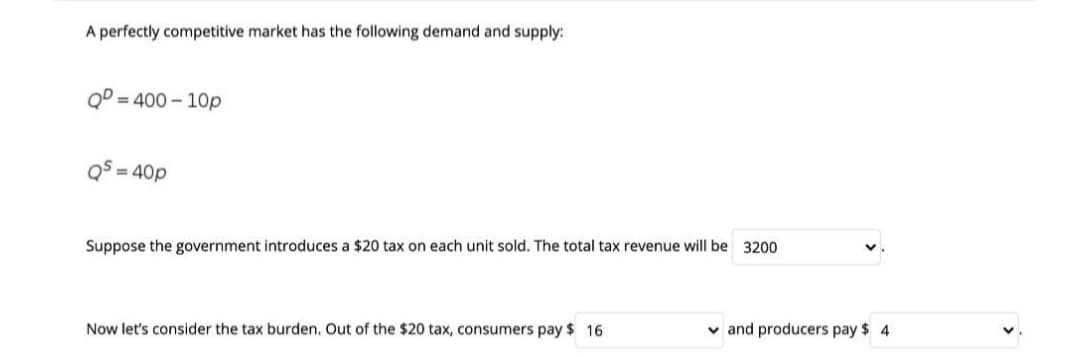

A perfectly competitive market has the following demand and supply: QD = 400- 10p Q5 = 40p Suppose the government introduces a $20 tax on each unit sold. The total tax revenue will be 3200 Now let's consider the tax burden. Out of the $20 tax, consumers pay $ 16 v and producers pay $ 4

Q: Explain :as an entrepreneur how can you use this concept of cross price elasticity of demand in prov...

A: Cross price elasticity refers to the responsiveness of change in quantity demanded of good 1 due to ...

Q: Auto Volta are planning to launch an import line of electric batteries and electric chargers going i...

A: International commerce enables countries to extend their markets and gain access to commodities and ...

Q: (10 may notice that the slope is the same everywhere on this demand curve. Yet, the elasticities are...

A: Price elasticity of demand measures the responsiveness in quantity demanded of a commodity to a chan...

Q: You currently have $250,000 in your retirement account. What equal ann each year for the next 13 yea...

A: Given the present value = $250000 Time, n = 13 years Interest rate, r = 8% Future value = $37000

Q: What is the role of Econometrics in Economics or in Agricultural Economics?

A: When studying economics, it can be seen that economics is divided into different parts according to ...

Q: Identify the background of the Scopes Trial in Tennessee during 1925 and explain how this trial perp...

A: To find : Background of scope trial and concept of separation of church and state

Q: assume that the price levels for a product is :[11,9,7,4,2], then create a table showing the Qd and ...

A: We have to construct an demand and supply schedule for given price.

Q: If MR (marginal revenue) is less than MC (marginal cost), then the firm sould O a. decrease producti...

A: The economics as a study is based upon the idea that resources which are present with the economies ...

Q: pro nas Y UGlars tO sper UP JO two periods. Let c denote the amount of consumption that the individu...

A: In period 1 : Budget Constraint : P1c1 + S1 = Y Where , S1 are savings , P1c1 is income spent on co...

Q: What is household consumption expenditure reflecting in terms of GDP of a country? What it indicates...

A:

Q: Output per worker Country ... Australia Brazil 200 Sleds Clarinets 300 2 Good Suppose that Australia...

A: Absolute advantage and comparative advantage are two important concepts in economics and internation...

Q: What is the growth rate in Country A in 2020? Select one: a. % 10 b. % 5 C. % 25

A: Growth rates refer to the percentage change of a specific variable within a specific time period. Fo...

Q: QUESTION TWo The costs of operating the canteen at 'Eat a lot Company' for the past three months (De...

A: (i) and (ii) Month Cost (TC) No. of employee Variable cost (VC) Fixed cost (TC - VC) December 2...

Q: Consider two bidders who are competing for an item in an 'all-pay auction.' Bidder 1 values the item...

A: There are two players in the game : Bidder 1 & Bidder 2 As per the question , If the bids are e...

Q: 11: Given the demand and supply system: Pb = 53 - 5 Qb & Pv = 3 + 2 Qv With a specific tax of T^ = 4...

A: Given; Demand function; Pb=53-5Qb Supply function; Pv=3+2Qv At equilibrium:- 53-5Q=3+2Q5Q+2Q=53-37Q=...

Q: Consider the O-Ring model with LaTeX: N=2 tasks. Workers in-country LaTeX: R each have a skill, LaTe...

A: According to O - Ring model : So worker's skill in Latex R = q_R which is 3 times of P Workers's ski...

Q: If quotas lead to an increase in prices, people may be constrained to reduce their consumption of th...

A: Macroeconomics is important for a country and microeconomics is also important for a country. Just l...

Q: From the previous graph, you can tell that Teresa is willing to pay s for her 8th slice of cheesecak...

A: The consumer surplus is the difference between the price the consumer is willing to pay and the pric...

Q: How much is accumulated for a savings plan with a deposit P1, 900 today at 13% compounded quarterly ...

A: Given: Deposit=P=$900 Rate of interest=i=13% Time=t=2 years Compounded in a year=n=Quarterly

Q: 1. Consider the market for Widgets. Suppose that the equation for the supply curve is: Qs = 1,000P –...

A: Given demand and supply can be used to determine the market price by equating them . And elasticity ...

Q: What is different about ethics in a global or international context and ethics in a national context...

A: Ethics are referred to as those principles or rules which deal with the ethical and moral issues whi...

Q: emand Tunction is nction is е cost unction is TC = C = 100 + 60(Q) +(Q)2 a. Find MR and MC o. Demons...

A:

Q: 1) The local breakfast restaurant has a new offer: those who buy more than 10 sandwiches a month get...

A: Given information Offer by local breakfast restaurant=50% on an additional sandwiches after 10 units...

Q: What is an economic bubble? A product of illegal asset trading. Assets that are worthless. The start...

A: Economic bubble refers to an economic cycle which shows rapid growth in an economy but good by a con...

Q: The following equations describe the long-run situation for prices and costs, where the numbers indi...

A: Answer-

Q: What I have Learn Answer the following question on a different answer sheet. 1. Why data is importan...

A: 1. Importance of data in statistics The study of learning from data is referred to as statistics. St...

Q: In what ways does Kevin's demand for up-front royalty payments affect Proof's ability to grow organi...

A: Kevin's demand for upfront and honest royalties, which is impacting the proof's capacity to grow spo...

Q: n 2015, a producer of wine purchased ingredients for $1 million, labor for $0.5 million, and equipme...

A: Given: Purchase of ingredients=$1 million Labor=$0.5 million Equipment=$0.5 million

Q: Suppose that a firm's marginal abatement cost function with existing technologies is MAC = 8 - E. I...

A: In economics, total cost is the least dollar cost of producing some quantity of yield. This is the a...

Q: Employer-provided private health insurance in the United States has resulted in: A. incentives that...

A:

Q: Points Price Qd Ed TR (Sales) = Qs Es Price x Quantity Demanded A 50 150 350 45 200 490 C 40 250 700...

A: Elasticity of Demand = (Percentage change in quantity demanded)/(Percentage change in price) Elastic...

Q: Future-looking interest rate expectations for 5 periods are as follows: 3%, 4%, 3.5%, 4.5%, 4%. Addi...

A: In the question above, it is given that : Future looking interest rate expectations for 5 periods a...

Q: Why does protectionism cost jobs in other unprotected industries? Select the two correct answers bel...

A: Answer: Protectionism provides support and creates jobs in a specific industry but it causes loss of...

Q: plz solve with expalnation within 10-20 mins

A: The FAR is a chapter within title 48 of the Code of Federal Regulations - TRUE

Q: Suppose that a consumer has $200 to spend on two goods: beer and pretzels. The price of beer is $6.0...

A: Given; Income of the consumer=$200 Price of beer= $6 Price of pretzels= $3

Q: measuring total benefit measuring total costs measuring companies that are weak or marginal ...

A: Marginal analysis aims to measure the net gain in additional benefit when one more unit of output is...

Q: The degree of inequality in the distribution of income in an economy is depicted in aln O Lorenz cur...

A: The Lorenz curve is a representation of the distribution of a metric – consumption, wages, education...

Q: You are given the following long-run cost function: TC = 200Q - 25Q2 + 1.5Q3 What level of Q will ec...

A: Here the firm's total cost=TC = 200Q - 25Q2 + 1.5Q3 here the total fixed cost-TFC=0 (since this is a...

Q: Which type of worker would earn the high income but has lesser marginal productivity? a.Fashion ...

A: At the marketplace, it can be seen that different occupation provide different range of income to th...

Q: Evaluate the effectiveness of using monetary policy to reduce the rate of inflation

A: The economics as a study is based upon the idea of scarcity, where the resources with the economies ...

Q: . At the point of equilibrium of firm (under perfect competition)

A: To find : What happens at point of equilibrium of firm.

Q: What is export,import rate and net export reflecting in terms of GDP of a country? What it indicates...

A: Money has been developed since the ages and people use money for various purposes and transactions. ...

Q: In Engineering Economics, which among these is/are true about a discount? A. It is the difference be...

A: Discount rate:- In a discounted cash flow (DCF) evaluation, the discount rate can be explained as t...

Q: What are the benefits of government setting and managing bank fees and rates?

A: Answer -

Q: 9. You want to estimate the effect of a city's having high-speed rail on their GDP per capita, and y...

A: Answer- "Thank you for submitting the questions.But, we are authorized to solve one question at a ti...

Q: Additional labor productivity would be equivalent to a.marginal productivity of the worker. b. e...

A: Additional labour productivity means how much addition is made to the total product when one additio...

Q: Manually calculate the compound amount and compound interest (in $) for the investment. Compound Amo...

A: A = Amount P = Principal t = Time Nominal rate= r Compound interest (CI) = Amount(A) - Principal(...

Q: Instruction: Adress the current condition of the Philippines by applying Appadurai's concept of "sca...

A: Appadurai's Scapes: An Explanation The creation of a new global cultural economy, or what we know as...

Q: Why has the government pumped billions into bank bailouts to prevent them from collapsing?

A: Bank bailouts refer to a situation when government or corporation injects funds into a bank that is ...

Q: A company in the United Kingdom earns $100 million by producing and selling advertising chances to d...

A: Intermediate goods, producer goods or semi-finished products are goods, such as partly finished good...

Please depict it through the diagram

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

- Question 25 A perfectly competitive market has a market demand given by P = 800-2q and market supply given by P= 150+4q. The government applies a tax to be paid by the consumer of $50 per unit. The government will raise tax revenue of_______ dollars.In the free-market equilibrium of a perfectly competitive market, the price of the good is 90 dollars and the elasticity of demand and the elasticity of supply values are respectively Ed* = -6.6 and Es* = 4.1 Suppose the government imposes a per-unit tax equal to 10.4 payable by consumers. Calculate the estimate of the price firms charge consumers in the tax equilibrium using the elasticity values provided above. Then enter that price value below.Consider the perfectly competitive market for an agricultural commodity. The direct market demand curve is Q(P) = 720 − 15P and the direct market supply curve is Q (P) = 15P. The market equilibrium quantity is 360 units at a price of $24. Suppose the government imposes a price floor at P = $36.00 and uses a deficiency payment program to implement the floor. What quantity will be sold and what prices will consumers and producers face under this policy? The new equilibrium quantity is 540 units. Consumers pay $12 and the producers receive $36. Find the: a. Change in consumer surplus and producer surplus. b. Government Expenditure. c. Change in social surplus.

- The market for mandrake root in Sodden is perfectly competitive. Market demad is given by Q = 477 - 3P and market supply is given by Q = 3P. the government is concerned about the high prices and imposes a price ceiling of $7. What is the quntitiy traded in the market with this price ceiling? Enter a number only.The market for Mandrake root in Sodden is perfectly competitive. Market demand is given by Q=294-3P and market supply is given by Q=5P . The government is concerned about high prices and imposes a price ceiling of $19. What is the quantity traded in the market with this price ceiling?Consider the perfectly competitive market for an agricultural commodity. The direct market demand curve is Q(P) = 780 − 15P and the direct market supply curve is Q (P) = 15P. The market equilibrium quantity is 390 units at a price of $26. Suppose the government imposes a price support at P = $39.00 and uses a deficiency payment program to implement the floor. What quantity will be sold and what prices will consumers and producers face under this policy? The new quantity demanded is 195 units and the quantity supplied is 585 units. Find the welfare impact for the following: a. Change in consumer surplus and producer surplus. b. Government Expenditure. c. Change in social surplus.

- Consider the perfectly competitive market for gasoline. The aggregate demand forgasoline is D (p) = 100 - p. Given the choke price is 100, if the equilibrium price is P25 and the equilibrium quantity is 75 units, what is the consumer surplus?Which of the following is true when there is a tax imposed in a market with perfectlyinelastic supply? Assume that the amount of the tax is less than the price before the tax isimplemented.(a) Buyers pay all of the tax(b) Buyers pay some but not all of the tax(c) Price paid by consumers falls by the amount of the tax(d) Price paid by consumers does not change(e) None of the aboveQ3. Suppose a perfectly competitive market is in a long run equilibrium at a price of $5. At that equilibrium, own price elasticity of demand is 0.6 and own price elasticity of supply is 1. The government then introduces a $6 tax in this market. Which of the following COULD be the new SR and LR demand (buyer) and supply (seller) prices? a) SR: PD = $9 & PS = $3. LR: PD = $11 & PS = $5. b) SR: PD = $7 & PS = $1. LR: PD = $11 & PS = $5. c) SR: PD = $9 & PS = $3. LR: PD = $10 & PS = $4. d) More than one of the above COULD be the new SR and LR prices.

- Suppose the demand for pickles on The Citadel is Qd=500-4P, and the supply is Qs=6P. Assume this market is perfectly competitive. Suppose the Council puts a tax of $5 per unit on the purchase of pickles. Write an equation showing the relationship between the price paid by consumers and the price received by producers.In a perfectly competitive market, the market demand curve isQd=10-pd, and the market supply curve is Qs=1.5Ps . What is the equilibrium price and quantity in the absence of government intervention?The wheat market is perfectly competitive and the market supply and demand curves are given by the following equations: QD = 20,000,000 - 4,000,000PQS = 7,000,000 + 2,500,000P,where QD and QS are quantity demanded and quantity supplied measured in kilogram (kg), and P = price per kg. question: a) Assume that the government has imposed a price floor at $2.25 per kg and agrees to buy any resulting excess supply.How many quantity (kg) of wheat will the government be forced to buy?Determine consumer surplus with the price floor.