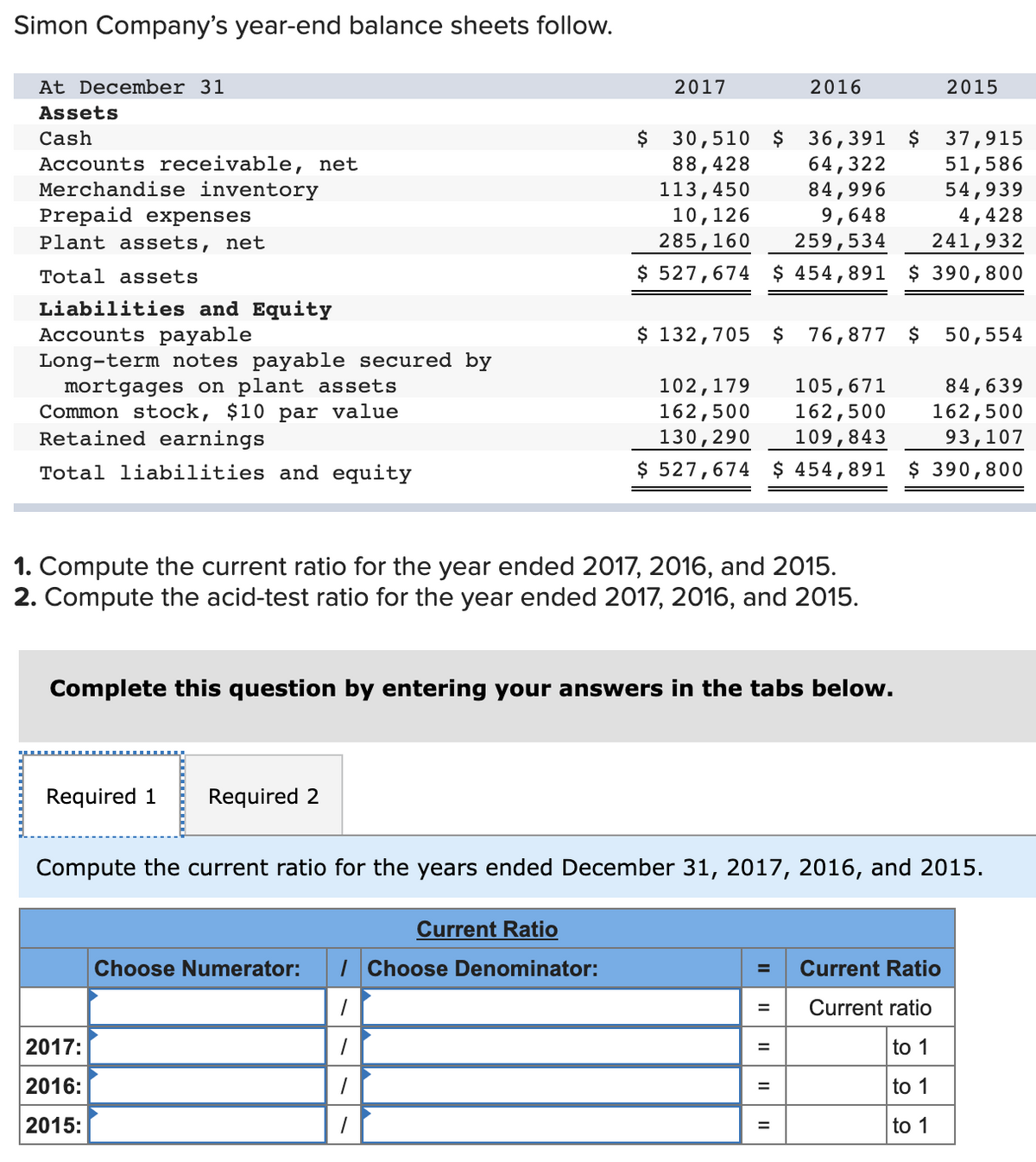

Simon Company's year-end balance sheets follow. At December 31 2017 2016 2015 Assets $ 30,510 $ 36,391 $ 88,428 113,450 10,126 285,160 $ 527,674 $ 454,891 $ 390,800 Cash Accounts receivable, net Merchandise inventory Prepaid expenses 64,322 84,996 9,648 259,534 37,915 51,586 54,939 4,428 241,932 Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings $ 132,705 $ 76,877 $ 50,554 102,179 162,500 105,671 162,500 109,843 $ 527,674 $ 454,891 $ 390,800 84,639 162,500 93,107 130,290 Total liabilities and equity 1. Compute the current ratio for the year ended 2017, 2016, and 2015. 2. Compute the acid-test ratio for the year ended 2017, 2016, and 2015.

Simon Company's year-end balance sheets follow. At December 31 2017 2016 2015 Assets $ 30,510 $ 36,391 $ 88,428 113,450 10,126 285,160 $ 527,674 $ 454,891 $ 390,800 Cash Accounts receivable, net Merchandise inventory Prepaid expenses 64,322 84,996 9,648 259,534 37,915 51,586 54,939 4,428 241,932 Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings $ 132,705 $ 76,877 $ 50,554 102,179 162,500 105,671 162,500 109,843 $ 527,674 $ 454,891 $ 390,800 84,639 162,500 93,107 130,290 Total liabilities and equity 1. Compute the current ratio for the year ended 2017, 2016, and 2015. 2. Compute the acid-test ratio for the year ended 2017, 2016, and 2015.

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter7: Inventories

Section: Chapter Questions

Problem 8PEA: Financial statement data for years ending December 31 for Holland Company follow: a. Determine the...

Related questions

Topic Video

Question

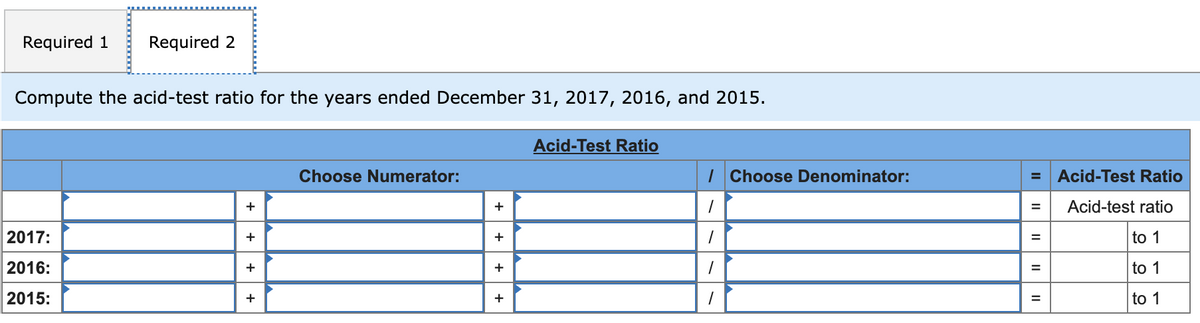

Transcribed Image Text:Required 1

Required 2

Compute the acid-test ratio for the years ended December 31, 2017, 2016, and 2015.

Acid-Test Ratio

Choose Numerator:

I Choose Denominator:

Acid-Test Ratio

+

+

Acid-test ratio

2017:

+

+

to 1

%3D

2016:

+

+

to 1

%3D

2015:

+

+

to 1

II

II

Transcribed Image Text:Simon Company's year-end balance sheets follow.

At December 31

2017

2016

2015

Assets

$ 30,510 $ 36,391 $

88,428

113,450

10,126

285,160

37,915

51,586

54,939

4,428

241,932

Cash

Accounts receivable, net

Merchandise inventory

64,322

84,996

9,648

259,534

Prepaid expenses

Plant assets, net

Total assets

$ 527,674 $ 454,891 $ 390,800

Liabilities and Equity

Accounts payable

Long-term notes payable secured by

mortgages on plant assets

Common stock, $10 par value

Retained earnings

$ 132,705 $

76,877 $

50,554

102,179

162,500

130,290

105,671

162,500

109,843

84,639

162,500

93,107

$ 527,674 $ 454,891 $ 390,800

Total liabilities and equity

1. Compute the current ratio for the year ended 2017, 2016, and 2015.

2. Compute the acid-test ratio for the year ended 2017, 2016, and 2015.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Compute the current ratio for the years ended December 31, 2017, 2016, and 2015.

Current Ratio

Choose Numerator:

| Choose Denominator:

Current Ratio

%3D

Current ratio

2017:

to 1

%3D

2016:

to 1

2015:

to 1

%3D

II

Expert Solution

Step 1

The current ratio is the measure of a company's ability to pay back its short-term debts. It is calculated by dividing the current assets of the company by the current liabilities.

The acid-test ratio is a more conservative measure of a company's ability to pay back its short-term debts. It is calculated by dividing the current assets less inventory by the current liabilities.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning