A single-family home was developed five years ago in Neighborhood X and the owner would like to estimate the value of the property. Due to the lack of comparables in the local market, the owner relies on the cost approach for valuation. Based on the information below, what is the estimated value of the property based on the cost approach? (choose the closest answer) • The living area costs $300,000 to replace as new (material cost and labor cost) . Cost of garage and patio adds up to $50,000 Physical depreciation is 10 percent of the replacement cost . There is no functional or external obsolescence . The land value is $200,000 and site improvement is worth 50,000 . 350,000 540,000 565,000 600,000

A single-family home was developed five years ago in Neighborhood X and the owner would like to estimate the value of the property. Due to the lack of comparables in the local market, the owner relies on the cost approach for valuation. Based on the information below, what is the estimated value of the property based on the cost approach? (choose the closest answer) • The living area costs $300,000 to replace as new (material cost and labor cost) . Cost of garage and patio adds up to $50,000 Physical depreciation is 10 percent of the replacement cost . There is no functional or external obsolescence . The land value is $200,000 and site improvement is worth 50,000 . 350,000 540,000 565,000 600,000

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter17: Business Tax Credits And The Alternative Minimum Tax

Section: Chapter Questions

Problem 13P

Related questions

Question

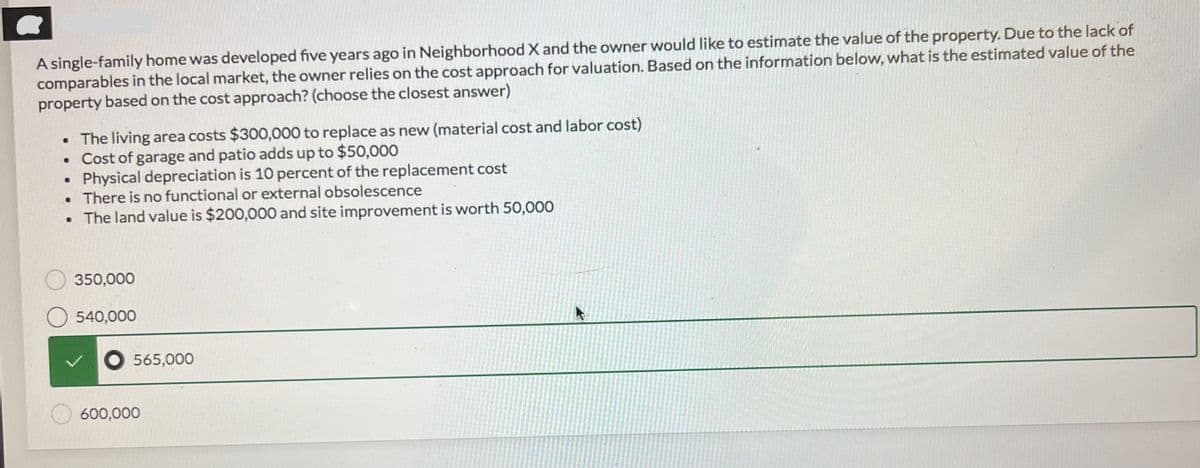

Transcribed Image Text:A single-family home was developed five years ago in Neighborhood X and the owner would like to estimate the value of the property. Due to the lack of

comparables in the local market, the owner relies on the cost approach for valuation. Based on the information below, what is the estimated value of the

property based on the cost approach? (choose the closest answer)

• The living area costs $300,000 to replace as new (material cost and labor cost)

. Cost of garage and patio adds up to $50,000

• Physical depreciation is 10 percent of the replacement cost

• There is no functional or external obsolescence

. The land value is $200,000 and site improvement is worth 50,000

350,000

540,000

565,000

600,000

k

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning