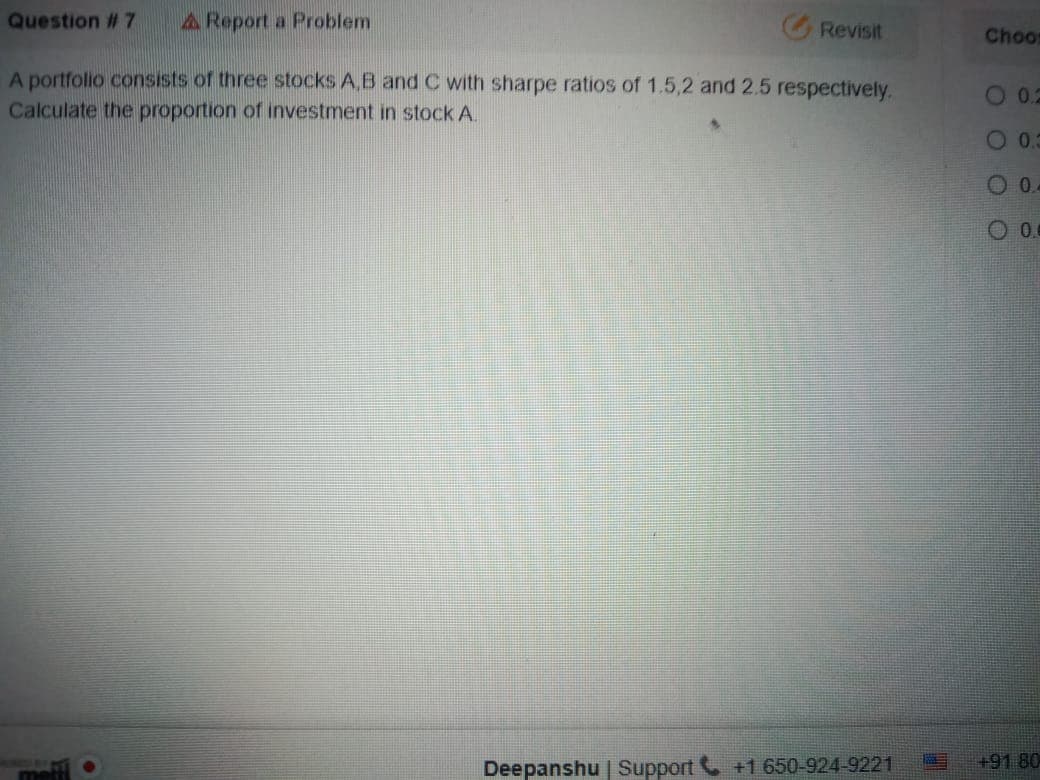

A portfolio consists of three stocks A,B and C with sharpe ratios of 1.5,2 and 2.5 respectively. Calculate the proportion of investment in stock A.

Q: Calculate the expected returns and expected standard deviations of a two-stock portfolio in which…

A: Expected return on R1 = 0.10 Expected return on R2 = 0.15 Standard deviation of 1 = 0.03 Standard…

Q: A portfolio consists of $17,600 in Stock M and $29,400 Invested in Stock N. The expected return on…

A: Given:

Q: 2. (a) You have a two-asset portfolio that comprises Stock PY and Stock NY with the following…

A: Portfolio standard deviation is the standard deviation of all the different investments in the…

Q: Two investments, X and Y, have the characteristics shown below. E(X) = $70, E(Y)%3D$120, o =7,000, o…

A: Expected Return on Portfolio = (Weight of security X * Return on security X ) + (Weight of security…

Q: A portfolio is comprised of equal weights of two stocks labeled Stock X and Stock Y. The covariance…

A: Covariance between stock X and stock Y (CovX,Y) = 0.10 Standard deviation of stock X (SDX) = 0.50…

Q: porlfolio p consists of two stocks: 50% is invested in stock A and 50% is invested in stock B. stock…

A: Formula for portfolio standard deviation is: Sigma = (w1^2*sigma1^2 + w2^2*sigma2^2 +…

Q: From the following information, calculate covariance between stocks A and B and expected return and…

A: Correlation between A and B = 0.65 Weight of A in portfolio = 50% Weight of B in portfolio = 50%…

Q: Consider a portfolio that is comprised of two stocks A and B. The position in stock A is valued at…

A: Note: As multiple questions have been posted, we will solve the first three questions for you. In…

Q: Example: Suppose you want to invest in one stock and one bond. The expected return and standard…

A: Given information : Asset Weight Expected return Standard deviation Stock 70% 9% 16% Bond…

Q: How would i do this question?

A: The most general form of expression for the portfolio variance is as shown on the white board. The…

Q: Stock A has a standard deviation of 3.5% while stock B has a standard deviation of 4.6%. If both…

A: Standard deviation is a variation in the mean value of given data. Standard deviation is a…

Q: Suppose 0.3 is the correlation of returns between any two stocks in an equal-weighted portfolio…

A: The volatility of a Portfolio indicates an overall risk of a portfolio, it is the measure of…

Q: The table below is a correlation matrix for Shares A, B and C. Each cell in the table shows the…

A: Investing in negatively correlated stocks indicate that one stock moves in the opposite direction as…

Q: For the above shares if the expected inter correlations are given as follows: Investment…

A: This question has several subparts. From the data given, only the first question (part d) can be…

Q: From the following information, calculate covariance between stocks A and B and expected return and…

A: Expected return on portfolio E(Rp) is calculated by sum product of stock returns and weight in the…

Q: ou are given the following information regarding prices for a sample of stocks. a. Construct a…

A: Price-Weighted Index = Sum of All Prices/Number of Stock Value-weighted Index = Total Value of…

Q: A portfolio is invested 27 percent in Stock G, 42 percent in Stock J, and 31 percent in Stock K. The…

A: The expected return of a portfolio refers to the sum of proportionate returns from each element of…

Q: The securities of firms A and B have the expected return and standard deviations given below. The…

A: Standard deviation = Sqroot of variance Portfolio variance = w12σ12 + w22σ22 + 2w1w2 σ1 σ2 r12…

Q: You have a two-asset portfolio that comprises stocks XX and ZZ. The information related to these two…

A: The Expected return of a portfolio refers to the total return which is expected by the investor…

Q: a portfolio consists of two shares share m and share n 30% of the portfolio is invested in share m…

A: The beta of the portfolio can be calculated by calculating the weighted average beta.

Q: Required: 1. What is the volatility of the portfolio as the number of stocks becomes arbitrarily…

A: Information Provided: Volatility of each stock = 40% Correlation between the stocks = 27% Answer…

Q: uppose Johnson & Johnson and the Walgreen Company have expected returns and volatilities shown…

A: given Return of johnson & johnson = 7%

Q: Calculate the expected return, variance, and standard deviation for a portfolio of four equally…

A: The expected return of the portfolio is the return that an investor gets based on the weightage…

Q: Suppose that the average stock has a volatility of 53%, and that the correlation between pairs of…

A: A combined investment that includes different kinds of market securities is term as the portfolio.

Q: Three portfolios are created using shares of Stock A and Stock B. The table below provides the…

A: Portfolio volatility formula: Volatility or standard deviation is represented by σ. w represents…

Q: A portfolio is invested 24 percent in Stock G, 39 percent in Stock J, and 37 percent in Stock K. The…

A: Stock Weight Return G 24.00% 10.50% J 39.00% 13.00% K 37.00% 18.00%

Q: Rank the following three stocks by their risk-return relationship, from best to worst: Stock A has…

A: The presentation of the ratio of the standard deviation of the project and the average return of a…

Q: The index model has been estimated for stock A with the following results: RA = 0.01 + 1.2RM + eA.…

A: Standard deviation is referred to as the measure of the dispersion of a dataset relative to its mean…

Q: Using the data in the following table, calculate the volatility (standard deviation) of a portfolio…

A: Given: Weight 75% 25% Year Stock A Stock B 2010 -10% 16% 2011 5% 20% 2012 2% 26% 2013…

Q: estimate the standard deviations of Stocks A and B. Then, compute the expected return, standard…

A: a) Standard deviation of A= (Beta2*Market SD2+Firm-specific SD2)(1/2)…

Q: a. What is the expected return for each stock b. What is the standard deviation for each stock, the…

A: Here, we need to calculate the expected return from each stock as well as the expected return of the…

Q: If an average share of stock is expected to yield a return of 7.2% and comparable Treasury bonds…

A: In this question we need to compute the value of market risk premium.

Q: Assume a portfolio compose of stocks and bonds. You were given the following relevant to the stocks…

A: Stock variance (Vs) = 300 Bond variance (Vb) = 100 Covariance (Cov) = 80 Weight of stock (Ws) =…

Q: Stocks A and B have the following returns: Stock A Stock B 1 0.09 0.06 2 0.05 0.02 0.13 0.05 4 -…

A: A combination of the different types of funds and securities for the investment is term as the…

Q: Consider two stocks, Stock D, with an expected return of 13 percent and a standard deviation of 28…

A: Standard deviation of stock D (S1) = 28% Standard deviation of stock I (S2) = 38% Correlation (c) =…

Q: Assume that the following data available for the portfolio, calculate the expected return, variance…

A: Portfolio Expected Return = [(rate of return ×probability) + (rate of return ×probability)]…

Q: Suppose the expected returns and standard deviations of Stocks A and B are E(RA) = .092, E(RB) =…

A: Portfolio is a bundle of various investments. To manage the risk, investors invest the money in…

Q: You own a portfolio that has $1,600 invested in Stock A and $2,700 invested in Stock B. Assume the…

A: Expected return of portfolio = (weight of stock A × Expected return of A) + (weight of stock B ×…

Q: Suppose you are given the following information about 2 stocks, what is the Sharpe Ratio of a…

A: Working Note #1 Expected return of portfolio= Wt. of stock A * Return of stock A + Wt. of stock B *…

Q: Suppose the expected returns and standard deviations of Stocks A and B are E(RA) = .092, E(RB) =…

A: The expected rate of return of the portfolio is the weighted average rate of return of all the…

Q: Beta of a portfolio. The beta of four stocks-G, H, I, and J-are 0.43, 0.86, 1.06, and 1.61,…

A: Beta of Portfolio = Weight of stock G * Beta of Stock G + Weight of stock H * Beta of Stock H +…

Q: A portfolio is invested 24 percent in Stock G, 39 percent in Stock J, and 37 percent in Stock K. The…

A: Information Stock Weight Return G 24% 10.5% J 39% 13.0% K 37% 18.4%

Q: Mr Donald has an equally-weighted portfolio of two stocks of Company A and Company B. The standard…

A: Weight of Stock A = 50% Weight of Stock B = 50% Standard Deviation of A = 20% Standard Deviation of…

Q: What is the standard deviation for each portfolio of the two stocks using the various percentages…

A: Standard Deviation is a measure to calculate the risk volatility of the security or portfolio. Here,…

Q: Using the data in the chart, calculate the first-period rates of return on the following indexes of…

A: SOLUTION:- t=0 Price( P0 ) (Q0) Market Value(P0 x Q0) A $90 100 $9,000 B $50 200 $10,000 C…

Step by step

Solved in 2 steps with 1 images

- Two-Asset Portfolio Stock A has an expected return of 12% and a standard deviation of 40%. Stock B has an expected return of 18% and a standard deviation of 60%. The correlation coefficient between Stocks A and B is 0.2. What are the expected return and standard deviation of a portfolio invested 30% in Stock A and 70% in Stock B?Q2 - Returns on stocks X and Y are listed below: Period 1 2 3 4 5 6 7Stock X 4% -2% 5% -1% 10% 7% 12%Stock Y -3% 7% 4% 2% 2% 8% -3% Consider a portfolio of 10% stock X and 90% stock Y. What is the mean of portfolio returns? Please specify your answer in decimal terms and round your answer to the nearest thousandth (e.g., enter 12.3 percent as 0.123).QG. The following information is available about the stocks of two companies A and B: Stock A Stock B Expected Return (%) Probability -5 12 15 20 0.05 0.55 0.35 0.05 Expected Return (%) Probability 5 15 18 20 0.05 0.65 0.20 0.10 Stock Standard Deviation of Returns (%) A B 25 35 The coefficient of correlation between the returns on A and B is 0.05. A portfolio is constructed by allocating the funds between A and B in the ratio of 2:3. Calculate the expected return on the portfolio. b. Calculate the portfolio risk.

- D4) Finance Consider a portfolio composed of shares AAA and BBB as shown in the following table. At 95% confidence level, select the correct statement AAA BBB Value 2,470,000 785,750 % investment 76% 24% Volatilities 2.32 % 2.69 % Correlation for both assets 0.65 Portfolio Value for both assets 3,255,750 a) The Component VaR of the Asset AAA is 92,223 and the component VaR of the Asset BBB is 27955.69 b) The contribution to the VaR of the Asset AAA is 77% and the one of the Asset 2 is 23% c) Both answers are correctQuestion: A portfolio consists of two stocks: Stock Expected Return Standard Deviation Weight Stock 1 10% 15% 0.30 Stock 2 13% 20% ??? The correlation between the two stocks’ return is 0.50(a) Calculate the expected return and standard deviation of the portfolio. Expected Return: Standard Deviation: b) (i) Briefly explain, in general, when there would be “benefits of diversification” (for any portfolio of two securities). (ii) Describe whether the above portfolio would exhibit “benefits of diversification” (and why). [No calculations are required.] (c) Show your calculations re: whether the above portfolio exhibits “benefits of diversification”and indicate whether it does/doesn’t (and why).QUESTION 3 – Risk and ReturnSintok Corporation has collected information on the following three investments. Which investment is the most favourable based on the information presented?Stock A Stock B Stock CProbability Return Probability Return Probability Return0.15 2% 0.25 -3% 0.1 -5%0.4 7% 0.5 20% 0.4 10%0.3 10% 0.25 25% 0.3 15%0.15 15% 0.2 30%

- 9. Portfolio beta and weights Brandon is an analyst at a wealth management firm. One of his clients holds a $5,000 portfolio that consists of four stocks. The investment allocation in the portfolio along with the contribution of risk from each stock is given in the following table: Stock Investment Allocation Beta Standard Deviation Atteric Inc. (AI) 35% 0.750 38.00% Arthur Trust Inc. (AT) 20% 1.400 42.00% Li Corp. (LC) 15% 1.300 45.00% Transfer Fuels Co. (TF) 30% 0.500 49.00% Brandon calculated the portfolio’s beta as 0.888 and the portfolio’s required return as 12.6600%. Brandon thinks it will be a good idea to reallocate the funds in his client’s portfolio. He recommends replacing Atteric Inc.’s shares with the same amount in additional shares of Transfer Fuels Co. The risk-free rate is 6%, and the market risk premium is 7.50%. A. According to Brandon’s recommendation, assuming that the market is in equilibrium, how much will the portfolio’s…3. Answer ALL parts of this question. The data below describes a three-stock financial market that satisfies the single index model. Stock Capitalization Beta Mean Excess Return Standard Deviation A £3,000 1.0 10% 40% B £1,940 0.2 2% 30% C £1,360 1.7 17% 50% The standard deviation of the market index portfolio is 25%. (a) What is the mean excess return of the index portfolio? (b) What is the covariance between stock A and stock B? (c) What is the covariance between stock B and the index? (d) Break down the variance of stock B into its systematic and firm specific components.Stock Expected Return A 15% B 10% C 22% D 14% Use the information in the schedule above to answer the following: (a). What is the expected return on a portfolio consisting of an equal amount invested in each stock (5 points)

- Q No 3 Assume you are a portfolio manager at JS Global Capital Ltd. Recently you came across three attractive stocks and want to create a portfolio investment in these three stocks. The details of the stocks are given below: Company name Volatility (Standard deviation) Weight in Portfolio Correlation with the market portfolio Engro Ltd 25% 0.30 0.40 Lucky Cement Ltd 12% 0.30 0.60 FFC Ltd 13% 0.40 0.50 The expected return on the market portfolio is 8% and its volatility is 10%. The risk-free rate based on central bank’s discount rate is 3%. Calculate each of the stock’s expected return and risk (beta) as compared to the market What should be the expected return of the portfolio based on values calculated in part a. Calculate the beta of the portfolio? what does it tells regarding the riskiness of the portfolio?INV 2-3a You are exploring the use of APT in making investment choices. You have identified three factors labelled F1, F2, and F3 with corresponding risk premia RP1 = 4%, RP2 = 5%, and RP3 = 2%. A stock with ticker ABC has historically shown returns which have followed the equation: rABC=0.12+.75F1+1.0F2+.5F3+eABC a. What is the equilibrium rate of return for stock ABC using the APT, if the T-bill rate is 4%?QUESTION 7 An investor wishes to construct a portfolio consisting of a 70 percent allocation to a stock index and a 30 percent allocation to a risk-free asset. The return on the risk-free asset is 4.5 percent, and the expected return on the stock index is 12 percent. Calculate the expected return on the portfolio. a. 16.50 percent b. 17.50 percent c. 14.38 percent d. 9.75 percent e. 8.25 percent