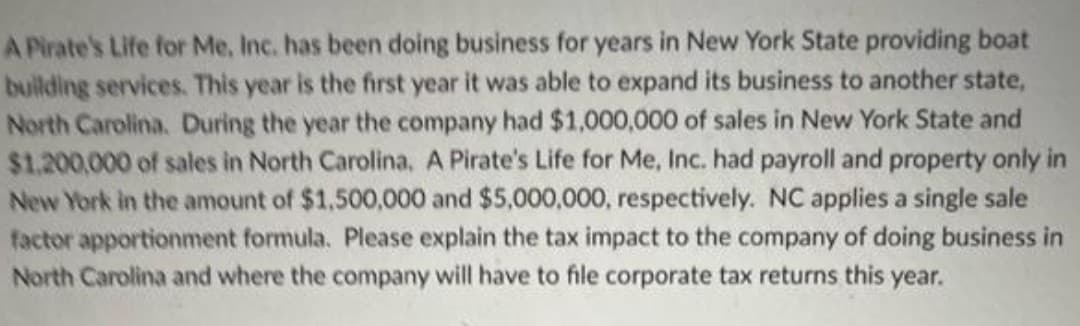

A Pirate's Life for Me, Inc. has been doing business for years in New York State providing boat building services. This year is the first year it was able to expand its business to another state, North Carolina. During the year the company had $1,000,000 of sales in New York State and $1.200,000 of sales in North Carolina, A Pirate's Life for Me, Inc. had payroll and property only in New York in the amount of $1,500,000 and $5,000,000, respectively. NC applies a single sale factor apportionment formula. Please explain the tax impact to the company of doing business in North Carolina and where the company will have to file corporate tax returns this year.

A Pirate's Life for Me, Inc. has been doing business for years in New York State providing boat building services. This year is the first year it was able to expand its business to another state, North Carolina. During the year the company had $1,000,000 of sales in New York State and $1.200,000 of sales in North Carolina, A Pirate's Life for Me, Inc. had payroll and property only in New York in the amount of $1,500,000 and $5,000,000, respectively. NC applies a single sale factor apportionment formula. Please explain the tax impact to the company of doing business in North Carolina and where the company will have to file corporate tax returns this year.

Chapter6: Business Expenses

Section: Chapter Questions

Problem 84TA

Related questions

Question

Transcribed Image Text:A Pirate's Life for Me, Inc. has been doing business for years in New York State providing boat

building services. This year is the first year it was able to expand its business to another state,

North Carolina. During the year the company had $1,000,000 of sales in New York State and

$1.200,000 of sales in North Carolina, A Pirate's Life for Me, Inc. had payroll and property only in

New York in the amount of $1,500,000 and $5,000,000, respectively. NC applies a single sale

factor apportionment formula. Please explain the tax impact to the company of doing business in

North Carolina and where the company will have to file corporate tax returns this year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College