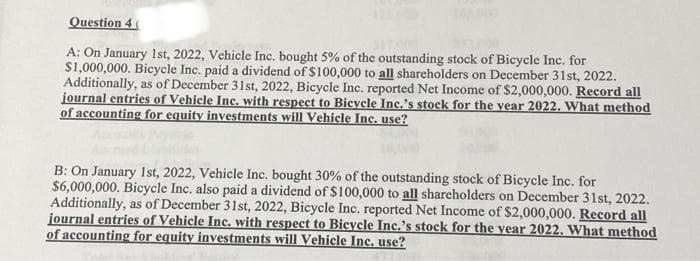

A: On January 1st, 2022, Vehicle Inc. bought 5% of the outstanding stock of Bicycle Inc. for $1,000,000. Bicycle Inc. paid a dividend of $100,000 to all shareholders on December 31st, 2022. Additionally, as of December 31st, 2022, Bicycle Inc. reported Net Income of $2,000,000. Record all journal entries of Vehicle Inc. with respect to Bicycle Inc.'s stock for the year 2022. What method of accounting for equity investments will Vehicle Inc. use? B: On January 1st, 2022, Vehicle Inc. bought 30% of the outstanding stock of Bicycle Inc. for $6,000,000. Bicycle Inc. also paid a dividend of $100,000 to all shareholders on December 31st, 2022. Additionally, as of December 31st, 2022, Bicycle Inc. reported Net Income of $2,000,000. Record all journal entries of Vehicle Inc. with respect to Bicycle Inc.'s stock for the year 2022. What method of accounting for equity investments will Vehicle Inc. use?

A: On January 1st, 2022, Vehicle Inc. bought 5% of the outstanding stock of Bicycle Inc. for $1,000,000. Bicycle Inc. paid a dividend of $100,000 to all shareholders on December 31st, 2022. Additionally, as of December 31st, 2022, Bicycle Inc. reported Net Income of $2,000,000. Record all journal entries of Vehicle Inc. with respect to Bicycle Inc.'s stock for the year 2022. What method of accounting for equity investments will Vehicle Inc. use? B: On January 1st, 2022, Vehicle Inc. bought 30% of the outstanding stock of Bicycle Inc. for $6,000,000. Bicycle Inc. also paid a dividend of $100,000 to all shareholders on December 31st, 2022. Additionally, as of December 31st, 2022, Bicycle Inc. reported Net Income of $2,000,000. Record all journal entries of Vehicle Inc. with respect to Bicycle Inc.'s stock for the year 2022. What method of accounting for equity investments will Vehicle Inc. use?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 25E

Related questions

Question

Don't give answer in image format

Transcribed Image Text:Question 4(

A: On January 1st, 2022, Vehicle Inc. bought 5% of the outstanding stock of Bicycle Inc. for

$1,000,000. Bicycle Inc. paid a dividend of $100,000 to all shareholders on December 31st, 2022.

Additionally, as of December 31st, 2022, Bicycle Inc. reported Net Income of $2,000,000. Record all

journal entries of Vehicle Inc. with respect to Bicycle Inc.'s stock for the year 2022. What method

of accounting for equity investments will Vehicle Inc. use?

B: On January 1st, 2022, Vehicle Inc. bought 30% of the outstanding stock of Bicycle Inc. for

$6,000,000. Bicycle Inc. also paid a dividend of $100,000 to all shareholders on December 31st, 2022.

Additionally, as of December 31st, 2022, Bicycle Inc. reported Net Income of $2,000,000. Record all

journal entries of Vehicle Inc. with respect to Bicycle Inc.'s stock for the year 2022. What method

of accounting for equity investments will Vehicle Inc. use?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning