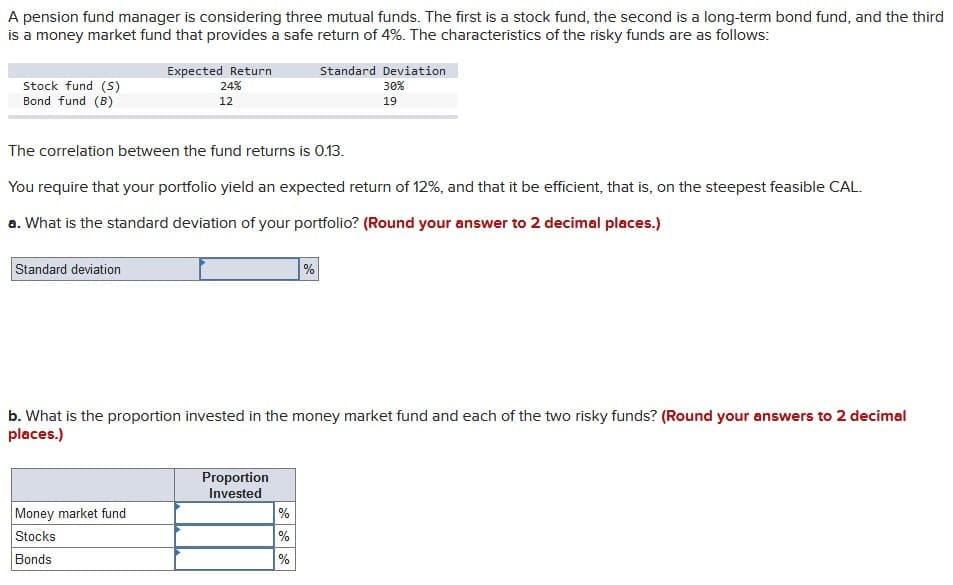

A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term bond fund, and the third is a money market fund that provides a safe return of 4%. The characteristics of the risky funds are as follows: Stock fund (S) Bond fund (B) Standard deviation Expected Return 24% 12 The correlation between the fund returns is 0.13. You require that your portfolio yield an expected return of 12%, and that it be efficient, that is, on the steepest feasible CAL. a. What is the standard deviation of your portfolio? (Round your answer to 2 decimal places.) Money market fund Stocks Bonds b. What is the proportion invested in the money market fund and each of the two risky funds? (Round your answers to 2 decimal places.) Proportion Invested Standard Deviation 30% 19 % % % %

A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term bond fund, and the third is a money market fund that provides a safe return of 4%. The characteristics of the risky funds are as follows: Stock fund (S) Bond fund (B) Standard deviation Expected Return 24% 12 The correlation between the fund returns is 0.13. You require that your portfolio yield an expected return of 12%, and that it be efficient, that is, on the steepest feasible CAL. a. What is the standard deviation of your portfolio? (Round your answer to 2 decimal places.) Money market fund Stocks Bonds b. What is the proportion invested in the money market fund and each of the two risky funds? (Round your answers to 2 decimal places.) Proportion Invested Standard Deviation 30% 19 % % % %

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 12P

Related questions

Question

A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long -term bond fund, and the third is a

Transcribed Image Text:A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term bond fund, and the third

is a money market fund that provides a safe return of 4%. The characteristics of the risky funds are as follows:

Stock fund (S)

Bond fund (B)

Standard deviation

Expected Return

24%

12

The correlation between the fund returns is 0.13.

You require that your portfolio yield an expected return of 12%, and that it be efficient, that is, on the steepest feasible CAL.

a. What is the standard deviation of your portfolio? (Round your answer to 2 decimal places.)

Money market fund

Stocks

Bonds

b. What is the proportion invested in the money market fund and each of the two risky funds? (Round your answers to 2 decimal

places.)

Proportion

Invested

Standard Deviation

30%

19

%

%

%

%

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning