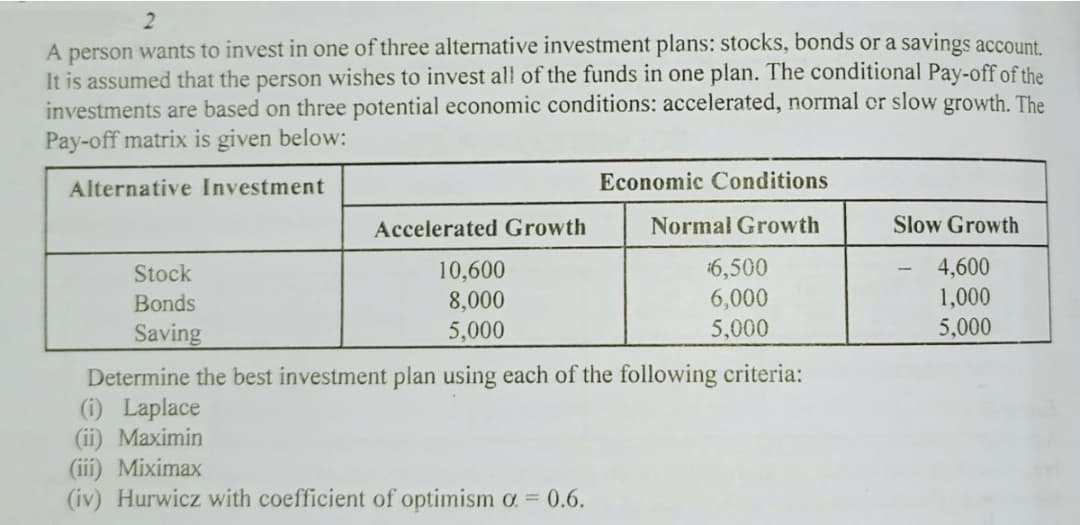

A person wants to invest in one of three alternative investment plans: stocks, bonds or a savings account. It is assumed that the person wishes to invest all of the funds in one plan. The conditional Pay-off of the investments are based on three potential economic conditions: accelerated, normal or slow growth. The Pay-off matrix is given below: Alternative Investment Economic Conditions Accelerated Growth Normal Growth Slow Growth 6,500 6,000 5,000 4,600 1,000 Stock 10,600 Bonds 8,000 Saving 5,000 5,000 Determine the best investment plan using each of the following criteria: (i) Laplace (ii) Maximin (iii) Miximax (iv) Hurwicz with coefficient of optimism a = 0.6.

Q: A buyer for a large sporting goods store chain must place orders for professional footballs with the…

A: a) Let us consider the following given above data Here we first construct the payoff table. We know…

Q: There are three investments, B1, B2 and B3. All of them have the same expected value and each with…

A: Given data is

Q: Exhibit 15-2. You would like to invest in one of the three available investment plans: money market,…

A: The expected value of perfect information is the amount that one would be responsible to give in…

Q: A firm offers three different prices on its products, depending upon the quantity purchased. Since…

A: Decision variables - x11= product 1 with a profit of $18 per unit x12= product 1 with a profit of…

Q: Determine the optimal action based on the maximax criterion ii. Determine the optimal action based…

A: The investor who has certain amount of money to be invested, has assigned probability based on his…

Q: What is the maximum number of meals Sheldon can produce in 12 hours? What is the maximum number of…

A: As it is not in Bartleby policy to Answer More than 1 Question, I am solving the First Question For…

Q: The demand equation for the BWS Bluetooth wireless loudspeaker is p = −0.05x + 145 where x is the…

A: the equilibrium quantity of 1000 units equilibrium price $95

Q: For the Orlando real estate investment problem, assume the probabilities for the gasoline shortage,…

A: Given data is

Q: Finance Applications. Refer to the PI Mortgages Example in the book about a firm that provides…

A: Decision variable: Suppose-X1 = Amount ($ million) invested in First MortgagesX2 = Amount ($…

Q: The Fairwinds Development Corporation is considering taking part in one or more different…

A:

Q: The planning committee of a bank makes monthly decisions on the amount of funds to allocate to loans…

A: Given data: To formulate a liner programming model x1,x2,x3,x4,x5,x6,x7 be the decision variables…

Q: The Schoch Museum (see Problem 30 in Chapter 11) is embarking on a five-year fundraising campaign.…

A: Donation refers to the instance of act concerning which a contribution, grant or gift is being…

Q: Brandon is considering expansion of a store. If he expands, the interest rate at which he borrows…

A: The decision tree has been represented as shown in the diagram.

Q: Solve for the future worth of each of the given series of payments: (a) $12,000 at the end of each…

A: Future value (FV) is the value of a current resource at a future date in view of an accepted pace of…

Q: We have $1,000 to invest. All the money must be placedin one of three investments: gold, stock, or…

A:

Q: Drawthe budget constraint for a consumer with standard preferences.

A: For the First Part here is the solution: If the consumer had an income of $3,000 and the cost of…

Q: Solve the LP problem. If no optimal solution exists, indicate whether the feasible region is empty…

A: GIVEN

Q: Optimal Objective Value 2170.00000 Variable Value Reduced Cost АВ 100.00000 0.00000 BM 60.00000…

A: a) The optimal solution is 2170 at AB = 100, BM = 60, AP = 0 and BP = 90. b) Those constraints are…

Q: A firm offers three different prices on its products, depending upon the quantity purchased. Since…

A: Objective Functions and Constraints: Based on the given details, the objective…

Q: A MANUFACTURING FIRM WISHES TO GIVE EACH 80 EMPLOYEES A HOLIDAY BONUS. HOW MUCH IS NEEDED TO INVEST…

A: The manufacturing firm needed P12,615.80 to invest monthly for a year at 12% nominal interest rate…

Q: facilities for drone production. The table below shows the potential profits/losses for each…

A: Ans15(18) Decision under equally likely rule--- States of nature Excellent Good Fair Poor Average…

Q: Compute the expected opportunity loss (EOL) for each investment v. Explain the meaning of the…

A: Expected Monitory value indicating a decision making tool where the future remains as uncertain.…

Q: An investment advisor at Shore Financial Services wants to develop a model that can be used to…

A: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question and…

Q: Two companies are producing widgets. It costs the first company q12 dollars to produce q1 widgets…

A: Given: First company Second company q12 dollars 0.5q22 dollars

Q: A simple desicion-making model with maximalization criteria is given. State 1 State 2 State 3…

A: Decision making under uncertainty involves maximax criteria which are also known as an optimistic…

Q: A rice importer has three sources: Thailand, Vietnam, and China. Unfortunately, the annual amount of…

A: It is a TRUE statement. It is a maximition problem.

Q: This is a maximization problem. True or False?

A: This is a maximization problem is true.

Q: A company has $10,000 to invest , to be divided into fixed interest, equities and property. For…

A: Here, the individual wants to make an investment decision. Let x = Amount invested in fixed interest…

Q: If the profit generated per cabinet is P80 and per dresser is P100, write the objecti that best…

A: Linear programming is a process to reach the best outcome such as maximum profit or lowest cost in a…

Q: Solve the LP problem. If no optimal solution exists, indicate whether the feasible region is empty…

A: Below is the solution:-

Q: The estimated selling price of a new mobile phone is RO 90. The company wants to earn a mark up of…

A: Small Introduction about Cost Gap A product design's projected costs can be compared against the…

Q: A firm offers three different prices on Its products, depending upon the quantity purchased. Since…

A: Objective Functions and Constraints: Based on the given details, we found the…

Q: Alexis Harrington received an inheritance of $95,000, and she is considering two speculative…

A: A small introduction about investment A venture is a resource or thing procured fully intent on…

Q: 3. The comptroller of Microsoft Corporation has $100 million of excess funds to invest. She has been…

A: Given data: investment funds = 100 mn rate of return - stocks and bonds probabilities

Q: 3. An investor wants to invest $55,000 in two mutual funds, A and B. The rates of return, risks and…

A: Let us say that Fund A as "x1" and Fund B as "x2" for formulation purpose As given in the question,…

Q: BP Cola must decide how much money to allocate for new soda and traditional soda advertising over…

A: Use the maximization function here to find the maximum profit gained.

Q: A firm offers three different prices on its products, depending upon the quantity purchased. Since…

A: Objective Functions and Constraints: Based on the given details, we found the…

Q: Dataware is trying to determine whether to give a $10 rebate, cut the price $6, or have no price…

A: Consider creating a $10 rebate for a $45 product. Alternatives to a rebate would be to reduce the…

Q: Over the next three years, the expected path of 1-year interest rates is 4, 1, and 1 percent, and…

A: Expected path of interest rate is 1,2,1 percent. Premia are 0,0.2 and 0.5 percent.

Q: This is a maximization problem. True or Flase?

A: As all variables are positive it is a maximization problem.

Q: The Acme Company is developing a product, the fixed costs are estimated to be $6000. and the unit…

A:

Q: Steve Johnson believes that this winter is going to be extremely rainy, and he is trying to decide…

A: Please find the attached excel working in below step-

Q: ayue Is The company is evaluating three different expansion plans: Minor, moderate, or major. They…

A:

Q: A company is considering two insurance plans with the following types of coverage and premiums: Plan…

A: Linear programming toll is the which takes into consideration certain linear relationships to obtain…

Q: A consumer has income of £3,000. Apple juice is priced at £3 a bottle and cheese is priced at £6 a…

A: Disclaimer: Since you have asked multiple question, so we will solve the first question for you. If…

Q: An investor has a certain amount of money available to invest now. Three alternative investments are…

A: Hello thank you for the question. As per guidelines, we would provide only first three sub-parts at…

Q: Ford has four automobile plants. Each is capable of producing the Taurus, Lincoln or Escort but it…

A: Integer programming: Integer programming represents the optimization of a linear function directed…

Q: Alexis Harrington received an inheritance of $95,000, and she is considering two speculative…

A: a) Let L and C be the amount to be invested in Land and Cattle respectively. Max 1.2L+1.3C s.t. L+C…

Q: Stock in Company A sells for $89 a share and has a 3-year average annual return of $24 a share. The…

A: Let; a be the number of shares in company A b be the number of shares in company B

Q: We are going to invest $1,000 for a period of 6 months.Two potential investments are available:…

A:

Step by step

Solved in 2 steps with 5 images

- Suppose you begin year 1 with 5000. At the beginning of each year, you put half of your money under a mattress and invest the other half in Whitewater stock. During each year, there is a 40% chance that the Whitewater stock will double, and there is a 60% chance that you will lose half of your investment. To illustrate, if the stock doubles during the first year, you will have 3750 under the mattress and 3750 invested in Whitewater during year 2. You want to estimate your annual return over a 30-year period. If you end with F dollars, your annual return is (F/5000)1/30 1. For example, if you end with 100,000, your annual return is 201/30 1 = 0.105, or 10.5%. Run 1000 replications of an appropriate simulation. Based on the results, you can be 95% certain that your annual return will be between which two values?A European put option allows an investor to sell a share of stock at the exercise price on the exercise data. For example, if the exercise price is 48, and the stock price is 45 on the exercise date, the investor can sell the stock for 48 and then immediately buy it back (that is, cover his position) for 45, making 3 profit. But if the stock price on the exercise date is greater than the exercise price, the option is worthless at that date. So for a put, the investor is hoping that the price of the stock decreases. Using the same parameters as in Example 11.7, find a fair price for a European put option. (Note: As discussed in the text, an actual put option is usually for 100 shares.)In August of the current year, a car dealer is trying to determine how many cars of the next model year to order. Each car ordered in August costs 20,000. The demand for the dealers next year models has the probability distribution shown in the file P10_12.xlsx. Each car sells for 25,000. If demand for next years cars exceeds the number of cars ordered in August, the dealer must reorder at a cost of 22,000 per car. Excess cars can be disposed of at 17,000 per car. Use simulation to determine how many cars to order in August. For your optimal order quantity, find a 95% confidence interval for the expected profit.

- Based on Grossman and Hart (1983). A salesperson for Fuller Brush has three options: (1) quit, (2) put forth a low level of effort, or (3) put forth a high level of effort. Suppose for simplicity that each salesperson will sell 0, 5000, or 50,000 worth of brushes. The probability of each sales amount depends on the effort level as described in the file P07_71.xlsx. If a salesperson is paid w dollars, he or she regards this as a benefit of w1/2 units. In addition, low effort costs the salesperson 0 benefit units, whereas high effort costs 50 benefit units. If a salesperson were to quit Fuller and work elsewhere, he or she could earn a benefit of 20 units. Fuller wants all salespeople to put forth a high level of effort. The question is how to minimize the cost of encouraging them to do so. The company cannot observe the level of effort put forth by a salesperson, but it can observe the size of his or her sales. Thus, the wage paid to the salesperson is completely determined by the size of the sale. This means that Fuller must determine w0, the wage paid for sales of 0; w5000, the wage paid for sales of 5000; and w50,000, the wage paid for sales of 50,000. These wages must be set so that the salespeople value the expected benefit from high effort more than quitting and more than low effort. Determine how to minimize the expected cost of ensuring that all salespeople put forth high effort. (This problem is an example of agency theory.)An automobile manufacturer is considering whether to introduce a new model called the Racer. The profitability of the Racer depends on the following factors: The fixed cost of developing the Racer is triangularly distributed with parameters 3, 4, and 5, all in billions. Year 1 sales are normally distributed with mean 200,000 and standard deviation 50,000. Year 2 sales are normally distributed with mean equal to actual year 1 sales and standard deviation 50,000. Year 3 sales are normally distributed with mean equal to actual year 2 sales and standard deviation 50,000. The selling price in year 1 is 25,000. The year 2 selling price will be 1.05[year 1 price + 50 (% diff1)] where % diff1 is the number of percentage points by which actual year 1 sales differ from expected year 1 sales. The 1.05 factor accounts for inflation. For example, if the year 1 sales figure is 180,000, which is 10 percentage points below the expected year 1 sales, then the year 2 price will be 1.05[25,000 + 50( 10)] = 25,725. Similarly, the year 3 price will be 1.05[year 2 price + 50(% diff2)] where % diff2 is the percentage by which actual year 2 sales differ from expected year 2 sales. The variable cost in year 1 is triangularly distributed with parameters 10,000, 12,000, and 15,000, and it is assumed to increase by 5% each year. Your goal is to estimate the NPV of the new car during its first three years. Assume that the company is able to produce exactly as many cars as it can sell. Also, assume that cash flows are discounted at 10%. Simulate 1000 trials to estimate the mean and standard deviation of the NPV for the first three years of sales. Also, determine an interval such that you are 95% certain that the NPV of the Racer during its first three years of operation will be within this interval.Amanda has 30 years to save for her retirement. At the beginning of each year, she puts 5000 into her retirement account. At any point in time, all of Amandas retirement funds are tied up in the stock market. Suppose the annual return on stocks follows a normal distribution with mean 12% and standard deviation 25%. What is the probability that at the end of 30 years, Amanda will have reached her goal of having 1,000,000 for retirement? Assume that if Amanda reaches her goal before 30 years, she will stop investing. (Hint: Each year you should keep track of Amandas beginning cash positionfor year 1, this is 5000and Amandas ending cash position. Of course, Amandas ending cash position for a given year is a function of her beginning cash position and the return on stocks for that year. To estimate the probability that Amanda meets her goal, use an IF statement that returns 1 if she meets her goal and 0 otherwise.)

- In Problem 11 from the previous section, we stated that the damage amount is normally distributed. Suppose instead that the damage amount is triangularly distributed with parameters 500, 1500, and 7000. That is, the damage in an accident can be as low as 500 or as high as 7000, the most likely value is 1500, and there is definite skewness to the right. (It turns out, as you can verify in @RISK, that the mean of this distribution is 3000, the same as in Problem 11.) Use @RISK to simulate the amount you pay for damage. Run 5000 iterations. Then answer the following questions. In each case, explain how the indicated event would occur. a. What is the probability that you pay a positive amount but less than 750? b. What is the probability that you pay more than 600? c. What is the probability that you pay exactly 1000 (the deductible)?A common decision is whether a company should buy equipment and produce a product in house or outsource production to another company. If sales volume is high enough, then by producing in house, the savings on unit costs will cover the fixed cost of the equipment. Suppose a company must make such a decision for a four-year time horizon, given the following data. Use simulation to estimate the probability that producing in house is better than outsourcing. If the company outsources production, it will have to purchase the product from the manufacturer for 25 per unit. This unit cost will remain constant for the next four years. The company will sell the product for 42 per unit. This price will remain constant for the next four years. If the company produces the product in house, it must buy a 500,000 machine that is depreciated on a straight-line basis over four years, and its cost of production will be 9 per unit. This unit cost will remain constant for the next four years. The demand in year 1 has a worst case of 10,000 units, a most likely case of 14,000 units, and a best case of 16,000 units. The average annual growth in demand for years 2-4 has a worst case of 7%, a most likely case of 15%, and a best case of 20%. Whatever this annual growth is, it will be the same in each of the years. The tax rate is 35%. Cash flows are discounted at 8% per year.If a monopolist produces q units, she can charge 400 4q dollars per unit. The variable cost is 60 per unit. a. How can the monopolist maximize her profit? b. If the monopolist must pay a sales tax of 5% of the selling price per unit, will she increase or decrease production (relative to the situation with no sales tax)? c. Continuing part b, use SolverTable to see how a change in the sales tax affects the optimal solution. Let the sales tax vary from 0% to 8% in increments of 0.5%.

- An investor has a certain amount of money available to invest now. Three alternative investmentsare available. The estimated profit in Kwacha of each investment under each economic conditionare indicated in the following payoff table:Event Investment SelectionA B CEconomy declines 500 -2000 -7000No charge 1000 2000 -1000Economy Expand 2000 5000 20,000Based on his own past experience, the investor assigns the following probabilities to eacheconomic condition:( )( )( )Economy declines 0.30No change 0.50Economy expands 0.20PPP===i. Determine the optimal action based on the maximax criterion ii. Determine the optimal action based on the maximin criterion iii. Compute the expected monetary value (EMV) for each investment iv. Compute the expected opportunity loss (EOL) for each investment v. Explain the meaning of the expected value of perfect information (EVPI) in thisproblem vi. Based on the results of (iii) and (iv), which investment would you choose?vii. Compute the coefficient of…An investor has a certain amount of money available to invest now. Three alternative investments are available. The estimated profit in Kwacha of each investment under each economic condition are indicated in the following payoff table: Event Investment Selection A B C Economy declines 500 -2000 -7000 No charge 1000 2000 -1000 Economy Expand 2000 5000 20,000 Based on his own past experience, the investor assigns the following probabilities to each economic condition: ( ) ( ) ( ) Economy declines 0.30 No change 0.50 Economy expands 0.20PPP=== iv. Compute the expected opportunity loss (EOL) for each investment v. Explain the meaning of the expected value of perfect information (EVPI) in this problem vi. Based on the results of (iii) and (iv), which investment would you choose? Why?An investor has a certain amount of money available to invest now. Three alternative investments are available. The estimated profit in Kwacha of each investment under each economic condition are indicated in the following payoff table: Event Investment Selection A B C Economy declines 500 -2000 -7000 No charge 1000 2000 -1000 Economy Expand 2000 5000 20,000 Based on his own past experience, the investor assigns the following probabilities to each economic condition: ( ) ( ) ( ) Economy declines 0.30 No change 0.50 Economy expands 0.20PPP=== i. Determine the optimal action based on the maximax criterion ii. Determine the optimal action based on the maximin criterion iii. Compute the expected monetary value (EMV) for each investment